Massive Deposits By Bitcoin (BTC) Whales At Exchanges, Avoid ‘Buy on Dips’

As Bitcoin (BTC) continues to flirt around $19,000, investors are at a crucial junction to decide whether to buy or sell. Although the institutional developments suggest a buy, the inflow data at the exchange by the Bitcoin whales suggest otherwise.

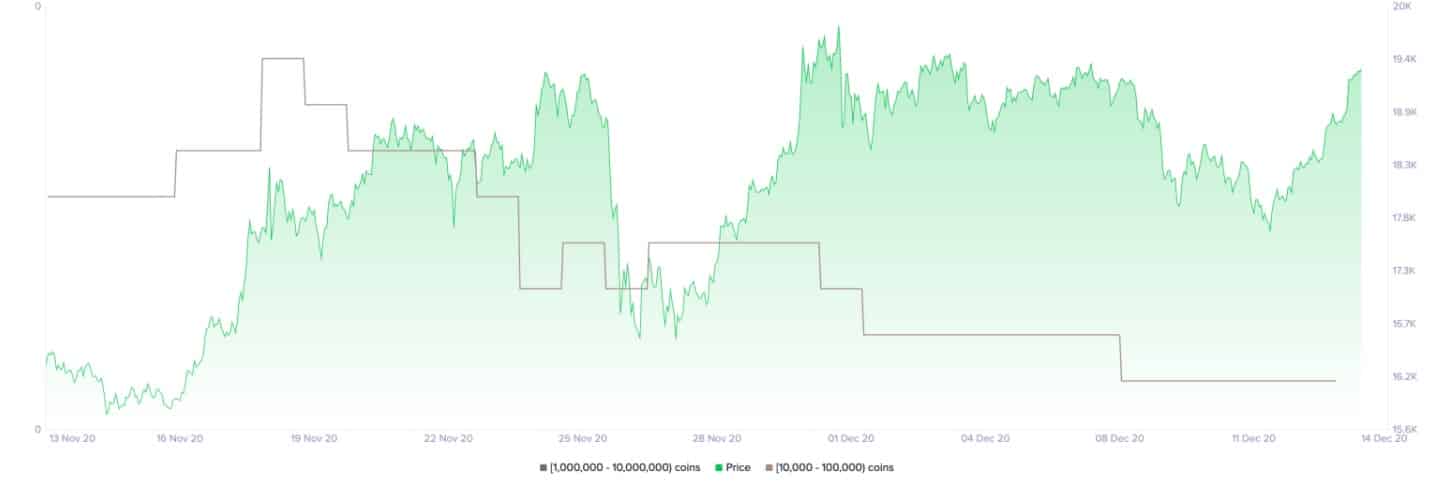

On-Chain Data From Santiment Shows Drop In Wallets Holdings Large BTC Quantity

Popular on-chain crypto data provider Santiment has also hinted at the recent whale action. Despite the huge bullish sentiment among retail investors, whales are ready to realize profits.

Data from Santiment suggests that the number of addresses holding between 10K-100K BTC has significantly dropped over the last month. Since November 18, whales have either left the network or have redistributed their tokens.

Also, the Bitcoin (BTC) and the overall cryptocurrency market looks bearish and under pressure at the moment. Another data from Santiment suggests a decline in the combined balance of wallets holding a small quantity of BTC. It suggests a downward trend in retail holders just at the time when institutions are accumulating.

There’s also a constant decline in Bitcoin (BTC) trading volumes from the month of November. During the last month of the Bitcoin bull run, the BTC trading volumes peaked at around $60 billion. The daily trading volumes have now dropped below $25 billion. It looks like BTC traders and investors are more skeptical at this stage and hints that a breakthrough past $20,000 looks difficult at this stage.

Houbi Bitcoin [BTC] Inflow Rising, Are Miners And Whales Getting Ready to Sell?

Several off-chain and on-chain data points suggest that whales are coming in huge numbers to liquidate their BTC holdings. Crypto analyst Ki-Young-Ju has been tracking the whale movement much recently. The All Exchange Inflow Mean has reached 144-block MA.

Realized profit at $19,250 and switched from generational long(10x) to normal long(1x).

Looking at All Exchange Inflow Mean(144-block MA), $BTC whales are depositing to exchanges. I think whales need more time to make a profit here.

Chart ???? https://t.co/Pr161YgbUT https://t.co/1en1zAneAn pic.twitter.com/24myj8m8BM

— Ki Young Ju 주기영 (@ki_young_ju) December 14, 2020

On the other hand, the very recent developments suggest that the Asian BTC whales are making massive deposits at the Huobi exchange. Analysts Ju predicts that it won’t be safe to go long at this point. Rather, investors can wait for the whales to drive the prices. “Don’t buy the f*cking dip Too many $BTC whales on exchanges” he adds.

Huobi BTC inflow by block is increasing as well.

I think it's not safe to long here as long as these Asian whales drive the price next 6 hours. pic.twitter.com/mbK1DEPQhu

— Ki Young Ju 주기영 (@ki_young_ju) December 15, 2020

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Bitcoin News: Anthony Pompliano’s ProCap Buys 450 BTC, Gold Bug Peter Schiff Reacts

- Fed Rate Cuts More Likely If U.S.-Iran Conflict Extends, Arthur Hayes Predicts

- Breaking: Ethereum Treasury BitMine Adds 50,928 ETH as Tom Lee Predicts March Bottom For Crypto Prices

- Bitget Champions Women’s Role in Crypto as Part of International Women’s Day Campaign

- Breaking: Michael Saylor’s Strategy Adds 3,015 BTC as Bitcoin Holds Steady Despite U.S.-Iran War

- Pi Coin Price Prediction for March 2026 Amid Network Upgrade, KYC Boost, Rewards Distribution

- Gold Price Nears ATH; Silver Eyes $100 Breakout on Us- Iran War

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

Buy $GGs

Buy $GGs