XRP Price Analysis: Ripple Social Media Mentions Hit 3-Month Peak After Dubai Bank Partnership

Highlights

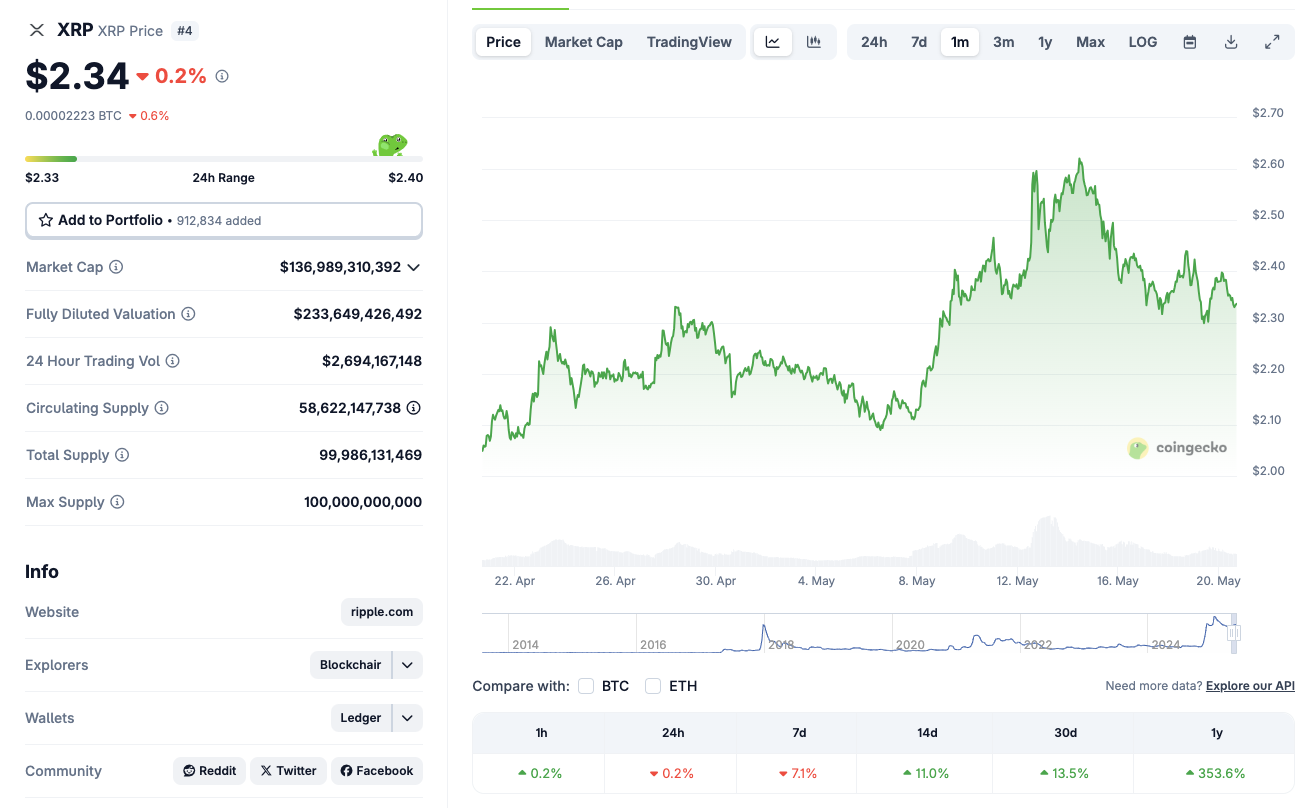

- XRP price rose to $2.35 on May 20, gaining 1% as Ripple expanded operations in the UAE.

- Ripple partners with Zand Bank and Mamo, backed by Dubai's DFSA license for blockchain-based cross-border payments.

- Social sentiment around XRP surged to a 3-month high, hinting at a potential bullish breakout.

XRP price climbed above the $2.35 level on Tuesday May 20, posting 1% gains on the 24-hour candle.

On-chain data shows that positive social media comments surrounding XRP surged to 3-months peak after Ripple inked a payment deal with a Dubai bank on Monday. Is this precursor to a major breakout ahead?

Ripple (XRP) Price Jumps on Dubai Partnership With Zand Bank, Mamo

Ripple (XRP) saw renewed market enthusiasm as price rebounded above $2.35, fueled by fresh institutional traction in the UAE.

On Monday, May 19 2025, Ripple announced partnerships with Zand Bank and Mamo, both newly onboarded clients in the United Arab Emirates.

This comes shortly after Ripple secured licensing from the Dubai Financial Services Authority (DFSA), a move enabling it to operate legally across Dubai’s financial ecosystem.

The collaborations aim to leverage RippleNet’s blockchain-powered infrastructure for cost-effective, real-time cross-border payments in the region.

By partnering with established financial institutions like Zand and fintech platforms like Mamo, Ripple’s expanding reach in the Middle-East increases demand for XRP use in global payment rails.

The broader crypto market remained relatively flat during the daily trading session on Tuesday. Coingecko data shows, XRP’s 0.2% dip alligns with tokens like Cardano and Dogecoin which also defended key support levels at $0.7 and $0.2 respectively.

XRP Positive Mentions Hit 3-Month Peak on Social Media

XRP’s recent price stability appears to be underpinned by a sharp rise in social media engagement, as measured by Santiment’s Weighted Social Sentiment indicator. This metric evaluates the tone of social discourse around a cryptocurrency by combining the volume of mentions with the ratio of positive to negative commentary.

A positive score reflects optimism and potential FOMO (fear of missing out), while a negative score implies market skepticism or disinterest. Historically, a sudden uptick in weighted sentiment has preceded bullish reversals and price breakouts across major digital assets.

According to Santiment data, XRP’s weighted sentiment surged above +1.74 on May 19–20, marking its highest reading in more than 60 days. This upward shift in crowd psychology comes after an extended bearish sentiment phase throughout March and April, during which scores hovered between -0.5 and -1.6.

Ripple (XRP) Weighted Social Sentiment | Source: Santiment

The last comparable positive spike in XRP Weighted Sentiment occurred on March 2, when weighted sentiment hit 5.44, a level that coincided with XRP’s rally to a local high of $2.94. Such elevated readings, especially when aligned with price action, often reflect early-stage accumulation by both retail and institutional actors.

This recent reversal from persistent negativity to sustained optimism suggests increasing investor confidence, possibly driven by Ripple’s growing international presence, including new partnerships in Dubai.

What’s Next for XRP Price?

Santiment’s weighted sentiment indicator has historically proven to be a reliable contrarian signal, particularly when extreme positive or negative sentiment marks inflection points. In XRP’s case, the current optimism, while not yet euphoric, may reflect renewed belief in the asset’s mid-term growth prospects.

If XRP holds the key support level above $2.30, the combination of rising social sentiment and bullish technical structure could enable a move toward the $2.60 resistance zone in the near term.

XRP Forecast Today: Sentiment Rebound Aligns with $2.60 Resistance Retest

XRP is displaying signs of bullish continuation, supported by recovering social sentiment and stable technical structure above $2.30. On the daily chart, the Chande Kroll Stop—a volatility-based trend indicator, shows dynamic support near $2.21, with the resistance band at $2.52 aligning closely with XRP’s short-term ceiling.

The XRP price has retraced modestly to $2.34 following a recent breakout above $2.50, yet remains structurally intact as long as the blue baseline holds as support.

More so, the Bull Bear Power indicator momentum turned slightly negative at -0.0228, suggesting a cooldown after May’s bullish expansion. However, the sell-off has lacked strong volume, hinting at consolidation rather than reversal. This sentiment aligns with Bitcoin price forecast today, where BTC hovers above critical support, helping sustain broader altcoin positioning.

If XRP reclaims $2.44, short-term momentum could target $2.60—where prior resistance rejected further upside on May 17.

A clean break above $2.60 may extend toward $2.94, the March high that previously coincided with extreme weighted social sentiment. Conversely, failure to defend the $2.21 trend floor could signal a retracement toward $2.00.

Frequently Asked Questions (FAQs)

1. Why did XRP price go up today?

2. What is the significance of Ripple’s Dubai license?

3. Is this a bullish signal for XRP price?

- U.S. CPI Release: Wall Street Predicts Soft Inflation Reading as Crypto Market Holds Steady

- Bhutan Government Cuts Bitcoin Holdings as Standard Chartered Predicts BTC Price Crash To $50k

- XRP News: Binance Integrates Ripple’s RLUSD on XRPL After Ethereum Listing

- Breaking: SUI Price Rebounds 7% as Grayscale Amends S-1 for Sui ETF

- Bitget Targets 40% of Tokenized Stock Trading by 2030, Boosts TradFi with One-Click Access

- Cardano Price Prediction Ahead of Midnight Mainnet Launch

- Pi Network Price Prediction as Mainnet Upgrade Deadline Nears on Feb 15

- XRP Price Outlook Amid XRP Community Day 2026

- Ethereum Price at Risk of a 30% Crash as Futures Open Interest Dive During the Crypto Winter

- Ethereum Price Prediction Ahead of Roadmap Upgrades and Hegota Launch

- BTC Price Prediction Ahead of US Jobs Report, CPI Data and U.S. Government Shutdown