Breaking: Michael Saylor’s Strategy Acquires 168 Bitcoin as Crypto Market Rebounds

Highlights

- Strategy bought 168 Bitcoin between October 13 and 19 last week.

- Michael Saylor hinted at the purchase yesterday.

- This comes as the crypto market rebounds led by Bitcoin.

- The MSTR stock is up almost 3% today.

Strategy, previously MicroStrategy, has announced another weekly Bitcoin purchase as Michael Saylor’s company continues to extend its dominance as the largest BTC treasury company. This latest purchase comes as the crypto market recovers, with Bitcoin leading the way.

Strategy Buys 168 BTC for $18.8 Million

In a press release, the company announced that it had acquired 168 BTC for $18 million at an average price of $112,051 per Bitcoin. It now holds 640,418 BTC, which it acquired for $47.40 billion at an average price of $74,010 per Bitcoin. Strategy has also achieved a BTC yield of 26% year-to-date (YTD).

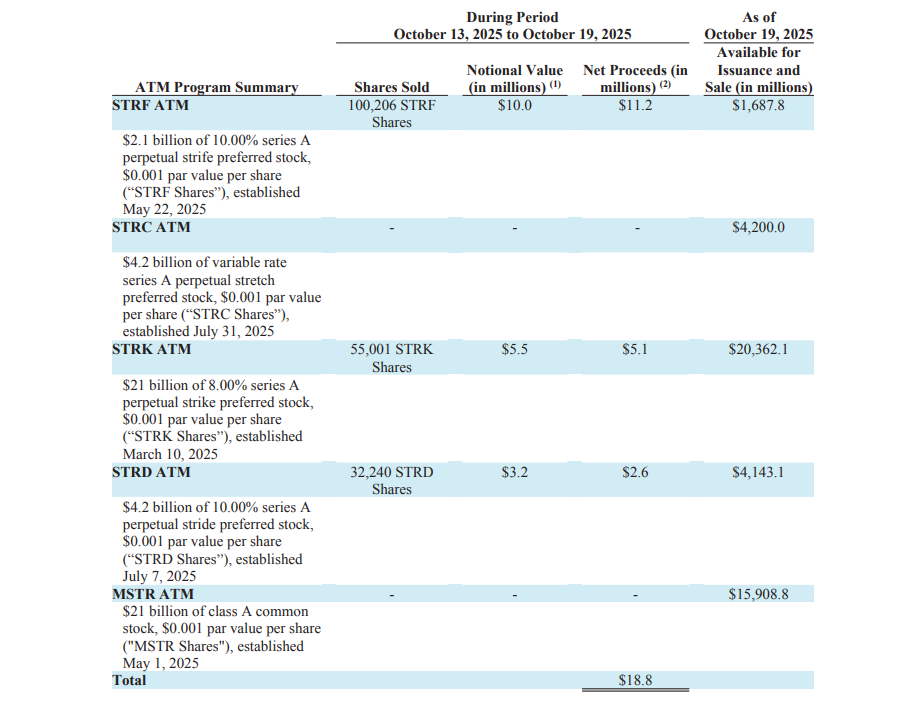

The SEC filing shows that Strategy funded this latest purchase with the proceeds from STRF, STRK, and STRD sales. The company raised $11.2 million, $5.1 million, and $2.6 million, respectively, from these stock sales.

Saylor hinted at the purchase in his conventional Sunday X post yesterday. He posted Strategy’s Bitcoin portfolio tracker with the caption “The most important orange dot is always the next.”

The most important orange dot is always the next. pic.twitter.com/N5GQOdqr6y

— Michael Saylor (@saylor) October 19, 2025

This marks the company’s second consecutive weekly Bitcoin purchase after a one-week break. As CoinGape reported, Strategy purchased 220 BTC for $27.2 million between October 6 and 12.

Meanwhile, this latest purchase comes as the crypto market rebounds. The Bitcoin price has surged to as high as $111,000 today after last week’s slump, during which it dropped to as low as $104,000.

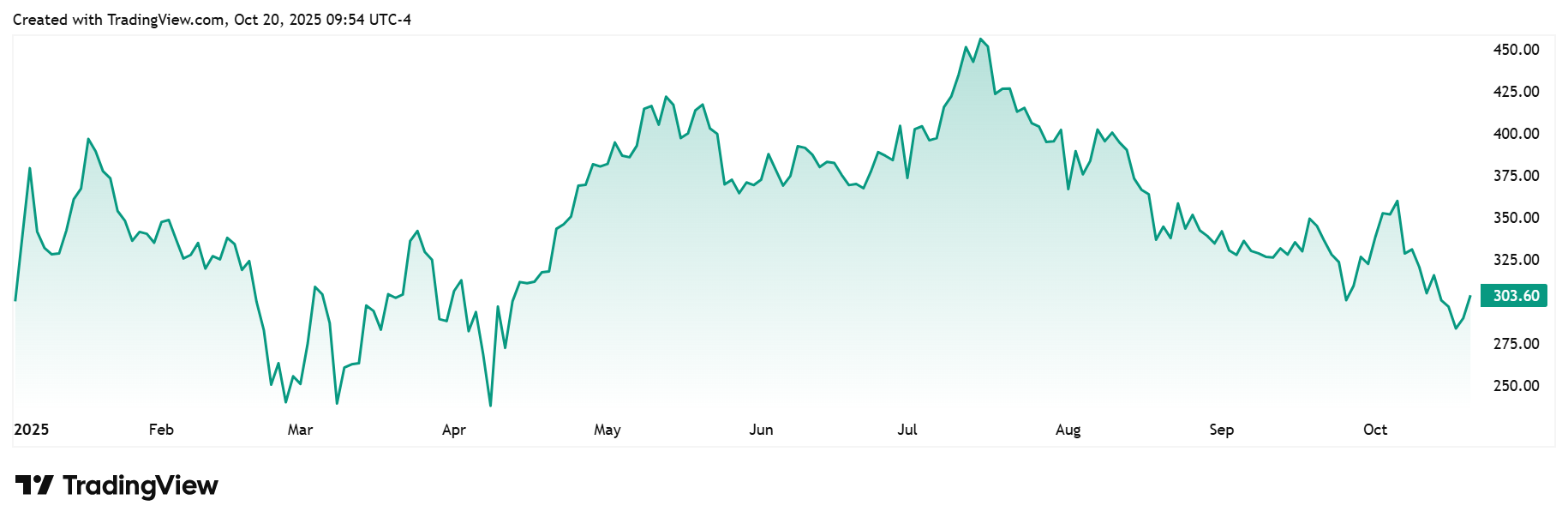

The Strategy stock has also recovered along with Bitcoin and the broader crypto market. TradingView data shows that the MSTR stock is up, trading at around $303, up almost 5% from last week’s closing price of $289.

However, MSTR has lost most of its year-to-date gains and is up just around 1% since the start of the year. Notably, the stock had reached a 2025 high of around $455 earlier in the year, but began to lose these gains towards the end of August.

- XRP Realized Losses Spike to Highest Level Since 2022, Will Price Rally Again?

- Crypto Market Rises as U.S. and Iran Reach Key Agreement On Nuclear Talks

- Trump Tariffs: U.S. Raises Global Tariff Rate To 15% Following Supreme Court Ruling

- Bitwise CIO Names BTC, ETH, SOL, and LINK as ‘Mount Rushmore’ of Crypto Amid Market Weakness

- Prediction Market News: Kalshi Faces New Lawsuit Amid State Regulatory Crackdown

- Dogecoin Price Prediction Feb 2026: Will DOGE Break $0.20 This month?

- XRP Price Prediction As SBI Introduces Tokenized Bonds With Crypto Rewards

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise