Metaplanet Buys More Bitcoin As MicroStrategy Acquired 51,780 BTC, New ATH?

Highlights

- Metaplanet's year-to-date Q4 Bitcoin yield surged to an impressive 186.9% amid recent purchases.

- Metaplanet's announcement led to a 14% surge in its stock price with next target to 3,000 JPY.

- Corporate Bitcoin acquisitions, led by MicroStrategy, have shot up this week with eyes on Microsoft shareholder voting.

- BTC price eyes new all-time high.

Japanese public-listed firm Metaplanet announced its latest purchase of 124 Bitcoins for an investment value of 1.75 billion Japanese Yen on Tuesday. With this, the company’s Bitcoin holdings have now surged past 1,100 BTC with its stock price gaining a massive 15% today. Moreover, the firm has been rightly adopting MicroStrategy’s Bitcoin adoption blueprint for its recent BTC purchases.

Metaplanet Purchases More Bitcoin, Stock Shoots 15%

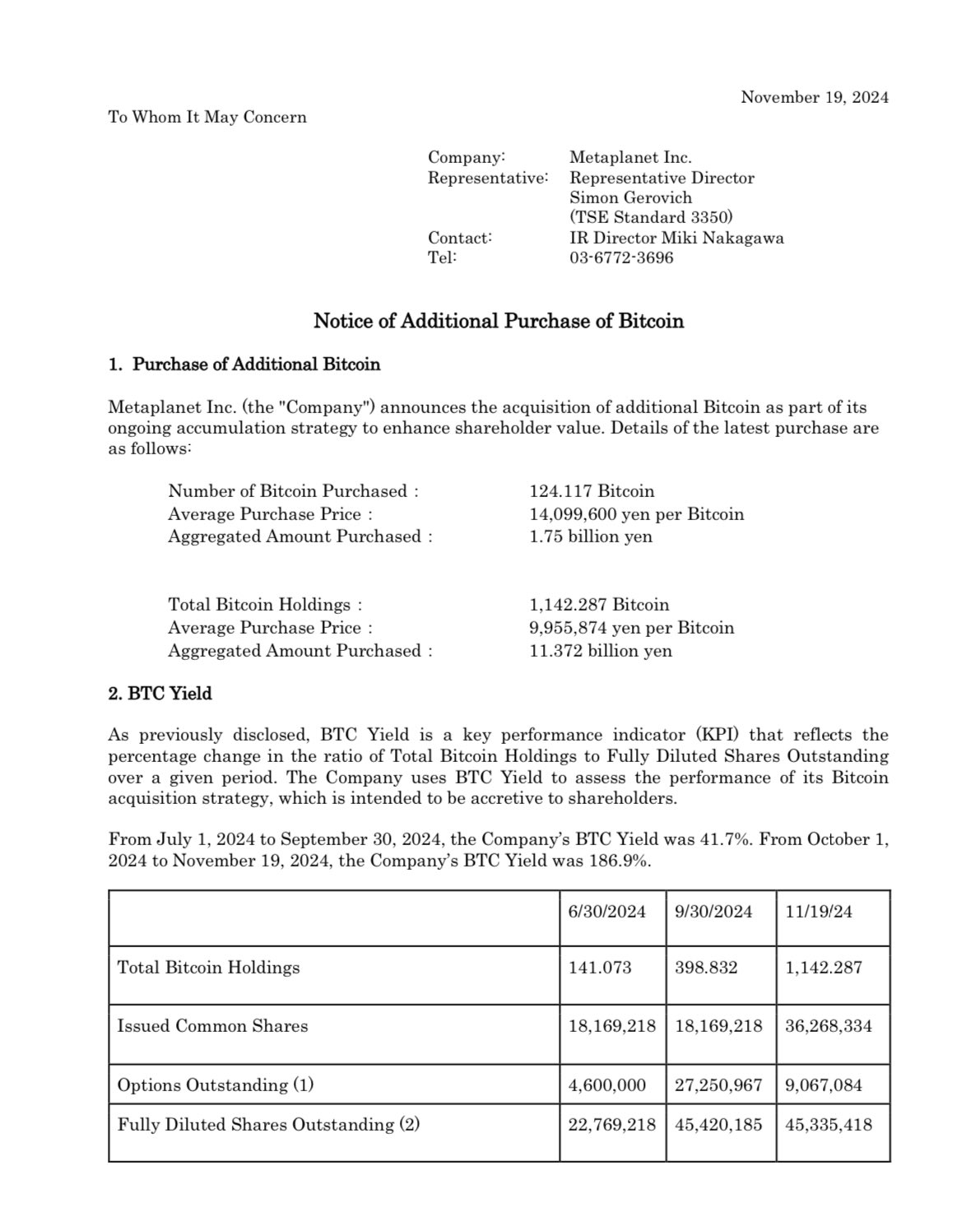

Metaplanet CEO Simon Gerovich has announced the acquisition of an additional 124.117 BTC for 1.75 billion yen. The latest BTC purchase happened at an average Bitcoin price of 14,099,600 yen per BTC. As of November 19, 2024, Metaplanet’s total Bitcoin holdings stand at 1,142.287 BTC, acquired for approximately 11.372 billion yen. Also, the average acquisition cost comes at 9,955,874 yen per BTC.

This strategic acquisition by Metaplanet has shot up the company’s quarterly-to-date (QTD) Bitcoin yield of 186.9% Interestingly, this development comes a day after MicroStrategy purchased 51,780 BTC for a staggering investment of over $4 billion.

Soon after the announcement, the Metaplanet stock price surged more than 14% shooting past 2,300 JPY levels in a massive bullish breakout past the critical resistance of 2,000 JPY. This sets the stage for the stock to rally an additional 30% to its 2024 high of 3,000 JPY.

On Monday, the Japanese firm announced its bond sale to buy more BTC. Similarly, MicroStrategy has been doing MSTR stock buyback to fund its BTC purchases, after a massive 400% rally in 2024 so far. The Japanese firm has also adopted Michael Saylor’s Bitcoin playbook thereby benefitting the company’s balance sheet as well as its shareholders.

MicroStrategy Creates Snowball Effect

Dylan Leclair, the Bitcoin acquisition strategist for Metaplanet, has highlighted a paradigm shift in corporate strategies. He stated that Bitcoin is the new “stock buyback” for Wall Street. “Wall Street has been put on notice,” LeClair stated.

He further stressed that the adoption of Bitcoin by major institutions happens through the long-anticipated game theory dynamics in the financial world.

Besides, Michael Saylor’s open sharing of the Bitcoin playbook created a snowball effect. Along with MicroStrategy, Marathon Digital and Semler Scientific announced their Bitcoin purchases and acquisition plans ahead. Not to forget, trillion-dollar tech giant Microsoft will hold a shareholders’ vote in December, regarding the decision to put Bitcoin on its balance sheet.

As of press time, the BTC price is trading 1.33% up at $91,763 with a market cap of $1.816 billion. A daily close above $91,900 will likely set the stage for a rally to $100K.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Crypto Market at Risk as U.S.–Iran War Threatens Inflation With Oil Price Surge

- Polymarket U.S.–Iran Strike Bets Fuel Insider Trading Speculation as Crypto Traders Net $1.2M

- Cardano’s DeFi TVL Climbs as USDCx Stablecoin Launches on Network

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

Buy $GGs

Buy $GGs