Zilliqa Price Prediction: ZIL Price Challenges 0.618% Fibonacci Retracement; Keeps Eye On $13.5 Next

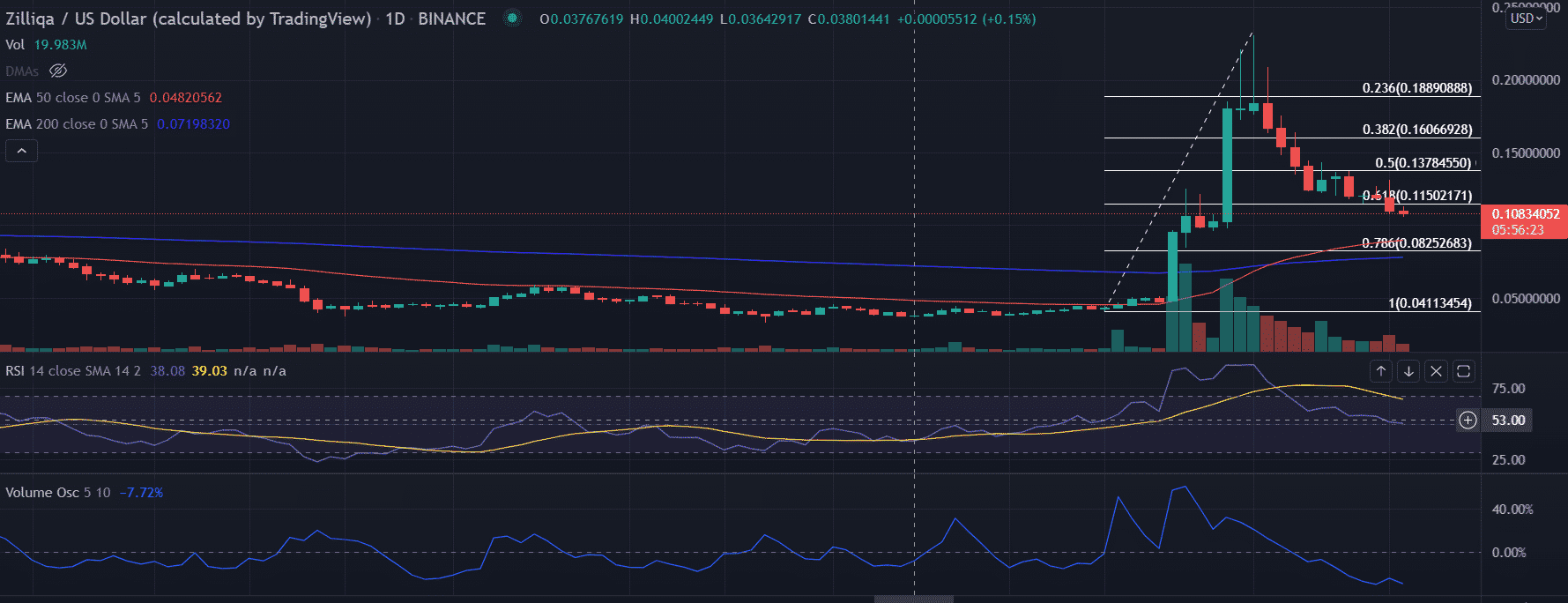

ZIL price is in a continuous downward spiral but trades on a muted note on Tuesday. The recent price action had pushed it below the crucial retracement levels.

- ZIL price trades in a very tight range with no clear directional bias.

- Expect, a bounce back in the price if the price gives a daily close above the 0.618% Fibonacci retracement at $0.11.

- However, the downswing could extend toward $0.78.

ZIL price is near an inflection point

ZIL’s price witnessed a considerable drop in its buying since the record high of $0.23. The ZIL buyers failed to carry forward the gains beyond the mentioned level which led to a trend reversal. Investors collect the liquidity extending from $0.16 and $0.13.

Further, a fall below the crucial $0.618% Fibonacci retracement fuels the downside momentum extending the selling toward the March 30 lows at $0.98.

However, the formation of the ‘Doji’ candlestick suggests a tug of war between bulls and bears to take over the further trend direction. After a fall of 35%, the sellers look exhausted as the volumes dry up on the daily chart.

Now, a daily candlestick above $0.12 could mean a reversal is on the corner. In that case, the first upside target is located at the $0.5% Fibonacci retracement level at $0.13.

Next, the ZIL buyers would attempt to lock in 23% gains from $0.13 to $0.16.

As of writing, ZIL/USD trades at $0.10, down 0.13% for the day. The 24-hour trading volume stands at $696,087,313.

Technical indicators:

RSI: The daily relative strength index hovers near 50 with a neutral stance. If the oscillator tilts slightly toward the positive side then the price could see more upside in the short term.

Volume oscillator: The indicator trades near the oversold zone as the price continues to fall.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Wall Street Expert Warns 35% Crypto Stock Market Crash Amid U.S- Iran War Tensions

- Why Crypto Market Is Falling Today (March 8, 2026)

- Michael Saylor Hints at Another Strategy Bitcoin Buy Despite BTC and Broader Market Weakness

- How Low Could Shiba Inu, Pepe Coin and Dogecoin Fall? Key Support Levels and Liquidation Risks to Watch

- UAE Carries Out First Iran Strike As BTC Bulls Struggle to Defend Key Support

- Is It a Good Time to Buy XRP As Price Falls 64% From All-time High

- Will Crypto Market Crash This Week? Analysts Predict Timeline for Volatility

- Gold Price Prediction Ahead of March 18 FOMC Meeting

- Dogecoin, Pepe coin, and Shiba Inu Price Prediction As BTC Crashes Below $70k

- Here’s Why Cardano Price Has Not Reclaimed $0.30

- Will XRP Price Crash as U.S. Nonfarm Payrolls Fell by 92,000 in February?

Buy $GGs

Buy $GGs