XRP Price Forecast Today: Traders Withdraw $160M as US Judge Rejects Ripple’s $50M SEC Settlement

Highlights

- XRP drops 1.3% to $2.39, underperforming BTC as a rejected Ripple-SEC settlement triggers internal bearish sentiment.

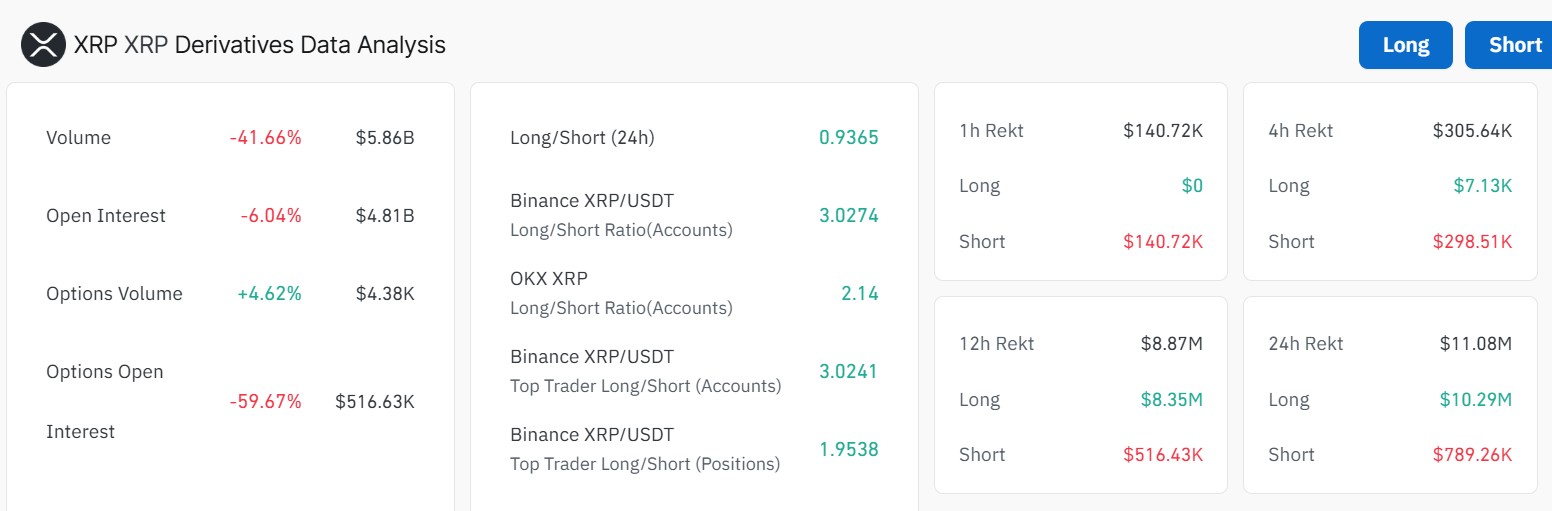

- XRP derivatives market sees $160M Open Interest decline, confirming active withdrawals amid heightened legal risk.

- Options Open Interest crashes 59%, indicating defensive positioning as traders reassess XRP exposure post-court ruling.

Ripple (XRP) has plummeted after US District Judge Analisa Torres overruled the SEC’s $125M settlement deal with Ripple. XRP price is down 1.3% on Saturday, and derivatives market data shows traders are being cautious. Amid these headwinds, can XRP defend the $2 support level or are further dips ahead?

XRP Finds Support at $2.40 US Judge Upholds $125M Fine on Ripple

Ripple (XRP) slipped by 1.3% on Saturday, trading as low as $2.38 following a negative legal development that reignited concerns over regulatory uncertainty.

The current bearish blow on XRP price comes after U.S. District Judge Analisa Torres rejected a proposed $50 million settlement between Ripple Labs and the U.S. Securities and Exchange Commission (SEC), affirming a prior $125 million penalty and an injunction on future securities violations.

Despite Ripple’s intention to appeal court’s decision to effectively raise the settlement fine from $50 million to $125 million, XRP traders showed negative reaction over the last 24 hours.

Coingecko data shows that Ripple price is trading at $2.35, down 3% since the Court ruling hit the newsreels.

Meanwhile, Bitcoin and Ethereum price posted mild gains on Friday, reclaiming key levels at $104,400 and $2,590 respectively at the time of writing.

XRP Derivatives Market Reaction: $160M in Open Interest Pulled Amid Legal Uncertainty

This renewed regulatory uncertainty surrounding the Ripple vs. SEC lawsuit has spread beyond the spot markets. XRP derivatives market trends observed on Friday show that speculative traders flipped into a more cautious stance following the ruling.

As seen in the Coinglass’ chart below, XRP traders have responded with a 6% decline in Open Interest, representing over $160 million in capital withdrawal within 24 hours. This signals traders actively de-risking and exiting leveraged XRP positions to mitigate risk amid regulatory uncertainty.

Data from Binance and OKX shows a declining long-to-short ratio among top traders, with Binance’s long/short (positions) ratio at 0.93 and a broader account ratio nearing 3.02, reflecting thinning bullish conviction.

Over $11 million in XRP derivatives positions were liquidated in the past 24 hours, 92% of which were long positions.

Options market sentiment corroborated the negative reaction among XRP traders on Friday. While options volume spiked 4.6% to $4.38K, open interest in options plunged over 59%, down to just $516.63K, revealing sharp outflows among large investors who often dominate options trading markets.

Will XRP Price Recover in May 2025?

With the case now likely to extend further into litigation, volatility expectations may continue to limit inflows from new entrants. In the near-term XRP price is now likely to enter a prolonged consolidation phase below $3.

More so, the 5.3% lag in XRP/BTC trend on Friday further emphasises risks that XRP could fall behind rival top-ranked assets, even if the crypto market rally advances further in 2025.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

Frequently Asked Questions (FAQs)

1. Why did XRP drop 3% today?

2. What does the drop in Open Interest mean for XRP?

3. Could XRP recover later this month?

- Gold ETF vs Tokenized Gold: Who Could Outperform in 2026?

- Crypto Weekly Wrap: Jane Street Targeted After Terra Suit, Vitalik’s ETH Selloffs, Regulatory Progress Feb 23-27

- Meme Coin Market Dead? Top 5 Reasons Dogecoin, Shiba Inu, and Pepe Are Crashing

- Crypto Market Crashes as U.S.-Iran Tensions Escalate With Airstrikes

- Breaking: Ethereum Price Drops Amid Israel-Iran Tensions; Machi Big Brother Liquidated Again

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

Buy $GGs

Buy $GGs