Will This Pattern Crash XRP Or Is A Bullish Revival Set for 2023?

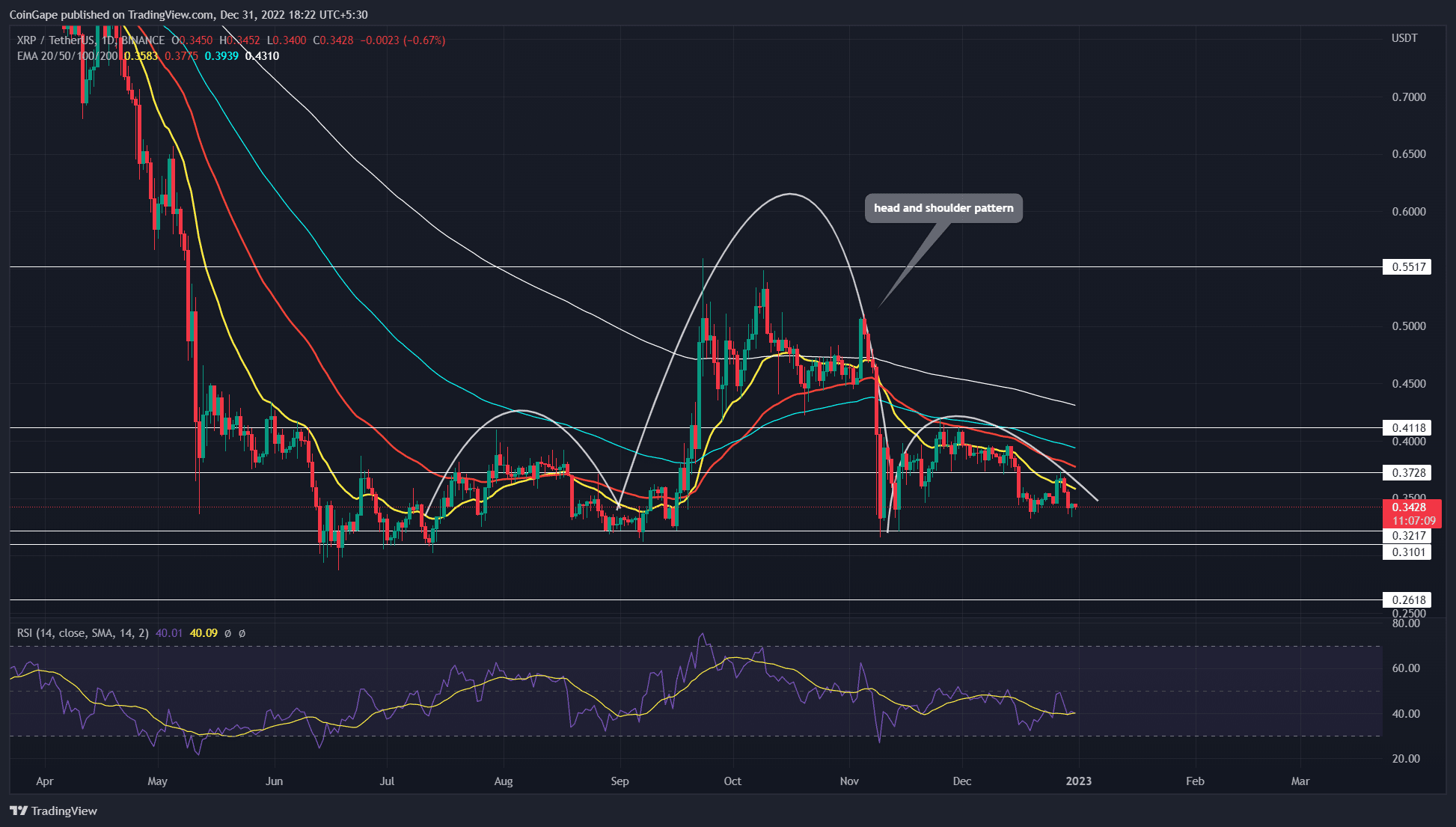

The XRP market has been exhibiting a head and shoulder pattern for the second half of 2022, which is often seen as a bearish signal indicating a potential decline in price. This pattern occurs when buyers are unable to push the price higher after reaching a certain level of support, known as the neckline, leading to a downward trend. However, a bullish indication hints at a bounce back in 2023.

Key points:

- A head and shoulder pattern govers the XRP price action

- A bullish breakout from $0.4 will undermine this bearish pattern

- The intraday trading volume in the XRP price is $372.1 million, indicating a 50% loss.

Despite the recent bullish recovery reaching the heights of the 50-day EMA, the XRP market price takes a bearish turn to create a bearish pattern coming in the long term. In the month of December, the market value of the refill token has plunged by 16.5% and trades slightly below the mark of $0.35.

Coming back to the long term pattern, the price trend shows a head and shoulder pattern forming in the daily chart with the neckline at $0.31-0.3. The neckline gets credibility by acting as a strong support level during the consolidation phase between June and October.

Also read – XRP Lawsuit: XRP Holders Are Biggest Loser In Ripple Case? Attorney Suggests This

Continuing the falling trend under the bearish aligned EMAs, the market value may soon succumb below the neckline highlighting a bearish entry point.

In such a case, XRP investors can witness further decline in market price, potentially a drop of 37% to the next support level at $0.18.

On a contrary note, if the new year brings new investors for ripple, a reversal above the neckline crossing the $0.40 mark will break the bearish hypothesis.

Additionally, to support the bullish reversal a double bottom pattern is evident within the right shoulder of the bearish pattern.

Considering, the bulls get momentum in 2023, a double bottom breakout can revive the XRP buying spree.

Technical Indicator

EMA: undermining the recovery in November and December, the crucial daily EMAs- 20, 50, 100, 200 maintain a negative trend displaying a long term bearish phase in action.

Relative strength indicator: the RSI slope shows a short-term decline from the midline but the bullish divergence in the double bottom pattern keeps the hope burning for XRP buyers.

XRP intraday price levels

- Spot price: $0.344

- Trend: Bearish

- Volatility: High

- Resistance level- $0.373 and $0.41

- Support level- $0.31 and 0.26

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Crypto Market at Risk as U.S.–Iran War Threatens Inflation With Oil Price Surge

- Polymarket U.S.–Iran Strike Bets Fuel Insider Trading Speculation as Crypto Traders Net $1.2M

- Cardano’s DeFi TVL Climbs as USDCx Stablecoin Launches on Network

- Analysts Predict Where XRP Price Could Close This Week – March 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

Buy $GGs

Buy $GGs