Breaking: Michael Saylor’s Strategy Announces $739M Bitcoin Purchase, MSTR Stock Up

Highlights

- Strategy bought 6,220 BTC between July 14 and 20, it's second purchase in as many weeks.

- The company's co-founder Michael Saylor had hinted about the purchase yesterday.

- The MSTR is up over 2% from its closing price of $423 last week.

Michael Saylor’s Strategy, previously known as Strategy, has announced another weekly purchase, which it made last week. This comes just as the company surpassed the 600k BTC milestone with its purchase two weeks ago. Meanwhile, the MSTR stock is up over 2% today, recovering from last week’s dip.

Strategy Acquires 6,220 BTC For $739.80 Million

In a press release, the company announced that it acquired 6,220 BTC for $739.80 million at an average price of $118,940 per bitcoin, achieving a BTC yield of 20.8% year-to-date (YTD).

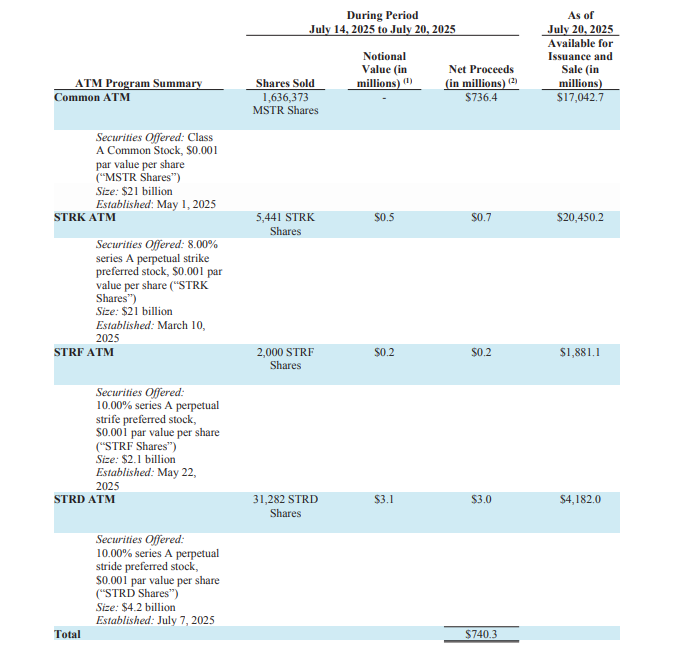

The company now holds 607,770 BTC, which it acquired for $43.61 billion at an average price of $71,756 per bitcoin. Strategy made this latest purchase mainly using the proceeds from its common shares sale, raising $736.4 million from the sale of 1.6 million MSTR shares.

This comes just a day after Saylor had hinted at another purchase by posting Strategy’s Bitcoin portfolio tracker with the caption, “Stay Humble. Stack Sats.,” indicating that they had again acquired BTC.

Stay Humble. Stack Sats. pic.twitter.com/aQyxsTXdhO

— Michael Saylor (@saylor) July 20, 2025

This marks the company’s second consecutive weekly purchase in as many weeks, following a brief hiatus in the first week of July. As CoinGape reported, the firm acquired 4,225 BTC for $472.5 million in the week that ended July 13, surpassing the 600,000 BTC milestone in the process and becoming the first company to reach this milestone.

This latest purchase again increases Strategy’s dominance above the other Bitcoin treasury companies, with second-placed MARA Holdings boasting a relatively smaller stash of 50,000 BTC.

Saylor’s company has also broken into the top 10 largest U.S. corporate treasuries thanks to its recent purchases and the Bitcoin rally to new highs. The company is now ranked ninth, ahead of the world’s most valuable company, NVIDIA.

Meanwhile, the MSTR stock is up amid the announcement of this latest Bitcoin purchase. TradingView data shows that the Strategy stock is trading at around $432, up over 2%. However, the stock is still down over the last five days, correcting alongside BTC, which is down from its all-time high (ATH) of $130,000.

- Will Bitcoin, ETH, XRP, Solana Rebound to Max Pain Price amid Short Liquidations Today?

- 3 Top Reasons XRP Price Will Skyrocket by End of Feb 2026

- Metaplanet CEO Simon Gerovich Defends Bitcoin Strategy Amid Anonymous Allegations

- “Sell Bitcoin Now,” Peter Schiff Projects Further BTC Price Crash to $20k

- 8 Best Decentralized Crypto Banking Solutions in 2026 – Top List Reviewed

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise

- Cardano Price Prediction Feb 2026 as Coinbase Accepts ADA as Loan Collateral

- Ripple Prediction: Will Arizona XRP Reserve Boost Price?

- Dogecoin Price Eyes Recovery Above $0.15 as Coinbase Expands Crypto-Backed Loans

- BMNR Stock Outlook: BitMine Price Eyes Rebound Amid ARK Invest, BlackRock, Morgan Stanley Buying