XRP, BTC, ETH Price Prediction As Inflation Data Sparks Downturn in U.S. Stocks

Highlights

- Cryptocurrencies price trends drop as U.S. inflation causes market downturn.

- Crypto market faces $450 million in liquidations amidst inflation concerns.

- XRP, Bitcoin, and Ethereum show sharp declines in recent hours.

The release of U.S. inflation data triggered an immediate decline in the Cryptocurrencies price trends. All digital assets experienced a market correction because of this recent development across the crypto market. Bitcoin trades below $83k and Ethereum exists below $1,800 in the current market situation. The current global crypto market cap reaches $2.68 trillion although it has declined by a total of 1.82% throughout the last day.

Trading activities experienced a substantial decline as market liquidity decreased to a 30% drop resulting in $62.18 billion volume. Bitcoin dominance rises to 61% as investors demonstrate a reserved market sentiment across the crypto market. A nationwide market downturn has been caused by stock market variants and decreased customer optimism that resulted in crypto liquidations totaling $450 million.

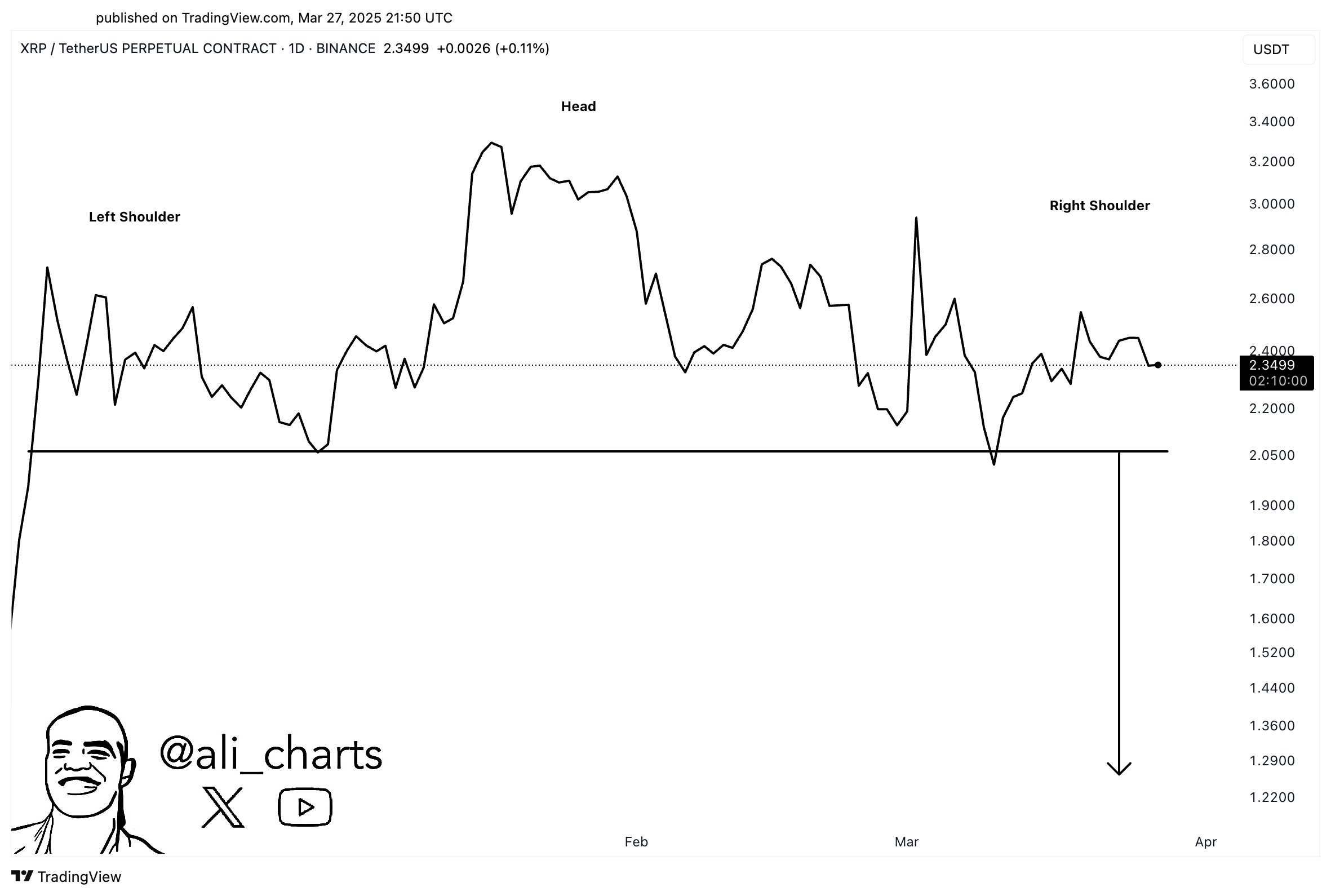

XRP

XRP has seen a 12% drop in just 48 hours, making it the worst-performing major cryptocurrency this week, despite Ripple’s victory over the SEC. The cryptocurrencies price, particularly XRP’s, has been on a downward trend.

A crypto analyst noted that if XRP manages to break above $3, it could invalidate the current head-and-shoulders pattern, potentially turning the outlook bullish for the cryptocurrency.

Bitcoin (BTC)

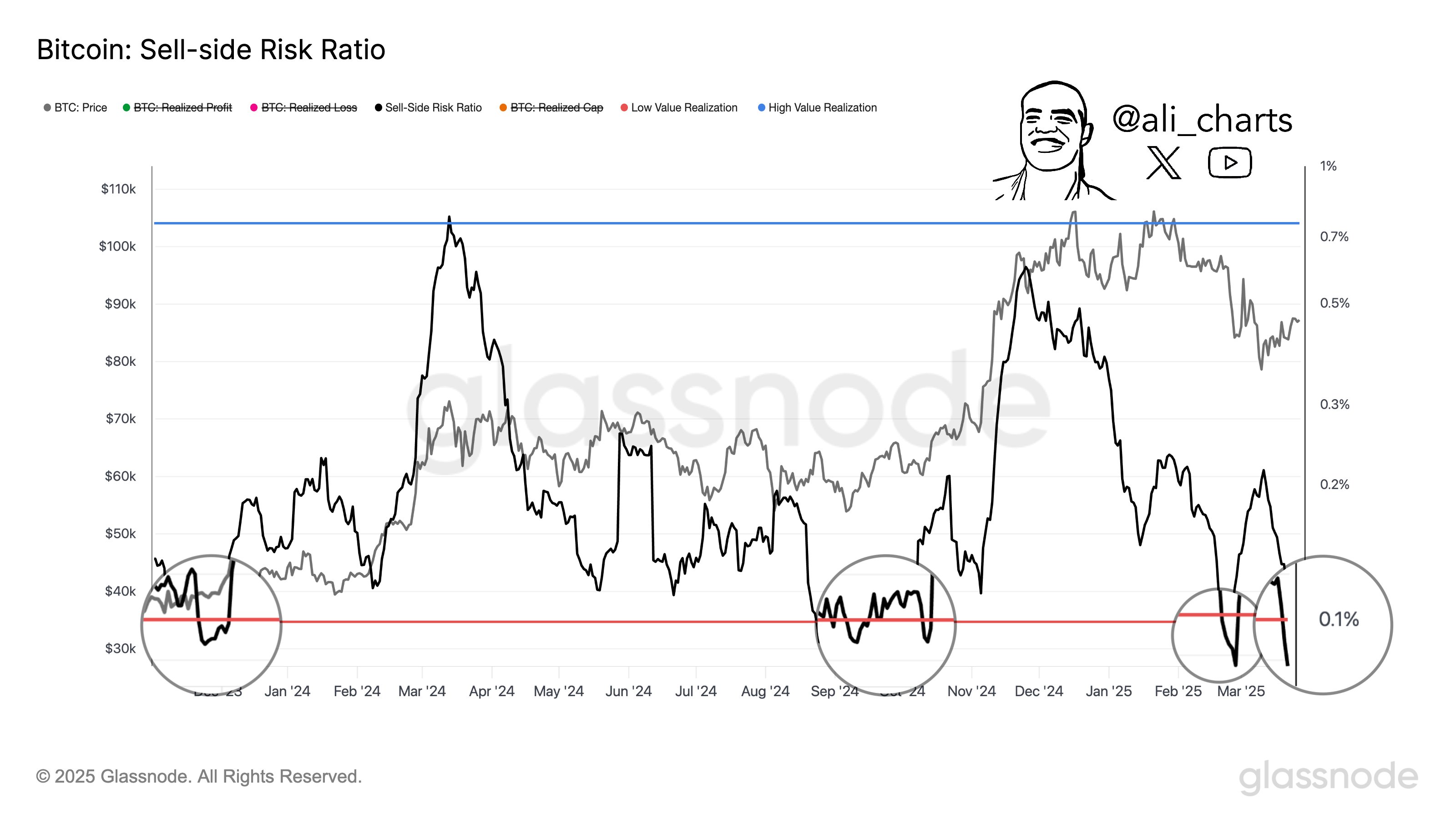

The Bitcoin market suffered a substantial price decrease in recent 24 hours which pushed its value below $83,000. Since recent height at $90,000 the leading Cryptocurrency has started to decline in price. The most recent BTC market information reveals its status at $82,324 while showing a decline of 2% during one day.

Crypto analyst AlI noted Bitcoin’s significant indicator, which shows that its sell-side ratio has dropped down to 0.086%. Previous price recovery signals have emerged when the sell-side ratio dipped below 0.1%.

The persisting bearish pressure would likely lead Bitcoin to fall briefly to $80,000 in the forthcoming period. The BTC price could increase to $90,000 provided the bulls eventually recapture dominance from bears.

Ethereum (ETH)

Ethereum prices faced a major drop during the past day resulting in values falling beneath $1,900 due to market-wide selling pressure. Within this period $136.21 million worth of liquidations occurred because of the price decline.

ETH price trades at a downward price movement while market participants continue to predict it will reachthe $2,000 mark. Ethereum may reach its key support region at $1,800 if its bearish movement keeps going down. A whale made an impactful purchase of 3,195 ETH which amounted to $5.97 million at the token rate of $1,868.

This whale has spent 29,341 ETH worth $58.18 million dollars starting from March 26 at $1,983 for each token.

A whale bought 3,195 $ETH($5.97M) at $1,868 again 1 hour ago!

Since March 26, this whale has bought 29,341 $ETH($58.18M) at an average price of $1,983.https://t.co/luJALJhvqr pic.twitter.com/Mn9FCYTV7F

— Lookonchain (@lookonchain) March 29, 2025

Conclusion

The cryptocurrency market currently experiences difficulties because of underlying economic market indicators. The market participants carefully observe how inflation data influences stocks and cryptocurrencies simultaneously.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

Frequently Asked Questions (FAQs)

1. What caused the recent drop in cryptocurrency prices?

2. How much has the global crypto market cap decreased?

3. What is the likelihood of Bitcoin recovering soon?

- Crypto Market Update: Top 3 Reasons Why BTC, ETH, XRP and ADA is Up

- Crypto News: Bitcoin Sell-Off Fears Rise as War Threatens Iran’s BTC Mining Operations

- U.S.–Iran War: Monday Crypto Crash Odds Rise As Pundits Predict Oil Price Spike

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

Buy $GGs

Buy $GGs