Breaking: Michael Saylor’s Strategy Adds 220 Bitcoin Amid Crypto Market Dip

Highlights

- Strategy bought 220 Bitcoin between October 6 and 12 last week.

- Michael Saylor had hinted about the purchase yesterday.

- The MSTR stock is trading flat today, just above $300.

Michael Saylor’s Strategy has resumed its weekly Bitcoin purchase after a one-week break. This latest purchase comes amid a crypto market dip, during which BTC erased all its gains from the start of the month. ‘

Strategy Acquires 220 BTC for $27.2 Million

In a press release, the company announced that it had acquired 220 BTC for $27.1 million at an average price of $123,561 per Bitcoin. It now holds 640,250 BTC, which it acquired for $47.38 billion at an average price of $74,000 per Bitcoin. Strategy has also achieved a BTC yield of 25.9% year-to-date (YTD).

The company funded this latest purchase by selling STRF, STRD, and STRK shares. It raised $19.8 million, $5.8 million, and $1.7 million, respectively, from these sales.

As CoinGape reported, Strategy’s co-founder, Michael Saylor, hinted at the Bitcoin purchase yesterday. He posted the company’s BTC portfolio tracker with the caption ‘Don’t Stop ₿elievin’.

Don’t Stop ₿elievin’ pic.twitter.com/LUMroqLSCl

— Michael Saylor (@saylor) October 12, 2025

Notably, this Bitcoin buy comes amid the Friday crypto market crash, which marked the largest liquidation event in crypto history. Bitcoin had dropped to as low as $104,000 after U.S. President Donald Trump announced a 100% tariff on China, starting on November 1.

The purchase also comes just a week after Strategy halted its weekly BTC purchases. Before then, the company had purchased Bitcoin for nine consecutive weeks. This dates back to July when it bought 21,021 Bitcoin for $2.46 billion, the largest purchase this year.

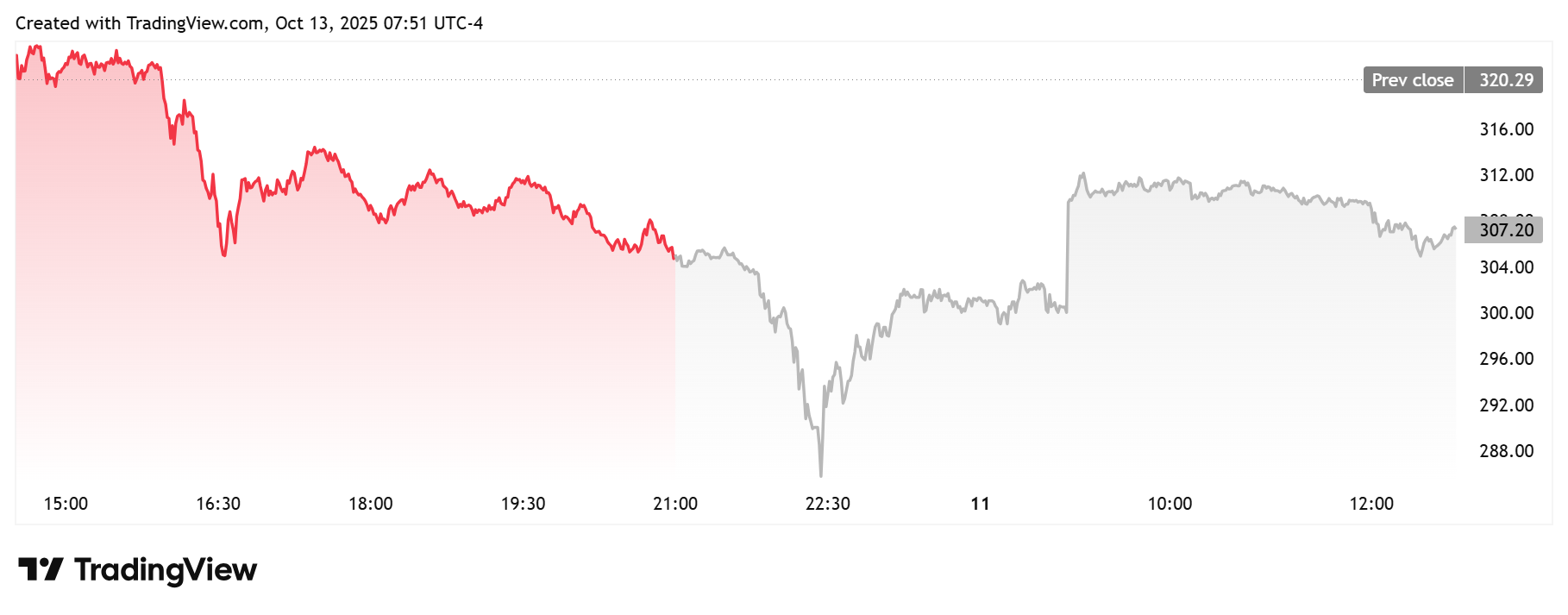

Meanwhile, the MSTR stock is trading flat amid the announcement of this latest purchase. TradingView data shows that the stock is trading at around $307 in premarket trading, up just 1% from last week’s closing price of $304.

The Strategy stock has dropped as much as 13% in the last five trading days. Meanwhile, it has been on a steady decline since its 2025 high of $455, losing almost all its year-to-date (YTD) gains in the process.

Peter Schiff Criticizes The Bitcoin Purchase

Bitcoin critic and renowned economist Peter Schiff questioned why Strategy didn’t buy Bitcoin when the price crashed to $104,000 last. He added that the company’s average purchase price for the week is almost 8% above the current market price.

So why didn’t you buy any when the price crashed down to $104K? Your average purchase price on the week is nearly 8% above the current market. Also, your average price on your entire position is $74K. That’s only a 55% gain. MSTR would be better off had you bought gold instead.

— Peter Schiff (@PeterSchiff) October 13, 2025

Schiff also pointed out that the company’s average price on its entire BTC position is $74,000, representing a 55% gain. In line with this, he remarked that Saylor and Strategy would have been better off if they had bought gold instead.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Vitalik Buterin Exceeds Planned Ethereum Sales as Total Liquidations Hit $35M

- Circle Stock Jumps 35% on Stablecoin Boom, USDC Supply Soars 72%

- Democrats Convene US Senate Crypto Bill Meeting as a16z Briefs Republicans on CLARITY Act & AI

- After 820% Gains: Privacy Coins Evolve into Payment Rails

- Bitcoin Price Rebounds as Jane Street “10 am Dump” Pattern Stops Amid Lawsuit

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

- Will Solana Price Rally to $100 If Bitcoin Reclaims $72K?

- XRP Price Eye $2 Rebound as On-Chain Data Signals Massive Whale Accumulation

- Ethereum Price Reclaims $2K- New Rally Ahead or a Temporary Bounce?

- COIN Stock Price Prediction as Wall Street Pros Forecast a 62% Surge

Buy Presale

Buy Presale