XRP Price Prediction as Ripple Scores Big Partnership in Cash-Rich Saudi Arabia

Highlights

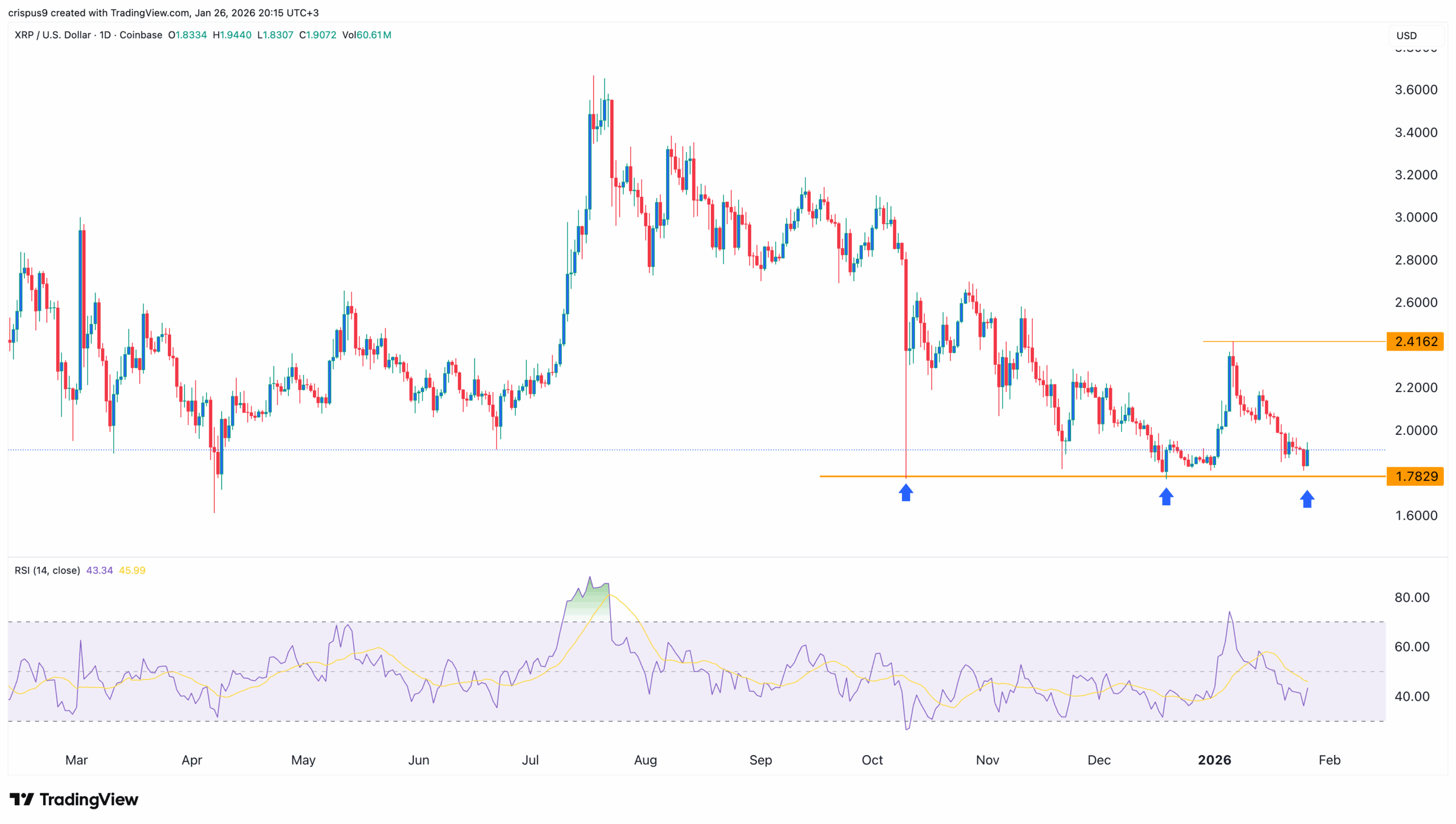

- XRP price formed a triple-bottom pattern at $1.7830, pointing to a rebound.

- Ripple Labs inked a major deal to accelerate its growth in Saudi Arabia.

- It recently acquired licenses in the UK and in Luxembourg.

XRP price rose by nearly 5% on Monday, paring back some of the losses made earlier during the day. It rose to a high of $1.9180, much higher than the intraday low of $1.8085. This rebound could continue after the coin formed a triple-bottom pattern and after Ripple Labs reached a deal with a major Saudi Arabian company.

XRP Price Technical Analysis Points to a Rebound as Triple Bottom Pattern Forms

The daily timeframe chart shows that the XRP price has been in a strong downward trend in the past few months. Most recently, the coin dropped and erased all the gains made earlier this year.

A closer look shows that the token has formed a triple-bottom pattern at $1.7830, its lowest level in October and December last year and this month. This pattern’s neckline is at $2.4162, its highest level this month. A triple bottom is one of the most common bullish reversal chart patterns.

The Relative Strength Index (RSI) has pointed upwards and is about to move above the neutral level at 50. Ripple price has also formed a bullish engulfing pattern, which is made up of a big bullish candle, that follows a small bearish one.

Therefore, the most likely Ripple price forecast is bullish as long as it remains above the important support level at $1.7810. If this happens, the next key target level to watch will be at $2.4162, which is about 25% above the current level.

On the flip side, a drop below the key support level at $1.7830 will invalidate the bullish outlook.

Ripple Labs Inks Major Partnership With Jeel

One of the top catalysts for the XRP price is a new partnership between Ripple Labs with Jeel, the innovation arm of Riyadh Bank, a major organization with over $120 billion. The partnership aims at advancing Saudi Arabia’s future through blockchain technology. This partnership will see the two entities assess ways for integrating the blockchain technology in areas like cross-border payments.

Ripple Labs has continued deepening its relationships with other countries. For example, the company recently acquired licenses in the United Kingdom and Luxembourg. It also recently received a banking charter from the Office of the Comptroller of the Currency (OCC).

Meanwhile, third-party data shows that Ripple is becoming a major player in the Real World Asset (RWA) tokenization industry. Its RWA assets have soared by 30% in the last 30 days to over $410 million, while its stablecoin market capitalization rose by 10% to $393 million. This growth will likely continue in the coming years as the industry matures.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

Frequently Asked Questions (FAQs)

1. What is the most likely XRP price prediction?

2. Is XRP a good coin to buy?

3. What next for the Ripple price this week?

- Breaking: MSTR Stock Price Climbs As Michael Saylor’s Strategy Adds 17,994 BTC

- BREAKING: US Oil Prices Crash $15 in Two Hours as G7 Eyes 400M Barrel Release — Crypto Markets on Edge

- BTC Markets Moves to Offer Tokenized Assets as RWA Market Hits $26.5B Peak

- Why BTC Price is Rising Today? (March 9, 2026)

- Wall Street Expert Warns 35% Crypto Stocks Market Crash Amid U.S- Iran War Tensions

- Bitcoin And XRP Price Prediction As US Oil Prices Fall Sharply- Will This Spark a New Bull Rally

- Is It a Good Time to Buy XRP As Price Falls 64% From All-time High

- Will Crypto Market Crash This Week? Analysts Predict Timeline for Volatility

- Gold Price Prediction Ahead of March 18 FOMC Meeting

- Dogecoin, Pepe coin, and Shiba Inu Price Prediction As BTC Crashes Below $70k

- Here’s Why Cardano Price Has Not Reclaimed $0.30

Buy $GGs

Buy $GGs