Michael Saylor Says Strategy Can Cover Debt Even If Bitcoin Crashes to $8,000

Highlights

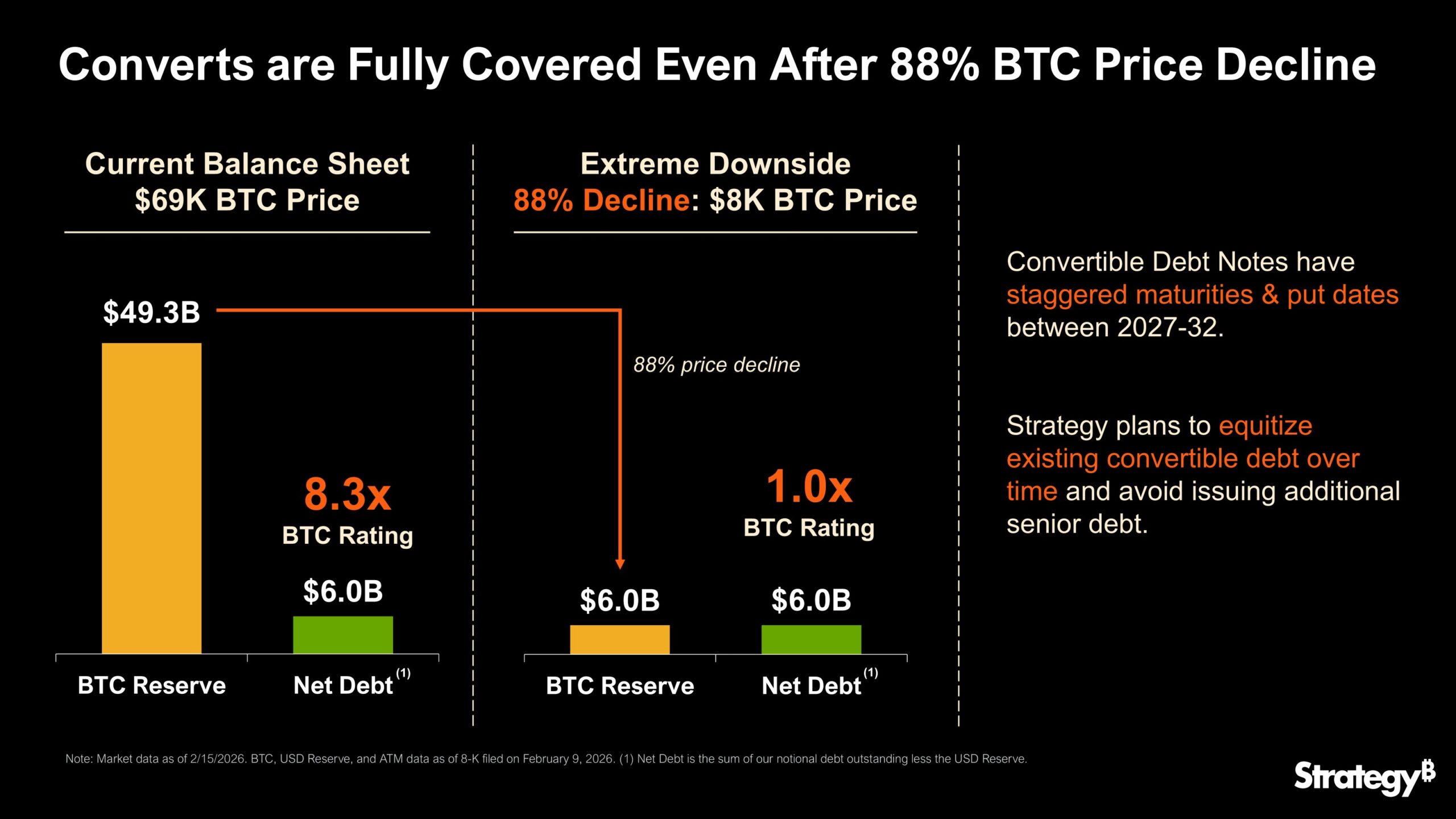

- Michael Saylor says Strategy can fully cover its debt even if Bitcoin crashes by 88% to $8,000.

- The firm plans to convert its convertible debt into equity over the next 3–6 years.

- This would reduce balance-sheet risk without issuing new senior debt.

Michael Saylor has once again reiterated that his Bitcoin treasury firm, Strategy, can withstand more dips in the value of the BTC price. He shared plans on how the company would control its debt in the future.

Strategy Says It Can Survive a Bitcoin Drop to $8,000

In recent posts, the Treasury firm and Michael Saylor confirmed that the company can cover its debts even if the Bitcoin price were to crash to $8,000. They shared a chart highlighting how it currently holds $6 billion in net debt, and in the case where there is a 88% crash in BTC price, its reserve value would still remain in the range of its net debt.

Saylor also shared that the plan was to equitize Strategy’s convertible debt over the next 3-6 years. This would reduce the debt on the balance sheet by issuing stock instead, avoiding new senior debt issuance.

Our plan is to equitize our convertible debt over the next 3–6 years. https://t.co/yRsCuCRNHl

— Michael Saylor (@saylor) February 15, 2026

These convertible notes are serviceable, which gives the company breathing room or ‘security’ in downturn situations. The firm’s CEO, Phong Le, had shared recently that even if the BTC price loses 80% of its value, it would take many years for it to affect the firm’s business. This will give the Bitcoin treasury firm more time to restructure and cover the debts.

Meanwhile, Saylor has consistently maintained that Strategy has no intention to sell any of its coins. Also said, they would keep buying BTC at least in every quarter of the year.

Michael Saylor Maintains BTC Accumulation Plan

While the Bitcoin drawdown continues, the company has continued to maintain purchases. On Monday last week, they bought 1,142 BTC coins worth around $90 million. Following the trends, it may seem the firm is now buying more tokens than usual as the value drops further.

Yesterday, Michael Saylor made his regular Bitcoin tracker post, hinting at another buy later today. This is especially notable because the firm is currently down by over $5 billion in unrealized losses. Strategy’s MSTR stock has also continued to lose value as experts predict deeper losses.

However, the stock has continued to move positively with the positive signals from the firm. It jumped by 10% on Friday even after the earnings report release.

The founder recently made a case for the United States to be more proactive in its Strategic reserve, urging it to embrace Bitcoin as it did gold. He added that the government should also pass pro-BTC legislation to make sure innovation grows in the country.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- BREAKING: US Oil Prices Crash $15 in Two Hours as G7 Eyes 400M Barrel Release — Crypto Markets on Edge

- BTC Markets Moves to Offer Tokenized Assets as RWA Market Hits $26.5B Peak

- Why BTC Price is Rising Today? (March 9, 2026)

- Wall Street Expert Warns 35% Crypto Stocks Market Crash Amid U.S- Iran War Tensions

- Why Crypto Market Is Falling Today (March 8, 2026)

- Is It a Good Time to Buy XRP As Price Falls 64% From All-time High

- Will Crypto Market Crash This Week? Analysts Predict Timeline for Volatility

- Gold Price Prediction Ahead of March 18 FOMC Meeting

- Dogecoin, Pepe coin, and Shiba Inu Price Prediction As BTC Crashes Below $70k

- Here’s Why Cardano Price Has Not Reclaimed $0.30

- Will XRP Price Crash as U.S. Nonfarm Payrolls Fell by 92,000 in February?

Buy $GGs

Buy $GGs