Why Pi Coin Price Is Not Rising?

Highlights

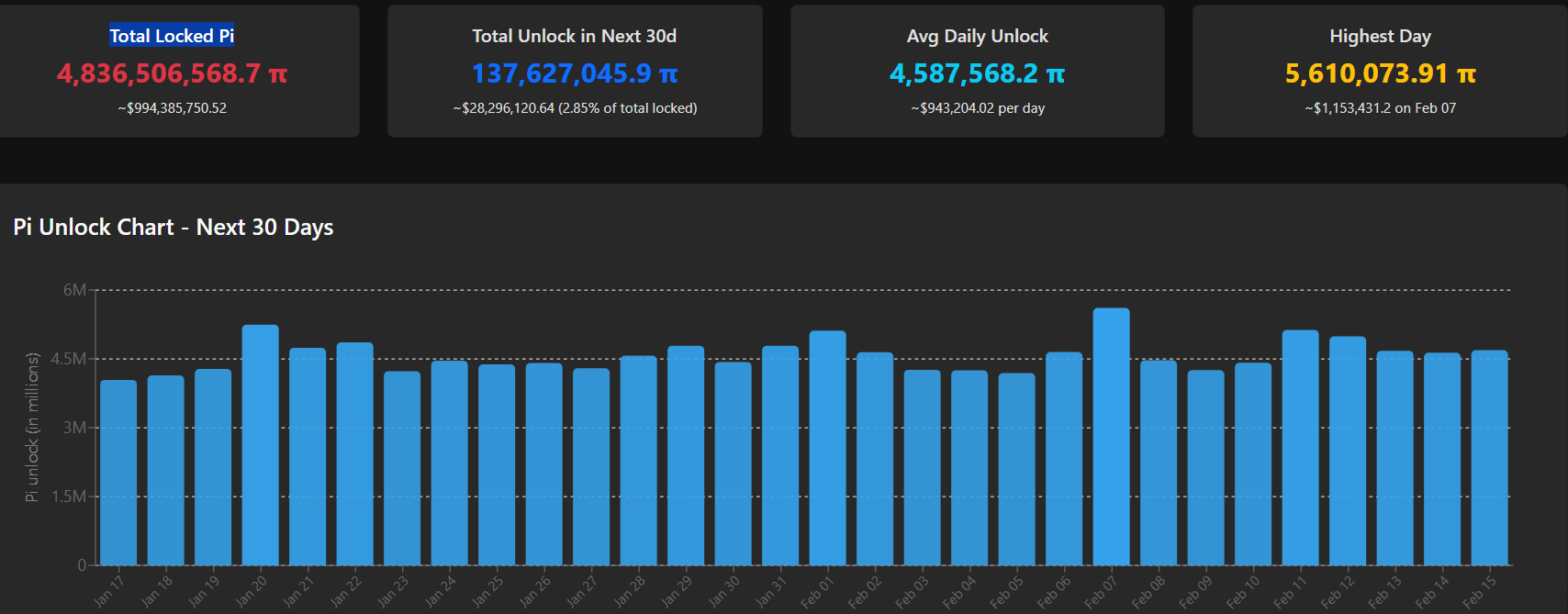

- Daily token unlocks increase supply, pressuring Pi Coin price.

- Weak momentum and low volume are indicators of low buyer interest.

- Sentiment and overall crypto market recovery are dampened by regulatory setbacks.

Pi Coin price continues to face downward pressure, as the broader cryptocurrency market shows signs of a downturn. Currently trading below the $0.20 level, Pi Coin has struggled to gain momentum, with prices hovering more than 90% below their all-time highs.

The market mood remains negative, as Bitcoin is trading below $95,000, and the market generally continued to be in a bearish mood over the last 24 hours. Investors are also worried because the liquidity risks are looming.

This week, the crypto market prepares against Fed actions, possible judicial decisions, and rate decisions in Japan, which all may shake the sentiment of investors. The next Federal Reserve information should determine the presence of liquidity support.

Reasons Why The Pi Coin Price Is Not Surging

Pi Coin is currently facing downward pressure as growing supply continues to weigh on its price. Each day, approximately $1 million worth of PI enters circulation through mainnet migrations and token unlocks.

These frequent issues, which are connected to the account that is proven by KYC, are consistently increasing the supply of the coin in the open market. To date, PI has been locked at more than 4.83 billion, and it is slowly migrating and is influencing the short-term price momentum.

The broader cryptocurrency market is also under mild pressure. As of now, the global crypto market cap stands at $3.12 trillion, reflecting a 0.4% decline. Leading assets like Bitcoin and Ethereum have seen similar effects.

Bitcoin is holding near $95,000, while Ethereum trades just above $3,200 after recently surpassing resistance levels. Their decline is due to the action by the U.S. Senate to cancel the markup of the Crypto Market Structure Bill, which has shaken the investor confidence in the entire market.

The net supply circulates as the mainnet migration of Pi Network is taking place. The development of the project is still in the process, but the demand in the market has not been corresponding. This supply-demand imbalance is playing into the failure of the Pi Coin price to move upwards. Trading has been stagnant and volatile or with little bullishness, over much of the year.

Trading Volume Signals Lack of Buying Interest

Pi Coin has been trading less than 7 million coins daily, which is a small number of a network of this scale. More importantly, the trading trends depict a bearish nature. Declines in prices are usually stronger in volume, whereas rebounds are usually stronger in activity. This trend means that the current market is more aggressive on the side of the sellers than the buyers.

Generally, bullish movement is supported by an increase in volume. But in the case of Pi Coin, the reverse appears to be taking place, and thus there is a question of whether distribution is still taking place. Such a lack of balance indicates poor investor confidence and low purchasing power.

Pi Network Price Prediction: Key Levels To Watch

The latest Pi Network Price traded at $0.2057, showing a minor gain of 0.15% on the 4-hour chart. The price of Pi Network has been in a tight range of consolidation. At this point, it is above the $0.20 support mark.

The MACD indicates a poor bearish crossover. The blue line of MACD is showing slightly lower than the orange signal line, and both are close to the zero line (neutral axis).

The histogram bars do not have a high buying or selling pressure as they are hardly visible. When the MACD crosses back above the signal line, it can initiate the bullish momentum.

The Relative Strength Index (RSI) is at 45.36, which indicates that the market is in the neutral position without the indication of being overbought or oversold.

If the future Pi Coin outlook holds above $0.20 and volume increases, the first upside target is $0.23.

A break below $0.23 may lead to $0.24, then $0.25. On the negative side, anything below $0.20 could cause a further fall to $0.18, the other level of support.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Crypto Market at Risk as U.S.–Iran War Threatens Inflation With Oil Price Surge

- Polymarket U.S.–Iran Strike Bets Fuel Insider Trading Speculation as Crypto Traders Net $1.2M

- Cardano’s DeFi TVL Climbs as USDCx Stablecoin Launches on Network

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

Buy $GGs

Buy $GGs