XRP Price Prediction as Ripple Gets MAS Licence in Singapore

Highlights

- XRP compresses near a major demand zone as buyers react at the lower regression band.

- Ripple’s MAS licence in Singapore strengthens long-term utility expectations across regulated payment channels.

- Deep spot outflows indicate accumulation as tokens exit exchanges, easing short-term selling pressure.

The XRP price draws renewed interest as it moves toward a familiar support region. The chart indicates a broad demand zone which tends to respond intensely in case of recurrent declines. This is a region that is now attracting attention since it is in line with historical rebound points observed in previous sell-offs.

Meanwhile, Ripple’s newly expanded licence in Singapore shapes a stronger narrative around its long-term reach. All these factors provide a significant background because the market is assessing the possibility of price stability to resume in the near future.

XRP Price Compresses Around A Major Support Zone

The XRP price sits directly above a wide demand zone that covers the lower region of the current structure. The buyers react fast within this zone since it has already elicited a number of previous rebounds.

At press time, the XRP value trades at $2.03 after a sharp intraday drop that pushed price close to the lower band of the regression channel. This channel directs movement within a regulated downward trend, and the lower band has become the primary response zone of every downward movement.

XRP is currently trading within this lower band and each touch is being met with obvious buy interest. This behaviour is very intentional on the part of buyers who consider the band as an early reversal zone. Price can still be pegged at $1.9545, which is close to the middle of the demand range. This stage is linked to previous rebound periods of comparable downturns.

At this point, buyers observe a recovery trend that starts at $2.23, which is the initial resistance checkpoint. The second obstacle is close to 2.53 and this is the level that corresponds to one of the major breakdowns in the early autumn. The broader structure also gives an opportunity to push to $3.00 in case buyers support this area in a consistent manner.

This setup is further supported by the MACD since the MACD line remains above the signal line with a consistent distance. This alignment tends to be seen close to early reversal areas and is a stronger control by buyers in pullbacks. The histogram also occupies positive territory, which is steadily increasing upwards. These circumstances reinforce the argument of a rebound as price moves towards the lower regression band.

Ripple’s MAS Licence Win Ignites Broader Market Confidence

Ripple secured an expanded MPI licence in Singapore, and this shift strengthens its presence across the region. The approval now gives Ripple room to scale regulated payment services across a wider operational scope.

This update enhances its capability of supporting quick and clear settlement channels to institutions. It also reinforces Ripple’s commitment to regulatory clarity as it expands through Asia.

The broader licence allows Ripple to serve banks, fintechs, and digital asset firms with more flexible payment rails. Such services ease the operation friction and allow token-based settlement to be more accessible.

Meanwhile, Asia continues to lead global adoption growth, which creates ideal ground for Ripple’s wider expansion plans. This scenery enhances the belief in its long term utility case.

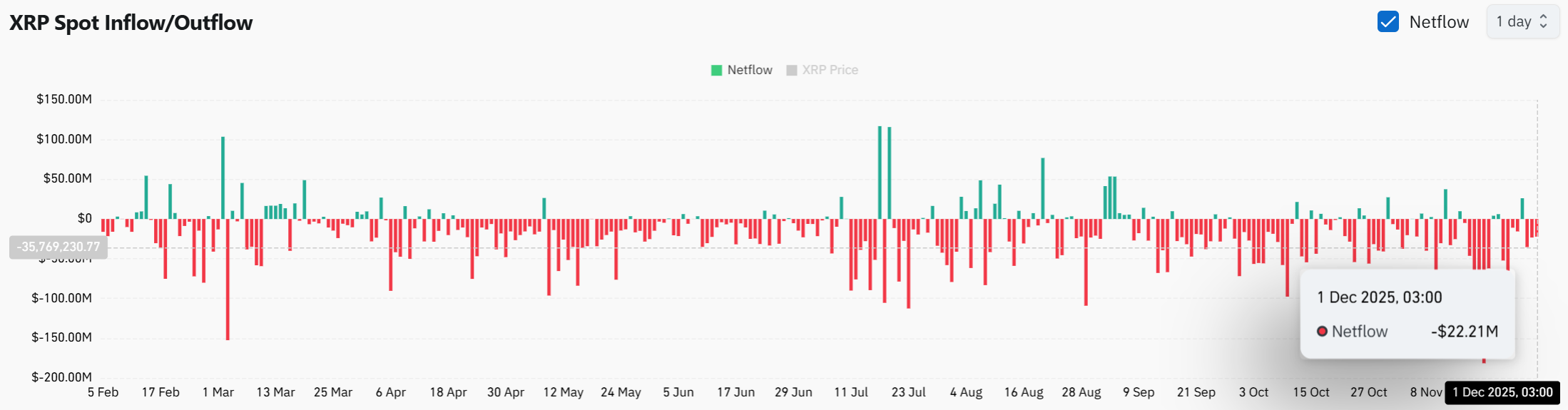

The spot netflow of XRP is currently experiencing deep outflows with increasing numbers of tokens moving out of exchanges on a daily basis. These exits minimize immediate selling availability and generate a light supply in the event of pullbacks. This is the most recent outflow of $22.21M on December 1, which is part of comparable declines in November.

This trend is usually an indication of silent hoarding as the holders transfer the tokens to their own storage. This shift eases selling pressure and supports the XRP price as it trades near a major support zone.

Conclusively, the XRP price sits near a zone that often triggers strong reactions during declines. The buyers are still protecting this structure with a definite purpose, and this keeps a recovery in the spotlight.

Ripple’s strengthened position in Singapore also adds confidence because regulatory clarity often improves long-term utility demand. All these factors are in favor of a positive outlook, particularly when price is above the demand region and starts to approach the closest resistance checkpoints.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

Frequently Asked Questions (FAQs)

1. How does the regression trend help interpret XRP’s market structure?

2. What does Ripple’s MAS licence allow the company to do in Singapore?

3. Why do spot outflows matter for XRP’s ecosystem health?

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Crypto Market at Risk as U.S.–Iran War Threatens Inflation With Oil Price Surge

- Polymarket U.S.–Iran Strike Bets Fuel Insider Trading Speculation as Crypto Traders Net $1.2M

- Cardano’s DeFi TVL Climbs as USDCx Stablecoin Launches on Network

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

Buy $GGs

Buy $GGs