Why Is MSTR Stock Price Down Despite Recent Bitcoin Purchase

Highlights

- MSTR stock price down despite Bitcoin purchases, showing limited correlation.

- Share dilution increases, reducing value for existing MicroStrategy investors.

- MSTR's market cap below Bitcoin value suggests investor concerns.

MSTR stock price has recently experienced a sharp decline, even though MicroStrategy (MSTR) has made a bold move to acquire additional Bitcoin.

The recent acquisition of 13,627 BTC by the company at a cost of 1.25 billion made the total to 687,410 BTC with a valuation of over 62.5 billion. However, despite the surge in Bitcoin’s price, MSTR stock has not mirrored this growth.

MSTR Stock Price Declines Despite Significant Bitcoin Purchase

Despite Bitcoin price climbing above $92,000, MSTR stock price has struggled to keep up. The stock has dropped by almost 50% over the last year despite the growth in the price of Bitcoin.

This lack of correspondence between the two has been a shock to many investors as they anticipated an equivalent rise in MSTR stock with that of Bitcoin.

The association between the two is more complex, instead. The stock of MSTR moves like the stock of a gold mining company where any changes in the price of Bitcoin result into the exaggerated price fluctuations of MSTR stock.

The Bitcoin price is on the rise, but it does not imply that the same thing will happen to MSTR stocks.

The Bitcoin strategy developed by MicroStrategy has received criticism and praise. Massive holdings of Bitcoin by the company are currently exceeding its market capitalization of $45 billion.

MicroStrategy Stock Price Outlook: What Lies Ahead

At present, MicroStrategy stock price is hovering around a crucial support level of $155. If this support fails to hold, the stock could drop further, with the next potential support levels between $150-$140. A deeper decline could lead to a collapse to $100 or even lower.

If MSTR stock manages to rally, it could potentially rise to $165. And if the upward momentum continues, it could reach $170 or even $180.

The next largest issue with MSTR stock is the dilution of shares, which has been growing, and is used to buy Bitcoin.

Shares outstanding have increased tremendously by over 300 million since 2021, as compared to 77 million. This dilution has resulted in a lot of strain on the stock, which has reduced the value to the current shareholders.

The net asset value of the firm has also decreased to 0.726, which has also contributed to the fears regarding the long-term effects of its Bitcoin acquisition strategy.

As MicroStrategy keeps financing its Bitcoin acquisition with share sales, investors are becoming increasingly concerned about the long-term effects of such a strategy.

The gap between the market valuation and the value of the Bitcoin holdings of the company makes some significant questions concerning the sustainability of the strategy. A further decrease in the crypto stock price might erode investor confidence, particularly when there are more shares in circulation.

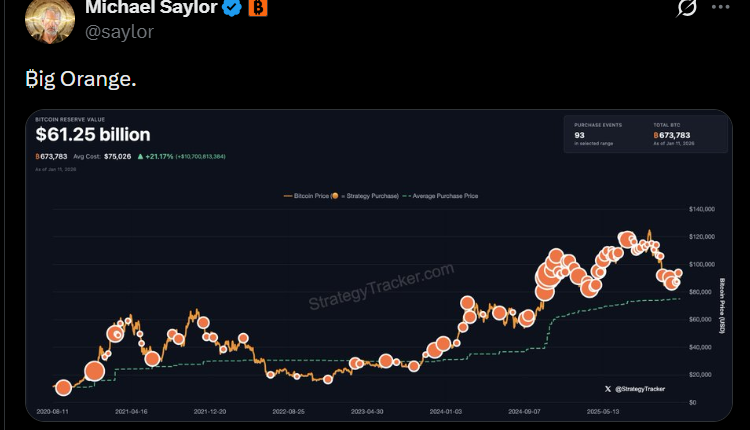

MSTR’s Bitcoin Strategy: Will Saylor’s ‘Big Orange’ Move Drive Change?

In the future, the future of MSTR stock is not clear. Although, according to the latest signal by CEO Michael Saylor, called the Big Orange, which suggests another acquisition of Bitcoin, the stock has not responded positively in any major way.

The signals sent by Saylor, who has previously used them to announce the acquisition of Bitcoins, are still creating buzz among the retail investors.

Frequently Asked Questions (FAQs)

1. Why is MicroStrategy's stock price dropping despite its Bitcoin purchases?

2. How many Bitcoins does MicroStrategy currently hold?

- Ripple’s RLUSD Gets Institutional Boost as SEC Eases Stablecoin Rules for Broker-Dealers

- Crypto Market Weekly Recap: BTC Waver on Macro & Quantum Jitters, CLARITY Act Deadline Fuels Hope, Sui ETFs Go Live Feb 16-20

- Robert Kiyosaki Adds To Bitcoin Position Despite Market Decline

- XRP News: Ripple Partner SBI Reveals On-Chain Bonds That Pay Investors in XRP

- BitMine Ethereum Purchase: Tom Lee Doubles Down on ETH With $34.7M Fresh Buy

- XRP Price Prediction As SBI Introduces Tokenized Bonds With Crypto Rewards

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise

- Cardano Price Prediction Feb 2026 as Coinbase Accepts ADA as Loan Collateral