Will Bitcoin Price Recover When US Govt. Opens? On-chain Data Shows Recovery Might Take a While

Highlights

- Bitcoin price declines amid U.S. government shutdown and uncertainty.

- BTC Price hovered below $105k following the crypto market corrections.

- On-chain Data Given bearish momentum, a time-lagged recovery may be predicted.

Bitcoin price continued its downward slide below $105k on Tuesday, extending a bearish trend that has plagued the market. In the last 24 hours, Bitcoin saw a 4% decline, pushing its weekly losses to 10%.

Risk-off sentiment in the equity market has also contributed to the crypto market crash. This decline comes after a series of liquidations in the cryptocurrency markets, which also adds to the general bearish mood.

Bitcoin Price Struggles Amid U.S. Govt. Shutdown and Liquidity Freeze

The current U.S. government shutdown, which has already reached its second month, is also having a major impact on financial markets, with Bitcoin being under certain pressure.

The Congressional Budget Office estimates that the shutdown would slow U.S. GDP growth by a maximum of 2% in the fourth quarter of 2025, costing the economy between 7-14 billion in economic output. It is not fiscal uncertainty alone that the market is struggling with; it is a severe freeze in liquidity, and this is showing up in the on-chain metrics of Bitcoin.

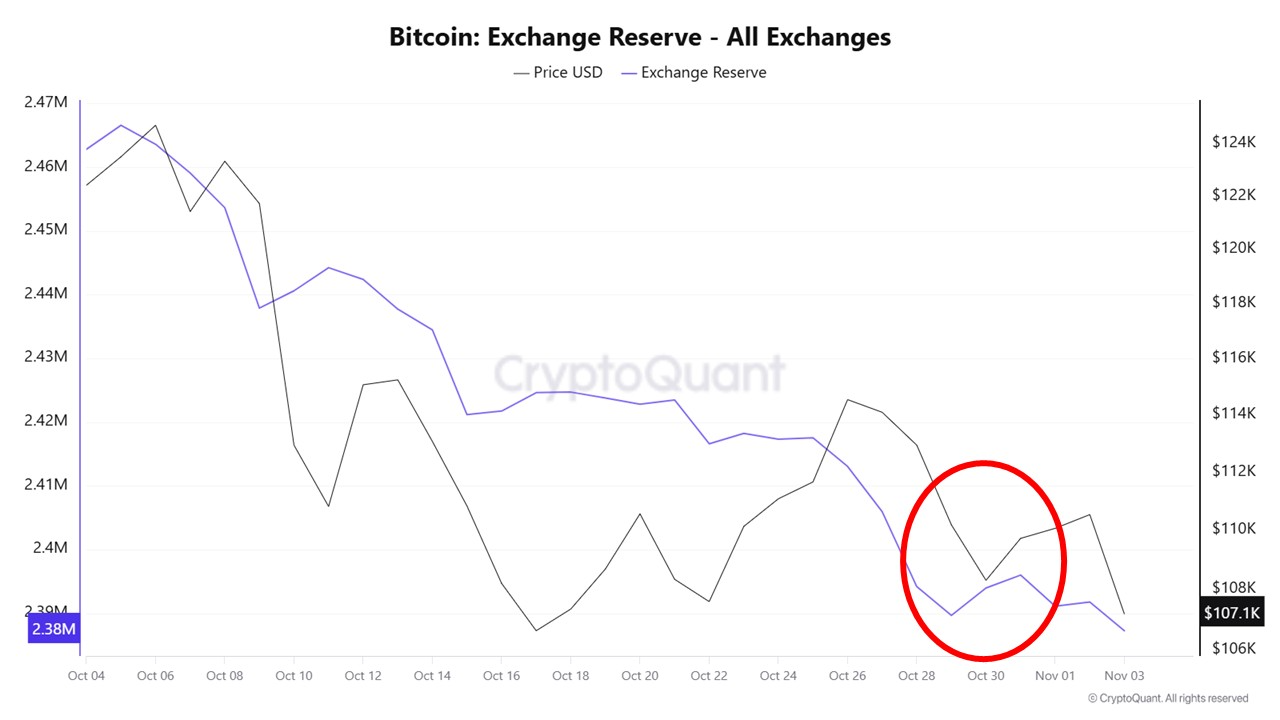

Bitcoin Exchange Reserves on the Rise Amid Market Uncertainty

According to on-chain data provided by CryptoQuant, the reserves of Bitcoin exchanges have risen for the first time in six weeks, indicating that investors are reinvesting coins on exchanges. This is a common indicator of either risk-taking or risk-reduction, and traders can be anticipating market volatility.

Moreover, the reserves of minerals are now the lowest since mid-2025, which means that miners might be selling Bitcoin to meet the costs of the operation since there are no longer energy subsidies and tax credits due to the shutdown.

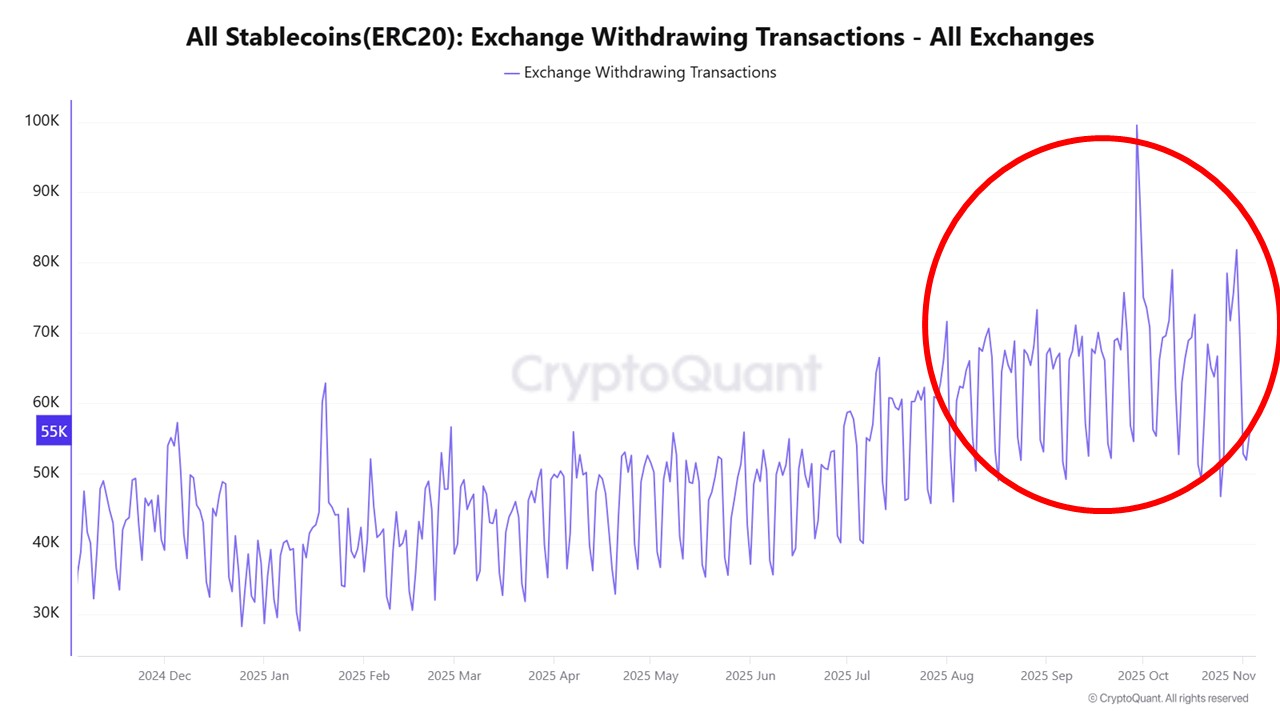

Stablecoin Surge Reflects Shift to Safe-Haven Assets

In addition to these developments, exchange withdrawals of stablecoins have soared to record highs, as investors rush to find the safety of dollar-backed assets. This action, along with the increase in the exchange reserves and the drop in the miner reserves, reflects a more overall trend of de-emphasis on risky assets.

Although there is a potential of rebound once the government opens its doors, there is a high chance that return of Bitcoin price may be delayed.

Can BTC Price Recover to $110,000 Soon?

At the time of writing, the price of BTC stands at $104,20,9, reflecting a slight drop of 4%.

The Relative Strength Index (RSI) stands at 29, which means that Bitcoin is in oversold territory. This indicates that there could be a price recovery in the case of buying momentum.

A rebound off the present support may rebound to the level of $105,000, and an advance to the level of $110,000 in case the bullish momentum becomes strong. With the current onchain data showing the recovery, the Bitcoin price outlook for the long term looks bullish.

However, if the market fails to hold the $104,000 support, further declines to $100,000 could be seen. The Moving Average Convergence Divergence (MACD) also has a bearish trend as the MACD line and the signal line have a difference. This shows that there is further pressure on BTC downwards. The histogram has red bars, implying that selling sentiment is still prevailing in the market.

Frequently Asked Questions (FAQs)

1. What is causing Bitcoin's price to decline?

2. How is the U.S. government shutdown affecting Bitcoin?

3. What do rising Bitcoin exchange reserves indicate?

- Bitcoin Price Today As Bulls Defend $65K–$66K Zone Amid Geopolitics and Tariffs Tensions

- XRP Realized Losses Spike to Highest Level Since 2022, Will Price Rally Again?

- Crypto Market Rises as U.S. and Iran Reach Key Agreement On Nuclear Talks

- Trump Tariffs: U.S. Raises Global Tariff Rate To 15% Following Supreme Court Ruling

- Bitwise CIO Names BTC, ETH, SOL, and LINK as ‘Mount Rushmore’ of Crypto Amid Market Weakness

- Pi Network Price Prediction: How High Can Pi Coin Go?

- Dogecoin Price Prediction Feb 2026: Will DOGE Break $0.20 This month?

- XRP Price Prediction As SBI Introduces Tokenized Bonds With Crypto Rewards

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act