MSCI Index Removal Threat Grows as Strategy Enters Negotiation Talks, Saylor Confirms

Highlights

- Michael Saylor confirms active engagement with MSCI ahead of the January 15 review.

- The firm seek for the potential removal from key global indices.

- Strategy established a billion dollar reserve to stabilize market confidence.

Strategy has officially started off talks with top index firm MSCI. Michael Saylor has confirmed that the negotiations are underway in a bid to remove his firm from the key index.

Strategy Opens Negotiations as Michael Saylor Confirms Talks

According to Reuters, Strategy is now in formal discussions with MSCI over the decision that could see the firm removed from key global indices. Chairman Michael Saylor confirmed the talks. He said that the firm is “actively engaging” ahead of MSCI’s January 15 review.

Experts say this could lead to $8.8 billion in outflows if other index providers follow suit. Saylor however pushed back on some of the forecasts. He said that he is “not convinced” the projected outflows is accurate with current market optics.

He acknowledged Bitcoin’s crash from its record above $120,000 in October which then took down equity and other digital assets.

“The equity is designed to move more sharply than Bitcoin,” Michael Saylor explained. He shared that this volatility is part of the firm’s structure as a leveraged Bitcoin play.

A recent note from JP Morgan said that if key stock market support levels are not maintained, it could raise concerns about the firm’s ability to raise money during times of high market turbulence.

This pressure started late last month when both MSCI and Nasdaq announced they were reviewing whether companies that have more than half of their assets tied to digital tokens should remain in major market indexes.

At the time, Saylor dismissed the concerns saying that index classification does not define the company.

Saylor Moves to Ease Market Stress With New Reserve Plan

To reduce market pressure, Strategy announced a reserve of $1.44 billion to pay dividends on preferred stock and cover interest on its debt. This decision came after CEO Phong Le warned that the company might sell Bitcoin. This would happen if its modified net asset value fell below one.

It came after major losses for leveraged ETFs pegged to the company. Two of the companies’ 2x long funds are down almost 85% so far this year. The inverse products dropped sharply as Bitcoin fell below $90,000.

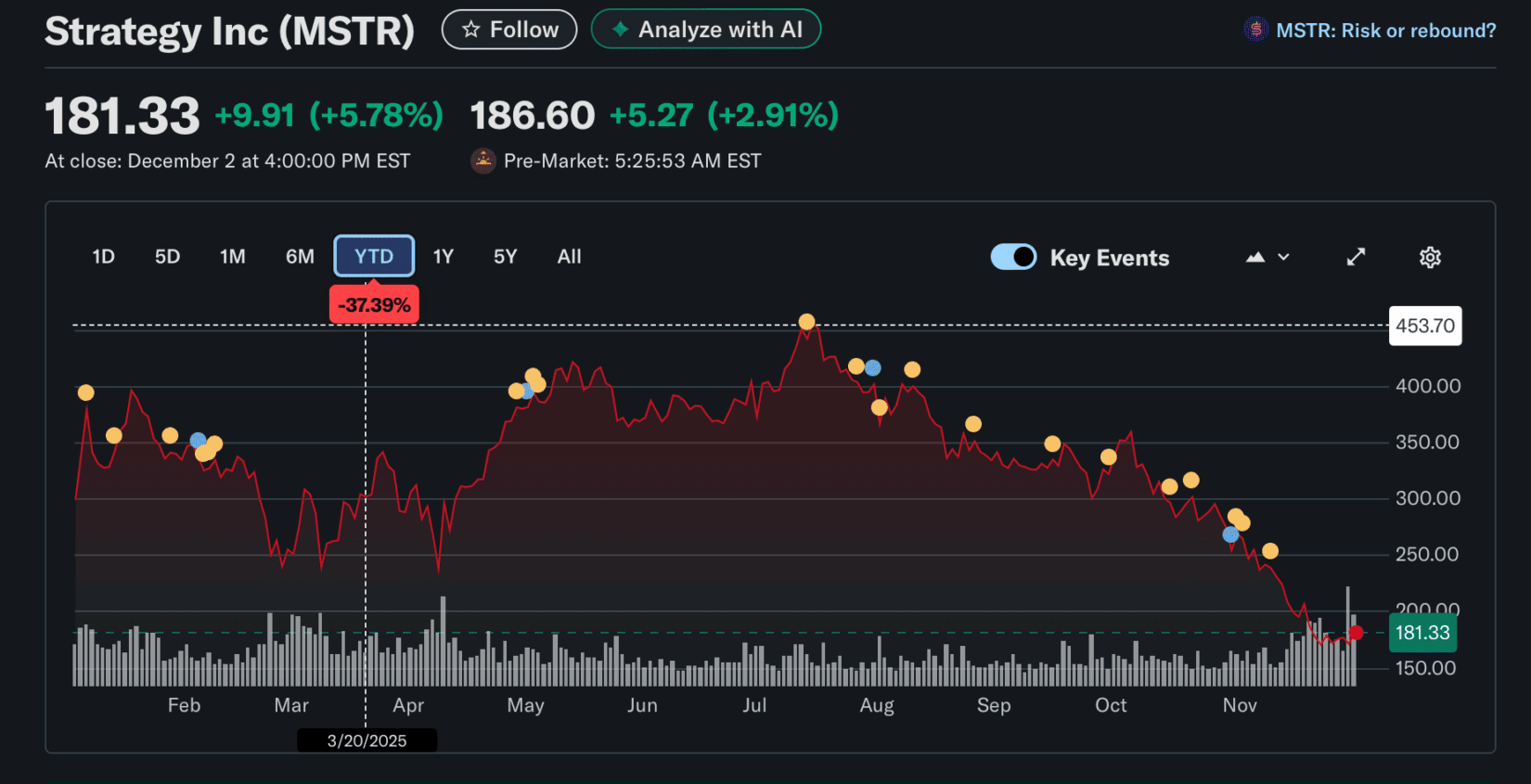

MSTR shares have also lost almost 40% this year. That led the firm to cut its full-year outlook from an expected $24 billion profit to a range between a $6.3 billion gain and a $5.5 billion loss.

Meanwhile, Peter Schiff says it’s the beginning of the end for the firm. He shared that the firm’s recent sale of stocks to shore up liquidity exposed what he calls a broken model.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Best Institutional Custody Solutions for Tokenized Assets in 2026

- Minnesota Considers Ban on Bitcoin and Crypto ATMs as Scam Reports Rise

- Breaking: Morgan Stanley Applies For Crypto-Focused National Trust Bank With OCC

- Ripple Could Gain Access to U.S. Banking System as OCC Expands Trust Bank Services

- $2T Barclays Explores Blockchain For Stablecoin Payments and Tokenized Deposits

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

Buy $GGs

Buy $GGs