Breaking: $8 Trillion Morgan Stanley Opens Bitcoin Investments to All Wealth Clients

Highlights

- Morgan Stanley will allow crypto investments in any kind of accounts including retirement accounts.

- The banking giant had earlier limited crypto investments to some specific clients.

- Crypto investments are limited to just BlackRock and Fidelity's Bitcoin ETFs for now.

Morgan Stanley, which manages $8 trillion in assets under management (AuM), plans to allow all its wealth management clients to access Bitcoin and crypto investments. This comes as the banking giant moves to lift earlier restrictions that limited crypto funds to specific clients based on risk exposure and assets.

Morgan Stanley To Let All Wealth Clients Invest In Bitcoin and Crypto

According to a CNBC report, the banking giant has dropped restrictions on which wealth clients can own crypto funds. The firm has already informed its financial advisors that it is broadening access to crypto investments for all clients. However, this move is limited only to BlackRock and Fidelity’s Bitcoin ETFs for now. The firm is looking to add other cryptos to these offerings at some point.

With this move, all accounts, including retirement accounts, will be able to invest in crypto. Notably, this aligns with U.S. President Donald Trump’s executive order, which opened the door for 401(k)s to invest in crypto.

Meanwhile, CNBC reported that, starting October 15, advisors will be able to pitch crypto investments to any of Morgan Stanley’s clients. The firm had previously only allowed its clients with an aggressive risk tolerance and at least $1.5 million in assets to invest in crypto funds.

This move comes as crypto continues to witness increased adoption among institutional investors. Major financial institutions have also moved to expand their crypto offerings amid the growing popularity of crypto firms and exchanges.

As CoinGape reported, the bank plans to offer crypto trading services to its E-trade clients starting from next year. Morgan Stanley is expected to begin by listing Bitcoin, Ethereum, and Solana.

Allocation Of Up to 4% To Crypto

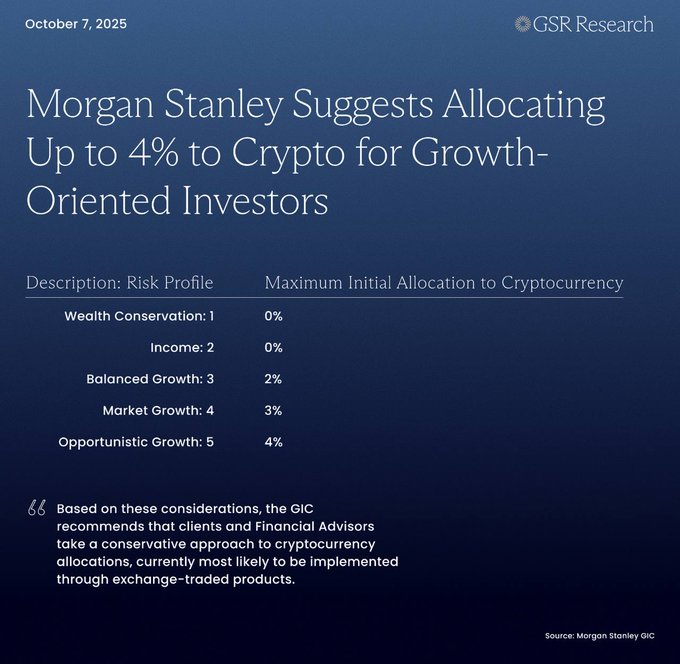

Notably, Morgan Stanley also recently recommended allocating up to 4% to crypto for growth-oriented investors. The firm noted that 4% was right for those seeking opportunistic growth.

Meanwhile, it recommended allocating 3% to crypto for those seeking market growth and 2% for balanced growth. The bank said that its global investment committee considers crypto as “a speculative and increasingly popular asset class that many investors, but not all, will seek to explore.”

With Morgan Stanley dropping eligibility requirements to access crypto funds, the bank plans to rely on an automated monitoring process to ensure that clients aren’t overly concentrating their wealth in this asset class.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- ChangeNOW Is Settling Crypto Swaps in Under a Minute.

- $3B Western Union Expands Into Crypto With USDPT Stablecoin Launch on Solana

- XRP News: Key Ripple Whale Indicator Turns Bullish After Months, Price Rally Ahead?

- Crypto Market Today: BTC, ETH, XRP, SOL, and DOGE Rally as Geopolitical Tensions Ease

- Crypto Market Bill Hits New Deadlock as Banks Reject White House Deal

- Pi Network Price As BTC Rallies Above $74K: Can PI Coin Extend Gains to $0.30?

- XRP Price As Bitcoin Reclaims $74K- Is $5 Next?

- Dogecoin Price Outlook as BTC Recovers Above $73,000

- XRP Price Prediction as Iran-U.S. Peace Talks Trigger a Crypto Rally

- COIN Stock Analysis as Bitcoin Retests $72k Ahead of February NFP Data

- Robinhood Stock Price Prediction As Cathie Wood Buys $12M Dip in Bold ARK Move

Buy $GGs

Buy $GGs