Zcash Price Defies Market Crash: Will Shrinking Exchange Netflows Keep ZEC Rallying?

Highlights

- ZEC held strong during a market-wide crash as buyers defended rising support zones.

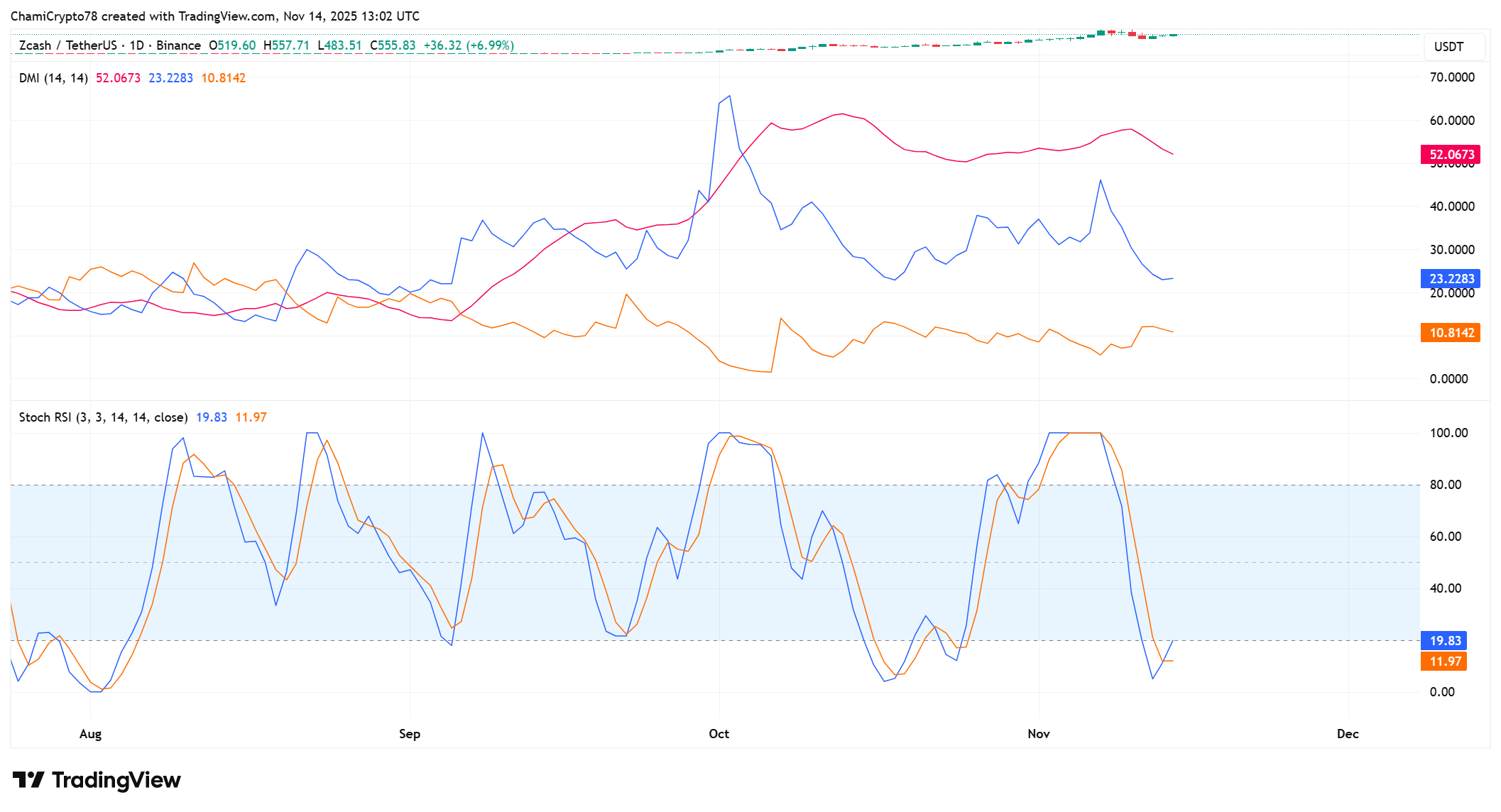

- Indicators such as DMI, ADX, and Stoch RSI confirm clear buyer control.

- Shrinking exchange netflows and rising shielded supply strengthen ZEC’s broader trend.

The Zcash price delivered a strong positive move today despite a deep market-wide crash. Bitcoin dropped to $95,000 after a sharp 7.6% decline, yet ZEC gained more than 12% during the same window. Buyers kept firm control along rising levels, supported by reduced exchange activity that eased sell-side pressure. ZEC held a clean structure through every intraday swing and reacted strongly at each dip. This resilience now sets a solid base for potential continuation above near-term resistance.

Zcash Price Action Holds With Clear Strength

The ZEC price still moves inside a strong uptrend that began in early October and continues to guide buyers higher. The candles show steady reactions along the ascending support line, which confirms clear interest at each dip.

Notably, the structure remains clean because price stretches upward after every touch of that trendline. This behavior shows strong confidence from buyers who defend the line with fast responses.

The $441 level stands out as an established support because ZEC bounced sharply each time price approached that area. Buyers used that zone as a launch point and pushed the market deeper into higher territory.

At the time of press, the ZEC value trades at $566 and now sits just below the $600 resistance region. That zone often forms a heavy reaction wall since earlier candles struggled there.

The MFI sits at 51.79, which signals dominant buying pressure and steady positive flow. This position shows buyers control the tape and push reactions with growing strength. The reading also supports continued upward movement because an MFI above 50 often aligns with trends that keep advancing.

A break above $600 could unlock space toward $750, which aligns with the next mapped reaction band. The market structure supports that possibility as long as buyers hold the rising trendline.

Indicators Strengthen ZEC’s Advantage

The DMI shows clear buyer dominance because the +DI sits at 23.22, while the -DI holds at 10.72. That separation reveals strong buy-side control across recent sessions. Buyers push reactions with firm pressure when the +DI maintains clear distance. The gap also shows how sellers struggle to build influence at major levels.

ADX adds another layer of clarity with a reading at 52.17. That level confirms strong trend conviction rather than short bursts of pressure. ADX rises only when consistent force holds across multiple sessions. ZEC fits this pattern with clean reactions at every rising support.

The Stoch RSI now shows %K at 19 and %D at 11, which places both lines deep in oversold territory. Readings below 20 often signal exhaustion from sellers and create space for sharp upside reactions. This setup shows how buyers can regain control once pressure fades around lower levels. The indicator now supports a potential shift upward as long as ZEC protects its rising structure.

Netflows Shift Sharply In Favor Of Buyers

Exchange netflows for ZEC dropped from $38.9 million to $748.69k between November 12 and 13, as per CoinGlass analytics. That collapse tightened liquid supply and reduced quick exits from short-term holders. Fewer tokens moved to exchanges, which changed the way reactions formed around major levels. The drop also helped limit sudden sell-side pressure during today’s volatile market swing.

Shielded ZEC supply now sits above 30% of total circulation, which removes a large portion of coins from active access. That shift gives buyers more control because fewer tokens sit in positions ready for rapid selling.

The rising shielded supply also supports stronger rebounds near major support zones. ZEC reacted with force each time the price returned to the $441 region and lifted quickly afterward.

This tightening trend gained extra support after Cypherpunk Technologies confirmed a 203,775 ZEC treasury position for a total of $50M. Their stack now sits deep in profit and shows strong long-term commitment.

These conditions aligned perfectly with the strength seen during today’s market crash. If this pattern continues, Zcash price could challenge the $600 ceiling with stronger conviction.

Summary

ZEC holds a clean rising structure while protecting every key support level. Buyers controlled reactions around $441 and kept pressure steady through heavy volatility. Shrinking netflows now tighten supply and strengthen the base behind each recovery. A sustained break above $600 can open a direct path toward $750 within the current trend.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

Frequently Asked Questions (FAQs)

1. What role does shielded ZEC supply play in market behavior?

2. How does reduced exchange activity affect ZEC market structure?

3. Why does Cypherpunk Technologies' ZEC purchase matter?

- Breaking: Morgan Stanley Applies For Crypto-Focused National Trust Bank With OCC

- Ripple Could Gain Access to U.S. Banking System as OCC Expands Trust Bank Services

- $2T Barclays Explores Blockchain For Stablecoin Payments and Tokenized Deposits

- Breaking: U.S. PPI Inflation Rises To 2.9%, BTC Price Falls

- XRP News: Ripple-Backed Ctrl Alt Completes $280M in Diamond Tokenization on XRPL

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

Buy $GGs

Buy $GGs