Miner’s Revenue Spikes 14% As Bitcoin Transitions From A Block-Reward To A Transaction Fees Model

8 days after halving, data streams from GlassNode, a crypto analytics platform, shows that miner revenue from Bitcoin transaction fees is up 14 percent to 2018 levels.

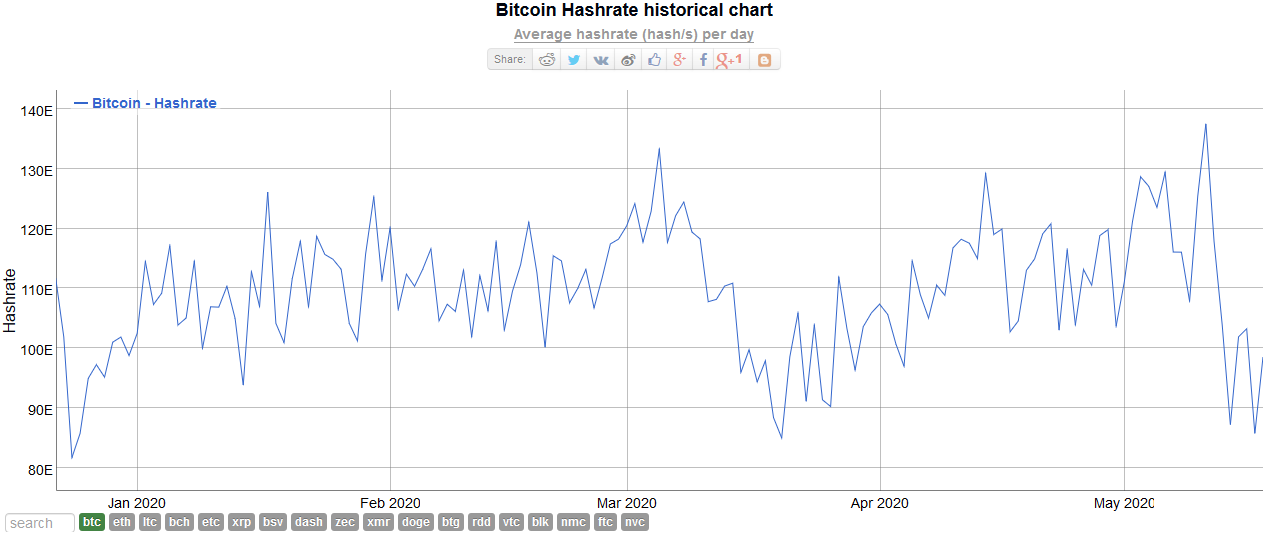

It is unprecedented but nonetheless expected since the network hash rate was somehow expected to shed computing power as miner block rewards were chopped by half.

Miners revenue from Bitcoin fees spiked to early 2018 levels

data: @glassnode pic.twitter.com/45bPxmx1D3

— Unfolded (@cryptounfolded) May 19, 2020

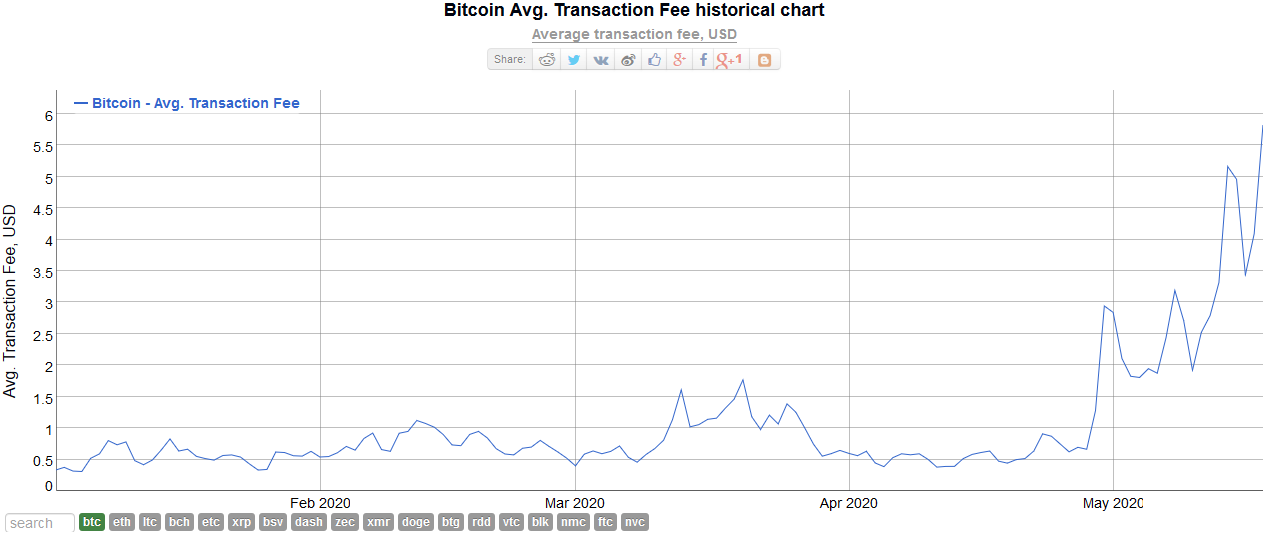

Rising Bitcoin Transaction Fees

The spike in transaction fees over the last few days has been aptly captured by Mati Greenspan the founder of QE and a market analyst.

In a series of tweet, he appears to have been tracking the average transaction fees charged on the Bitcoin network.

“Average fee to send BTC is now up to $5.82 (Please tell me how your favorite shitcoins can do it faster and cheaper. I’m dying to hear about it. /s) Mining difficulty will be adjusted in 91 blocks and that should clear the backlog and reset the fees to normal.”

Average fee to send #BTC is now up to $5.82

(Please tell me how your favorite shitcoin can do it faster and cheaper. I'm dying to hear about it. /s)

Mining difficulty will be adjusted in 91 blocks and that should clear the backlog and reset the fees to normal. pic.twitter.com/I5LzMeXJE8

— Mati Greenspan (tweets are not trading advice) (@MatiGreenspan) May 19, 2020

Over the last few days, it should be noted that fees have varied drastically. Pre-halving, and specifically around early April, the average transaction fees charged to users of Bitcoin stood at between 50 cents and $1.

Bitcoin Mining Difficulty Adjustment

Still, there is hope, and fees may drop to pre-halving levels. In less than 15 hours, the Bitcoin network will re-adjust its difficulty. The last difficulty adjustment was executed on May 5, 2020.

Then, in light with increasing hash rate ahead of the highly anticipated halving, difficulty was increased by 0.92 percent. A sharp change was made on March 26—two weeks after Black Thursday when prices of BTC fell to $3,800 automatically forcing some miners to shut down, when difficulty was downgraded by 15.95 percent.

This was the third largest single-day drop of mining difficulty.

Hash Rate May Force Another Downgrade, Fees to Rise Over time

Today’s mining difficulty adjustment, considering the drop in hash rate to below 100 EH/s, may see another reduction and a subsequent leveling of transaction fees.

Even though fees may drop, the readjustment will marginally reduce transaction fees since the network is progressively shifting away from a block-reward based model to a transaction fees model which will subsequently be the principal source of revenue for all miners.

Inevitably, over time–and despite decent difficulty, transaction fees will rise. Here, altcoins like XRP and Litecoin may be viable options for fee sensitive users.

Mati’s tweets attracted comments and replies from supporters of rival networks as Ripple. Even so, Ripple and Bitcoin clientele diverge since the former primarily seeks to disrupt remittance, a nice which is dominated by SWIFT.

I can send an email for FREE!! What's your point?!

XRP does not have a credible claim to digital scarcity. https://t.co/UR3NNycznT

— Mati Greenspan (tweets are not trading advice) (@MatiGreenspan) May 18, 2020

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- BREAKING: Iran Refutes WSJ’s Claims on Push to Resume Nuclear Talks with US, Bitcoin Slips

- Crypto Market Crash Deepens as Trump Confirms More Airstrikes to Hit Iran

- US CLARITY Act Likely to Pass by Mid-Year, JPMorgan Signals Major Crypto Shift

- Crypto Market Update: Top 3 Reasons Why BTC, ETH, XRP and ADA is Up

- Crypto News: Bitcoin Sell-Off Fears Rise as War Threatens Iran’s BTC Mining Operations

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

Buy $GGs

Buy $GGs