XRP Price Outlook Ahead of Possible Government Shutdown

Highlights

- XRP price faces bearish momentum, trapped in a descending channel pattern.

- Fears of a government shutdown decline, which reduces market uncertainty on XRP.

- Solana ETFs and Ethereum are on the rise; XRP experiences outflows.

XRP price is facing significant pressure ahead of a potential government shutdown, with a notable 7% pullback recently. The price dropped below the key $1.80 support level, now testing the $1.70 mark. This fall is a bigger part of the general market dynamics, which have been impacted by regulatory changes and institutional actions regarding the XRP ETF. The highs of XRP were previously around $1.90-$2.00, which are now wiped out.

The total cryptocurrency market has dropped by 5.95%, and the total market cap is currently at 2.81 trillion. The coordinated sell-off, which is forcing the unwinding of leveraged long positions, has led liquidations of more than 1.7 billion at major exchanges and whales.

Bitcoin price fell below the support of $85,000, and Ethereum (ETH) traded under $3,000, falling by 7%. These actions underscore the prevailing macroeconomic and geopolitical events that have driven the decline in the cryptocurrency coins.

U.S. Government Shutdown Threat Eases Now

The U.S. government shutdown threat has decreased after new developments in the Senate. President Trump has achieved a bipartisan consensus with the Democratic lawmakers. Such a deal will avert another government shutdown.

The office of Chuck Schumer has reported that the agreement has been negotiated by the lawmakers. Nonetheless, the conflicts regarding the financial support of ICE and immigration enforcement restrictions persist. These problems remain the essential impediments to the discussions. This notwithstanding, the fear of a government shutdown has reduced considerably.

Indications of a possible agreement between President Trump and Senator Chuck Schumer have come to their rescue. The accord has significance in the continuity of legislation, including the CLARITY Act. The threat of a shutdown has been reduced, but the unity between the two parties is essential.

It maintains government services that are running smoothly. The politicians are also working on solving urgent funding challenges within the next few weeks.

XRP Sees Significant Outflow While ETH and SOL Gain Momentum

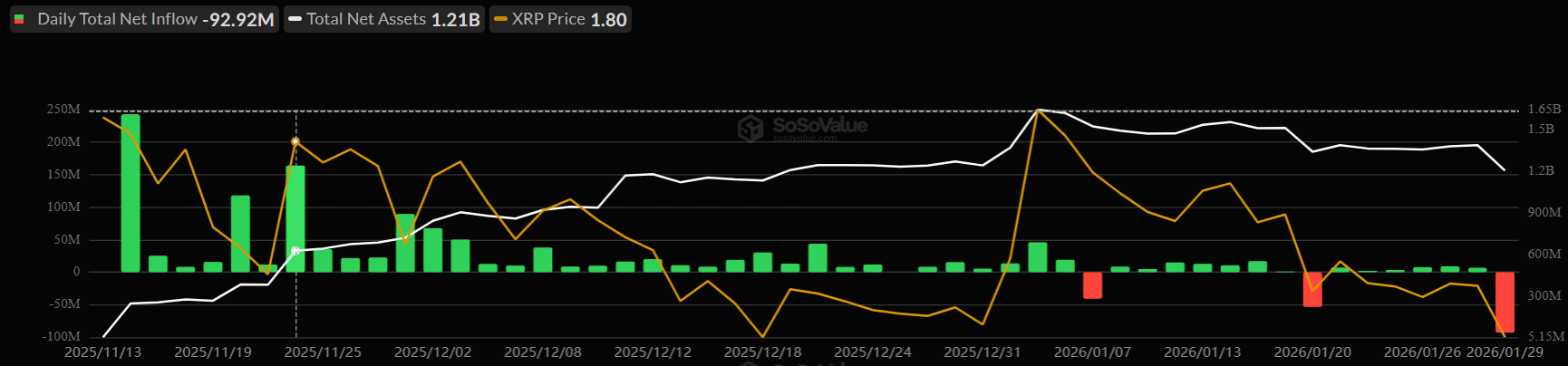

According to SoSoValue, XRP price experienced a significant outflow of $92.92 million. Bitcoin spot ETFs had net outflow of -19.64 million, and Ethereum ETFs had net inflow of 28.10 million within the same period.

Solana spot ETFs also registered a higher positive net inflow of $6.69 million, which shows different sentiments in the market.

Is More Crashing Coming For XRP Price?

As of January 30, 2026, the XRP Price crashed to $1.74, struggling to hold above its recent support levels.

The technical indicators imply that XRP price is now stuck in a declining channel, with regular low lows and high highs, which are bearish momentum features.

The Relative Strength Index (RSI) is at the current level of 29, which means that XRP is in the oversold category and may be subjected to a possible reversal.

The Moving Average Convergence Divergence (MACD) is negative as well, indicating the bearish crossover of the MACD line and signal line. This implies that there is a deficiency in strength to move upwards.

The most important support levels to be observed are the $1.70 level, which is critical and may determine the direction of the XRP price to either stand steady or fall. The resistance aspect at $1.90 is still a heavy point and may serve as a resistance point in case the price increases further in the future.

Frequently Asked Questions (FAQs)

1. Why is XRP's price declining?

2. How does the U.S. government shutdown affect XRP?

- CryptoQuant Flags $54K Bitcoin Risk As Trump Considers Limited Strike On Iran

- Why Is Bitdeer Stock Price Dropping Today?

- Breaking: U.S. Supreme Court Strikes Down Trump Tariffs, BTC Price Rises

- Breaking: U.S. PCE Inflation Rises To 2.9% YoY, Bitcoin Falls

- BlackRock Signals $270M Bitcoin, Ethereum Sell-Off as $2.4B in Crypto Options Expire

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise

- Cardano Price Prediction Feb 2026 as Coinbase Accepts ADA as Loan Collateral

- Ripple Prediction: Will Arizona XRP Reserve Boost Price?