Breaking: Michael Saylor’s Strategy Buys 1,229 BTC as Bitcoin Heads Toward a 2025 Loss

Highlights

- Strategy bought 1,229 Bitcoin between December 22 and 28.

- The company now holds 672,497 BTC.

- The MSTR stock is trading flat today amid the announcement of this purchase.

Michael Saylor’s Strategy, previously MicroStrategy, has made another weekly BTC purchase amid the crypto market downtrend. This latest purchase comes as Bitcoin and MSTR stock head toward a 2025 loss, after losing their gains from earlier in the year.

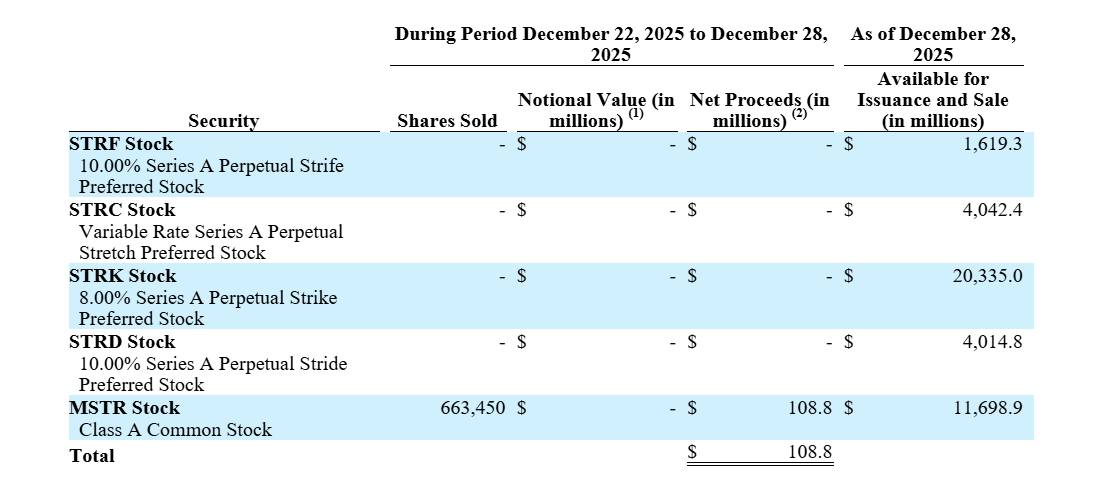

Strategy Acquires 1,229 BTC For $108.8 Million

An SEC filing showed that the company acquired 1,229 BTC for $108.8 million at an average price of $88,568 per Bitcoin. It has now achieved a BTC yield of 23.2% year-to-date (YTD). It now holds 672,497 BTC, which it acquired for $50.44 billion at an average price of $74,997 per Bitcoin.

The filing also shows Strategy sold MSTR shares to fund this latest purchase. The company sold 663,450 shares, with net proceeds of $108.8 million, which it used to buy more BTC.

This follows Saylor’s hint of another Bitcoin purchase yesterday. The company’s executive chairman had made his conventional Sunday X post, with the caption, ‘Back to Orange,’ signaling another purchase.

Back to Orange. pic.twitter.com/J3lnpOObER

— Michael Saylor (@saylor) December 28, 2025

Meanwhile, this purchase comes just a week after Strategy had paused its Bitcoin buys. Instead of a purchase in the week ending December 21, the company announced that it increased its USD reserves to $2.19 billion.

Notably, the company made some of its largest purchases in 2025 this month, including a $980 million BTC purchase in the week ending December 14, which was its largest since July. It also bought 10,624 BTC for $962.7 million in the week ending December 7.

BTC Heads For A Yearly Loss

The latest Strategy purchase comes as the BTC price heads towards a 2025 loss, with the flagship crypto down almost 7% year-to-date (YTD). BTC staged a rebound above $90,000 yesterday and looked on course to erase its YTD loss, but has now dropped to an intraday low of around $87,000.

A positive for the flagship crypto heading into 2026 is that it has never recorded consecutive yearly losses. Based on history, 2026 is likely to be a green year for BTC, though there are concerns that the crypto asset may already be in a bear market.

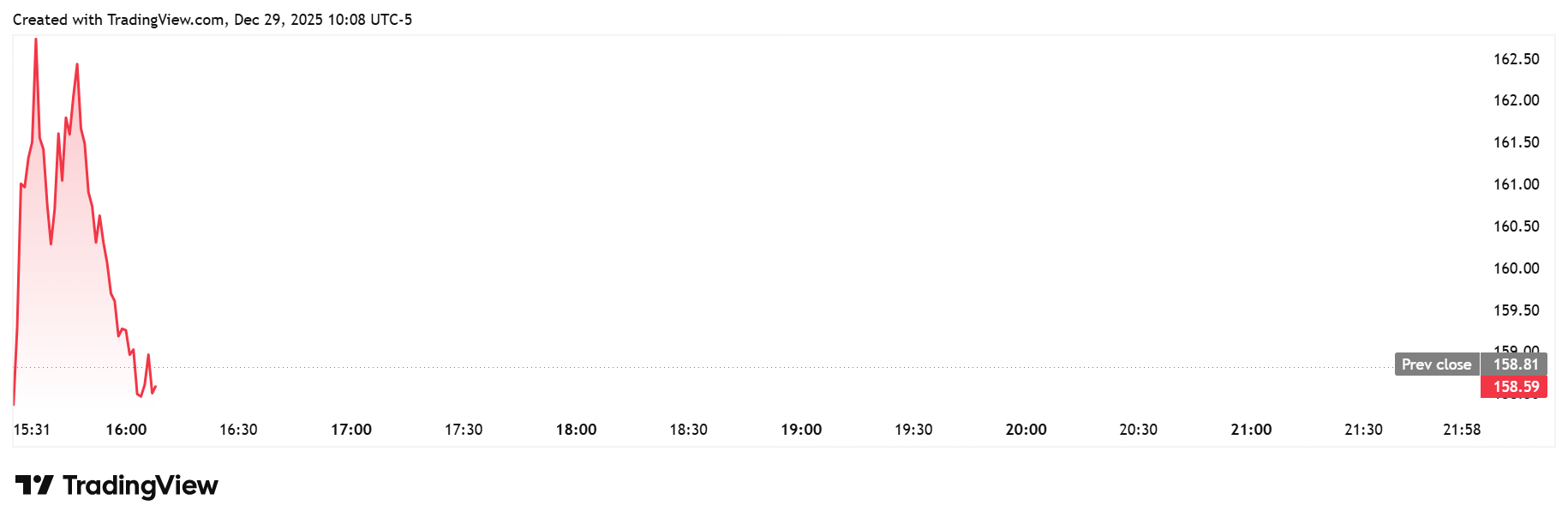

Meanwhile, the MSTR stock is also on course to end this year in the red. TradingView data shows that the stock is down 47% YTD, having crashed from a yearly high of around $455 to below $160.

The Strategy stock is currently trading flat amid the announcement of this latest Bitcoin purchase. The stock is trading at $158, around the same price level as last week’s close.

Bitcoin critic Peter Schiff again criticized Saylor and his decision to adopt the BTC model. In an X post, he noted that Saylor’s company has been buying BTC for five years at an average cost of $75,000, with a “paper profit” of 16%, which translates to an average return of just over 3%. Schiff then remarked that Strategy would have been better off buying any other asset instead of BTC.

Strategy has been buying Bitcoin for five years. With an average cost of $75K, the company has a “paper profit” of just 16%. That’s an average annual return of just over 3%. $MSTR would have been much better off had @Saylor bought just about any other asset instead of Bitcoin.

— Peter Schiff (@PeterSchiff) December 29, 2025

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Fed Rate Cut Odds Drop as Inflation Fears Rise Due To U.S. Iran Conflict

- Here’s Why Tether Gold (XAUt) Price Is Falling Even With Growing Gold Demand

- XRP News: Ripple Expands Payments Platform To Unify Fiat and Stablecoins Globally

- U.S.–Iran War: Bitcoin Price Extends Decline as Oil Prices Surge To Two-Year High

- Bitcoin Treasury Firm MARA Considers Selling BTC Reserves After Policy Update

- RIOT Stock Prediction as Needham, Piper Sandler Slash Target After Earnings

- Cardano Price Outlook As Charles Hoskinson Warns Over CLARITY Act

- Circle Stock Price Climbs 15% to $96, Can Rally Continue in March 2026?

- Bitcoin Price Prediction as US-Iran War Enters 4th Consecutive Day

- Top 5 Historical Reasons Dogecoin Price Is Not Rising

- Pi Coin Price Prediction for March 2026 Amid Network Upgrade, KYC Boost, Rewards Distribution

Buy $GGs

Buy $GGs