MicroStrategy Buys Bitcoin Worth $1.11B, MSTR Stock Price Jumps 8%

Highlights

- MicroStrategy has acquired another 18,300 BTC worth $1.11 billion.

- The net BTC holding of the firm has increased to 244,800 BTC worth $9.45 billion

- MSTR stock price jumped slightly and BTC price cotntinues to trade sideways.

The business intelligence company MicroStrategy on Friday said it has acquired 18,300 BTC worth $1.11 billion, according to a filing with the US SEC. The company’s net BTC holding has increased to 244,800 BTC, revealed Michael Saylor, executive chairman of the firm. This is one of the largest Bitcoin purchases by the firm. MSTR stock price closed the week at 18.74% higher this week.

MicroStrategy Acquires Another 18,300 BTC

In a post on the X platform on September 13, MicroStrategy’s Executive Chairman Michael Saylor revealed that the company has further increased its BTC holdings. The largest corporate holder of Bitcoin purchased 18,300 BTC worth $1.11 billion, as per an SEC filing.

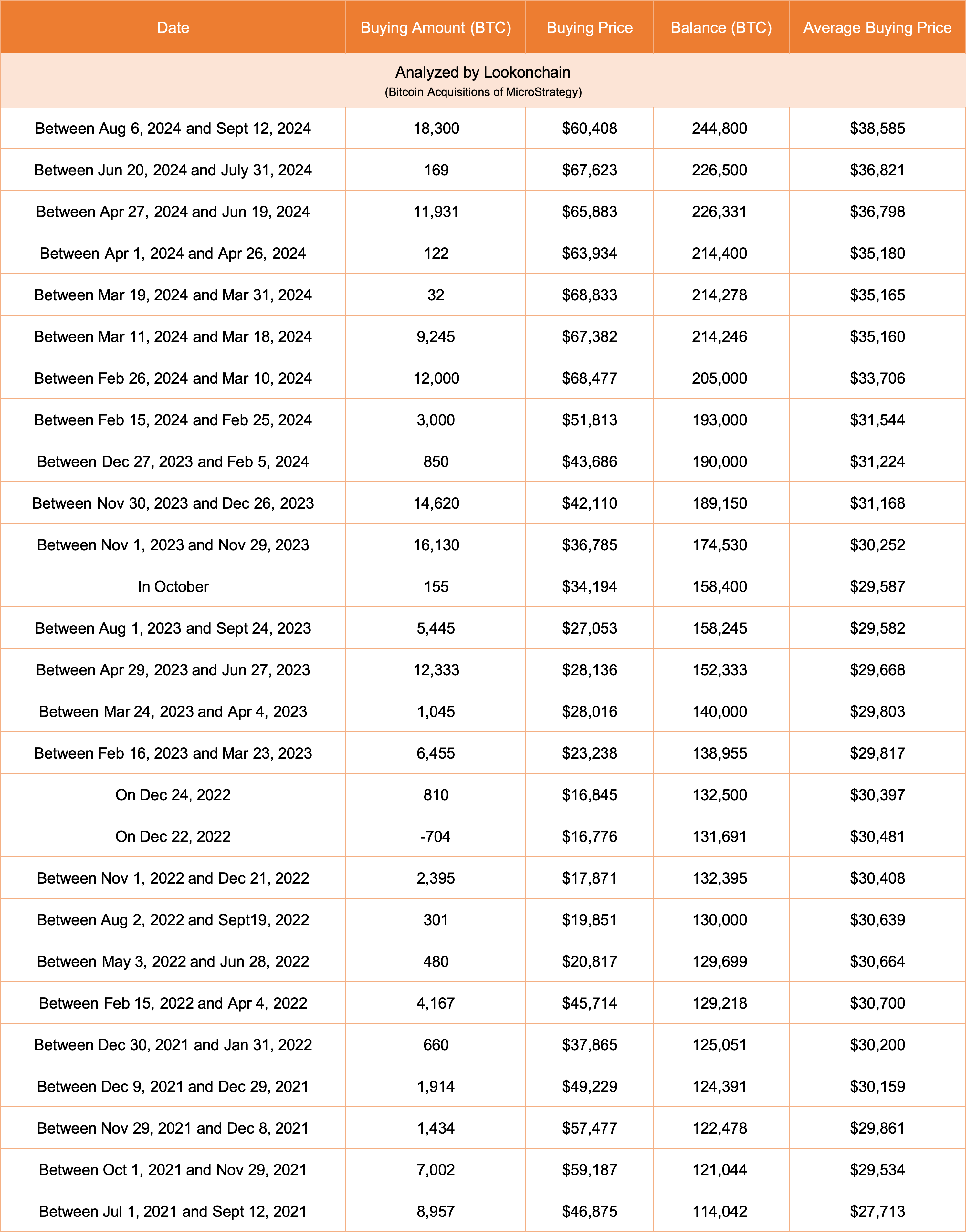

With the latest purchase, the company has increased its total BTC holdings to 244,800 BTC valued at $9.45 billion, which accounts for $38,585 per BTC. The firm has achieved a BTC Yield of 4.4% QTD and 17.0% YTD. The current profit is $4.71 billion, as per Lookonchain.

In June, MicroStrategy acquired 11,931 bitcoin from a $800 million private offering of convertible senior notes. The company said it intended to use the proceeds primarily to purchase additional Bitcoin, aligning with its ongoing strategy of leveraging debt to expand its cryptocurrency holdings. Meanwhile, the convertible senior notes are unsecured and senior, meaning they rank higher in claim priority over other debt but lack collateral backing.

MSTR stock price was volatile during the premarket hours after MicroStrategy revealed the BTC purchase. MSTR stock closed 8.18% higher at $141.47 on Friday. MSTR price saw an 18.74% leap in a week.

Michael Saylor Drives Bitcoin Price

The traders respond immediately to MicroStrategy’s Bitcoin purchase. Bitcoin price regained the $60K level amid bullish price action. BTC price is currently trading at $60,179, with a 24-hour low and high of $57,650 and $60,656, respectively. Furthermore, the trading volume has increased by 8% in the last 24 hours.

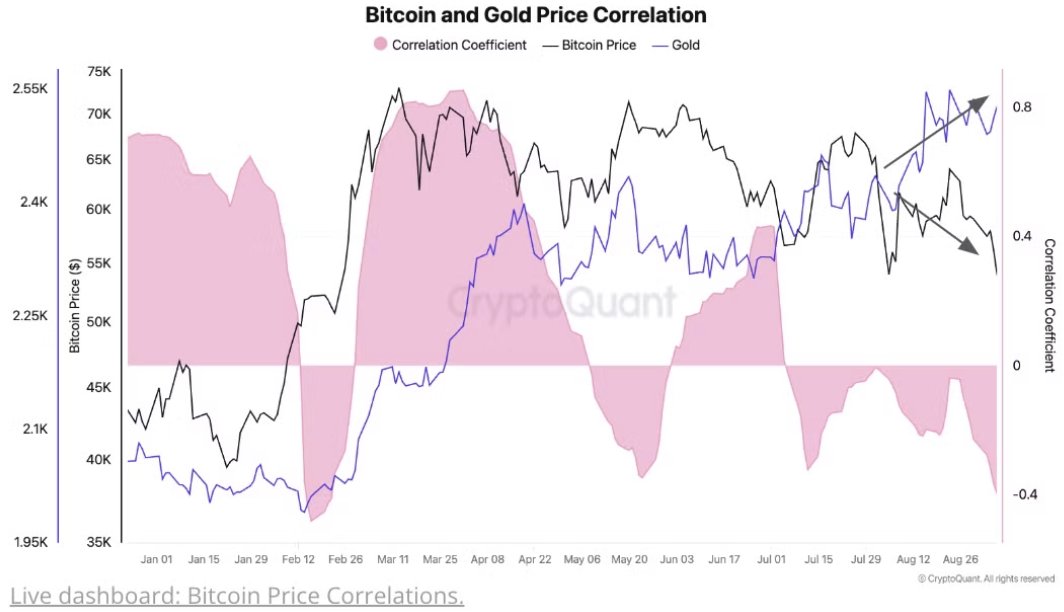

CryptoQuant data indicates that Bitcoin and decoupled from gold, with BTC price dropping while gold hitting higher. The negative correlation signals a risk-averse market, with investors turning towards traditional safe-haven assets like gold.

In the derivatives market, total BTC futures open interest increased 5% in the last 24 hours, indicating buying activity among traders. As per Coinglass data, the 530.99K BTC OI is valued at $32 billion.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Crypto News: Bitcoin Sell-Off Fears Rise as War Threatens Iran’s BTC Mining Operations

- U.S.–Iran War: Monday Crypto Crash Odds Rise As Pundits Predict Oil Price Spike

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Crypto Market at Risk as U.S.–Iran War Threatens Inflation With Oil Price Surge

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

Buy $GGs

Buy $GGs