Will Ethereum Price Revisit $3,000 As 340K ETH Leaves Exchanges?

Highlights

- Ethereum price crashed 27% on Monday, setting a daily low of $2,080, but bounced back 38% on the same day, showing resilience.

- A decline in the supply of ETH held on exchanges and ETF inflows suggest a bullish outlook for Ethereum's price recovery.

- Technical and on-chain analysis suggest that $2,400 to $2,500 could be a good place for buying dips, potentially leading to a revisit of the $3,000 psychological level.

After a brutal trade war-led crash on Monday, 330K ETH worth nearly $920 million left exchanges since February 2. Additionally, the spot Ethereum ETFs saw inflows of nearly 11K ETH. With these bullish developments, will Ethereum price recover losses and revisit $3,000?

Can Ethereum Price Revisit $3,000 Anytime Soon?

On Monday, Ethereum price crashed 27%, setting a daily low of $2,080. Massive liquidations, short positions covering and investors buying dips led to a 38% bounce on the same day. Due to the sudden crash and recovery, there is a large wick on the daily chart. More often than not prices typically retrace toward the wick’s midpoint before a full-blown recovery rally.

If such an outlook should unfold, investors can expect ETH’s value to crash another 10% to $2,474, which is the midpoint of the wick. A revisit to this level could lead to a revisit of the $3,000 psychological level if the price stabilizes around $2,400 to $2,500.

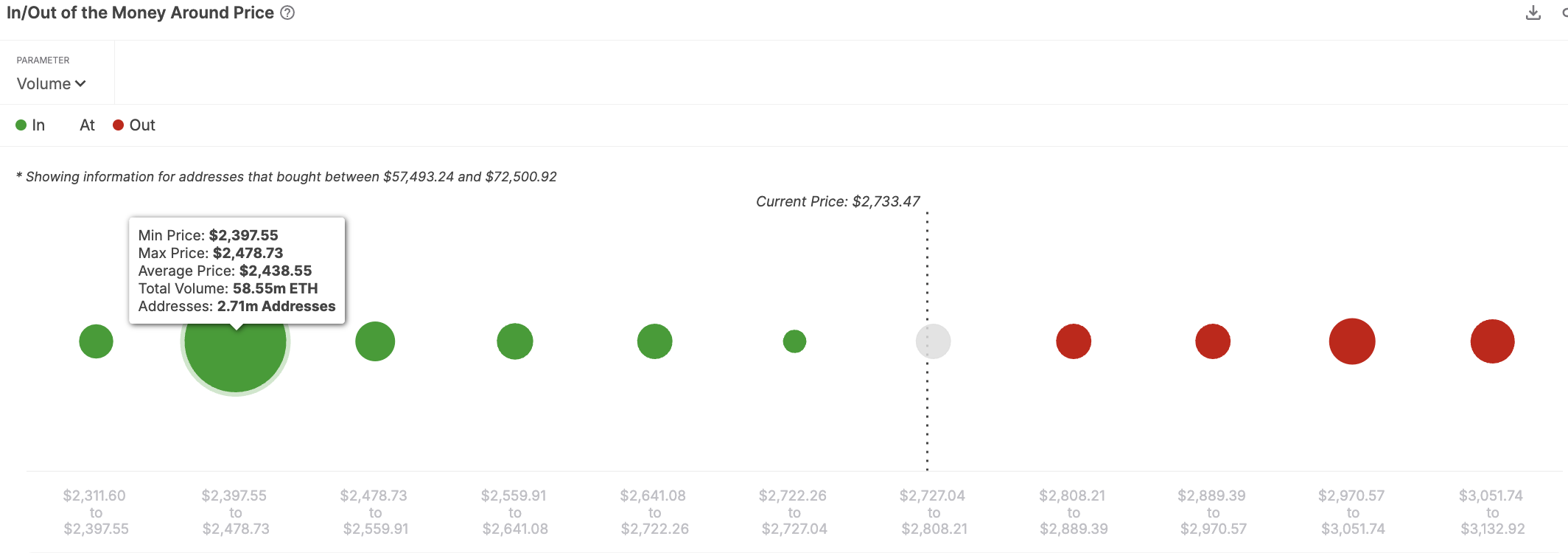

Supporting this outlook is IntoTheblock’s IOMAP (In/Out of the Money Around Price) indicator. This metric shows that the next key support area is $2,438, where roughly 2.71 million addresses bought 58.55 million ETH at an average price of $2,438. This level coincides with wick’s midpoint, adding credence to a 10% crash for Ethereum price.

While technicals suggest a correction on the lower time frames, a decline in the supply of ETH held on exchanges and ETF inflows suggests a bullish outlook from a big-picture perspective.

340K ETH leaves Exchanges

Ethereum price is influenced by the supply of ETH held on exchanges. According to Santiment, a data analytics platform, the supply of ETH on exchanges dropped from 10.86 million to 10.52 million between February 2 and 5. Roughly 340K ETH worth $920 million left exchanges. Still, this is not bullish for ETH when looking at the big picture.

While the supply of ETH steadily declined after November 28, 2024, it stopped on January 21 and reversed, noting an inflow of 210K ETH in the next 12 days. Hence, the recent outflow, might seem bullish if isolated, but does not mean it is positive development that could support ETH price recovery.

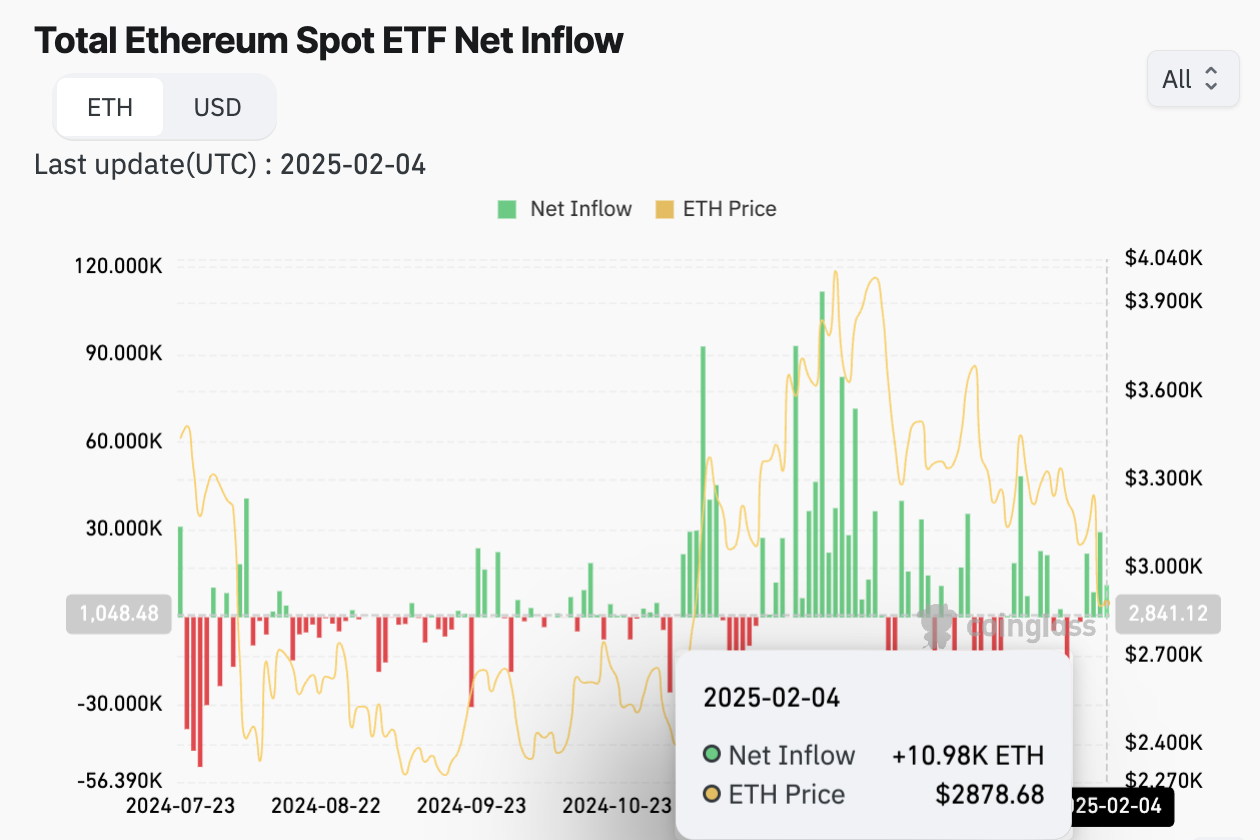

Despite such a brutal sell-off, Ethereum ETFs saw an inflow of 10,980 ETH on February 4, according to CoinGlass data. Since January 30, the inflows have been positive, which is an optimistic development considering Ether’s 2024 performance.

ETH ETF Sees Inflows

All in all, the big-picture perspective remains bullish, with the short-term outlook expecting a correction in Ethereum price. A good place for buying dips is $2,400 to $2,500 as suggested by both technical and on-chain analysis.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

Frequently Asked Questions (FAQs)

1. Will Ethereum price recover losses and revisit $3,000?

2. What's the significance of Ethereum leaving exchanges?

3. Are Ethereum ETFs seeing inflows or outflows?

- Crypto News: Bitcoin Sell-Off Fears Rise as War Threatens Iran’s BTC Mining Operations

- U.S.–Iran War: Monday Crypto Crash Odds Rise As Pundits Predict Oil Price Spike

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Crypto Market at Risk as U.S.–Iran War Threatens Inflation With Oil Price Surge

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

Buy $GGs

Buy $GGs