XRP Price Prediction: Ripple Swell 2025, ETF Hints, RLUSD Plans, and Market Outlook

Highlights

- XRP price shows signs of reversal as buyers defend the $2.10–$2.20 zone amid fading sell pressure.

- Ripple Swell 2025 fuels optimism with ETF launch hints and major institutional collaborations.

- RLUSD integration and record DEX activity reinforce long-term ecosystem growth and liquidity strength.

The XRP price continues to draw attention as Ripple’s Swell 2025 event delivers new catalysts for market speculation. The ongoing conference has sparked excitement over potential ETF approval, RLUSD’s expanding role, and major institutional partnerships. Meanwhile, recent on-chain data, rising DEX activity, and renewed investor interest signal that the token may be at a turning point. As the event unfolds, all eyes are on how these developments could influence the next phase of the XRP price trajectory.

XRP Price Action Hints at a Potential Reversal Above Key Support

The XRP price has been consolidating within a steady downtrend since mid-August, with sellers maintaining dominance through lower highs. However, signs of exhaustion have emerged after XRP retested the $2.10–$2.20 buy zone, an area repeatedly defended by long-term buyers in previous pullbacks.

At the time of press, XRP value trades at $2.26, showing resilience near the lower boundary of the structure. The first major resistance lies at $2.64, where short-term sellers have historically triggered retracements, making it a key level for buyers to reclaim control.

If XRP breaks above this range, the next critical region will be $3.10 — a mid-level resistance where prior rallies paused. This often signals partial profit-taking before renewed buying strength resumes.

Above this threshold, the $3.66 zone forms the primary target, representing the convergence of historical liquidity and Fibonacci retracement alignment. A decisive breakout past $3.10 could therefore ignite momentum toward $3.66, setting up XRP for a structural reversal if volume follows through.

Ripple Swell 2025 Sparks ETF Speculation and Institutional Anticipation

Ripple Swell 2025 has quickly become the focal point of institutional attention. Canary Capital’s CEO Steven McClurg confirmed readiness to launch the XRP ETF next week, intensifying optimism about broader market participation. Ripple CEO Brad Garlinghouse’s discussions with U.S. policymakers also emphasized the need for balanced crypto regulation, reinforcing XRP’s potential role in regulated financial systems.

Additionally, Ripple’s recent acquisition of GTreasury and its expansion into real-world asset tokenization highlight a deep institutional pivot. These moves suggest that the company is strategically aligning XRP with mainstream financial infrastructure, raising expectations for stronger price performance once regulatory and liquidity hurdles ease.

Ripple’s RLUSD initiative is transforming its stablecoin framework into a key liquidity engine for the XRP ecosystem. Through Bitnomial’s margin program, RLUSD now serves as collateral for futures, options, and perpetual trading, bridging stablecoin efficiency with institutional-grade settlements.

This expansion enhances capital flexibility, enabling traders to leverage XRP and RLUSD together for stable liquidity management. Ripple’s million funding round of $500 million at a $40 billion valuation underlines investor confidence in this growth strategy.

Moreover, the integration supports Ripple’s push toward regulated on-chain settlements across global financial corridors. By coupling RLUSD’s reliability with XRP’s speed, Ripple has positioned itself as a bridge between stablecoin-backed finance and decentralized value transfer.

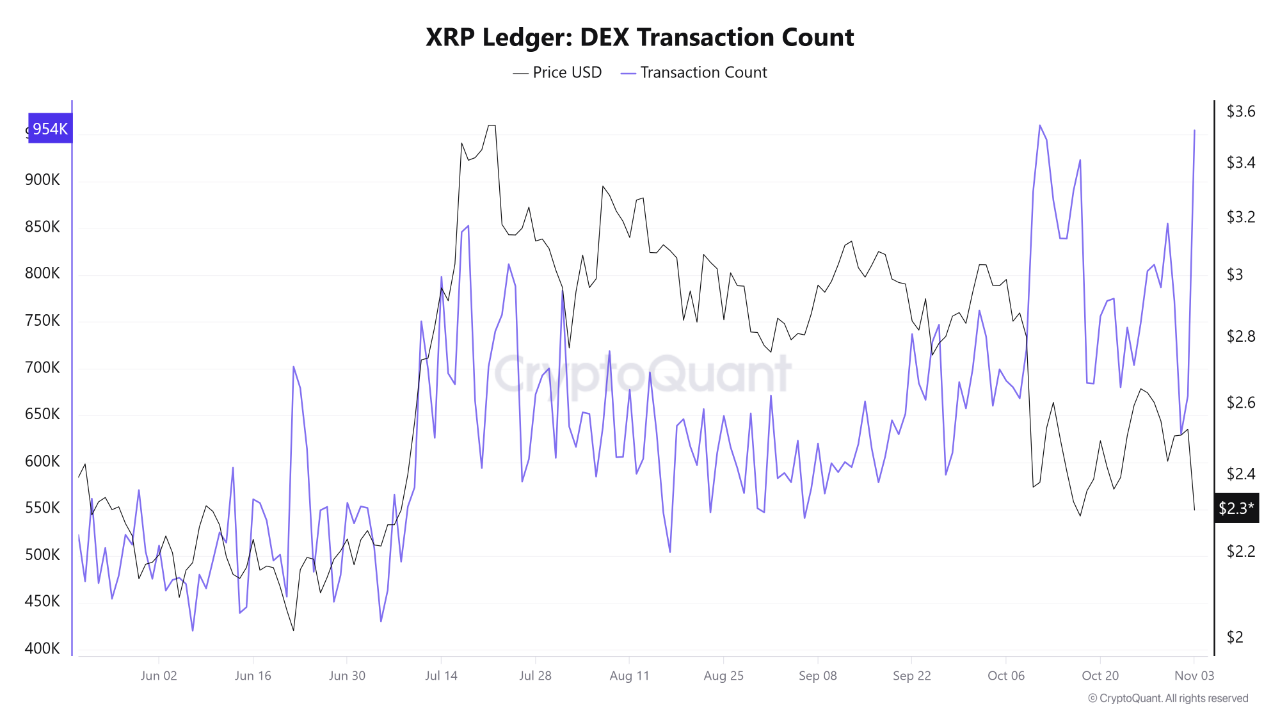

XRP DEX Activity Surges Despite Price Weakness

According to CryptoQuant, XRP’s decentralized exchange activity soaring to record levels, surpassing 954,000 daily transactions, the highest in months. While this spike indicates network vitality, its divergence from price performance reveals a more nuanced picture.

Such decoupling often points to automated arbitrage or redistribution rather than broad-scale accumulation. Still, the increased usage reflects robust utility within the XRP Ledger, showing that underlying demand for transaction processing remains intact.

Historically, when price action catches up to on-chain engagement, volatility often shifts in favor of buyers. Should XRP price sustain recovery above $2.64, this alignment could propel renewed momentum toward the $3.10–$3.66 range.

To sum up, the XRP price is approaching a critical technical and fundamental juncture. Ripple’s Swell 2025 event, ETF anticipation, and RLUSD expansion provide the necessary fuel for a potential breakout. If buyers maintain strength above $2.20 and reclaim $2.64, a push toward $3.66 becomes increasingly likely. The convergence of market catalysts and on-chain signals points to a decisive phase for XRP as 2025 draws to a close.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

Frequently Asked Questions (FAQs)

1. What is the significance of Ripple Swell 2025?

2. How does RLUSD contribute to Ripple’s ecosystem?

3. Why is DEX activity important for XRP?

- Crypto Weekly Wrap: Jane Street Targeted After Terra Suit, Vitalik’s ETH Selloffs, Regulatory Progress Feb 23-27

- Meme Coin Market Dead? Top 5 Reasons Dogecoin, Shiba Inu, and Pepe Are Crashing

- Crypto Market Crashes as U.S.-Iran Tensions Escalate With Airstrikes

- Breaking: Ethereum Price Drops Amid Israel-Iran Tensions; Machi Big Brother Liquidated Again

- CLARITY Act: Stablecoin Yield Debate Heats Up, but March 1 Deadline Not ‘Do or Die’

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

Buy $GGs

Buy $GGs