Breaking: Mt Gox’s Huge Bitcoin Unlock To Hit The Market, BTC Price To Crash?

Beleaguered crypto exchange Mt. Gox could start repayments in Bitcoin to some creditors soon, as per sources on Reddit. While Mt. Gox delayed repayments by another year to October 2024, some creditors who had already provided the required details are expected to receive BTC repayment through the next two months.

Mt. Gox Bitcoin Repayment

Creditors have received emails from Mt. Gox Rehabilitation Trustee confirming ownership of their accounts and identity verification with crypto exchange or custodian that they entered earlier as the payment address for BTC/BCH, according to a subreddit.

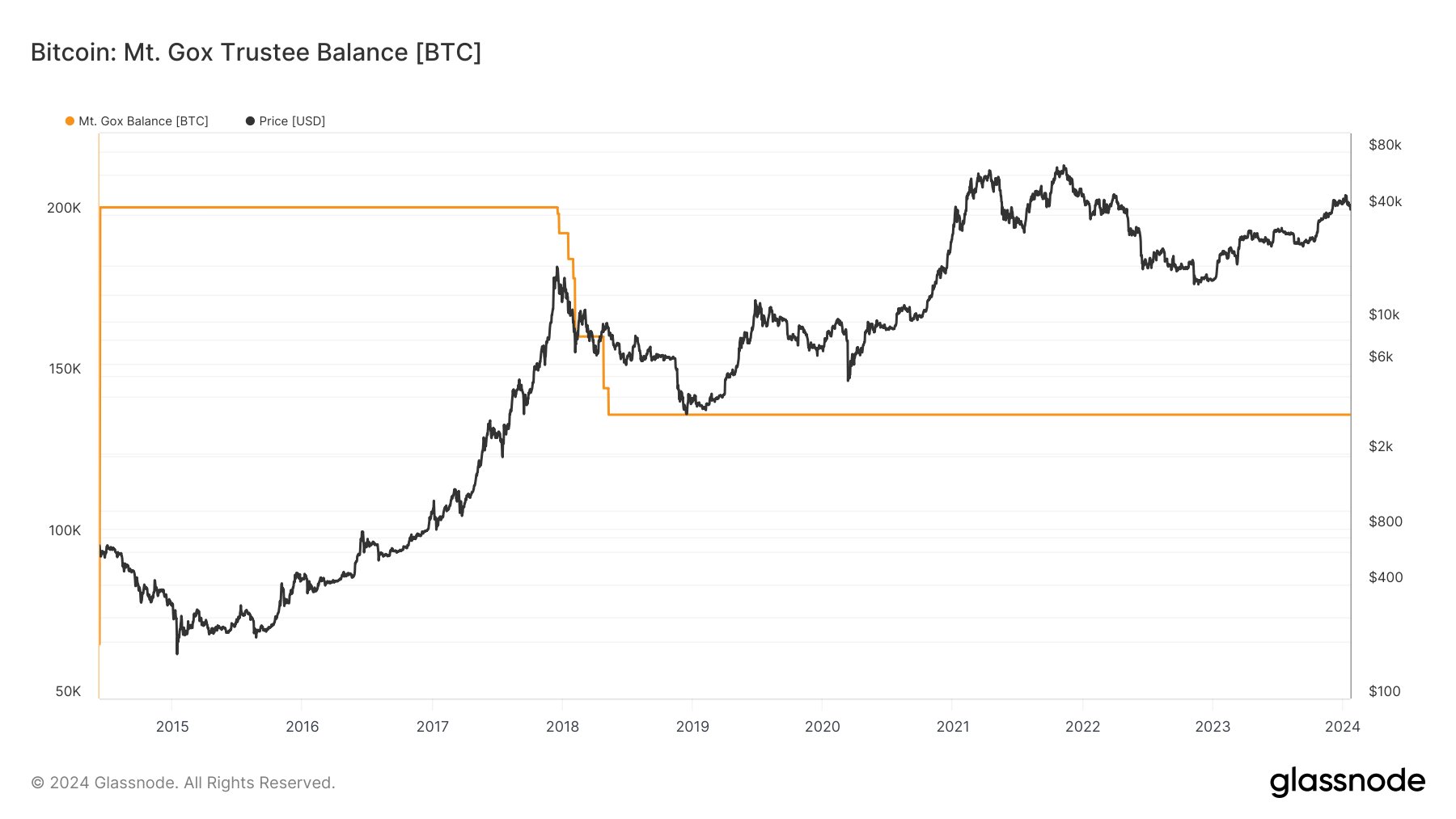

Mindao Yang, founder of decentralized stablecoin protocol dForce Network, in a post on X also reached out to the crypto community warning about Mt. Gox Bitcoin distribution hitting the market over the next two months. He said Mt. Gox creditors are expected to unlock huge BTC amounts from the 200,000 BTC, which is in addition to 600,000 lost and GBTC repricing after the spot Bitcoin ETF approval.

“Bitcoin halving will reduce the annual supply by 160,000 coins. Interesting supply dynamics will emerge in the coming months,” said Mindao Yang.

In order to receive repayment in BTC/BCH, creditors must have their account in active status. People may not be able to receive repayment in BTC/BCH if the account is disabled or frozen in the future is disabled or frozen in the future.”

In December 2023, creditors reported that they received compensation in Japanese yen in their PayPal accounts. Repayments are continuing, with many also receiving payments in US dollars.

According to TokenUnlocks data, Mt Gox still holds more than 137,800 BTCs worth $5.5 billion. The total BTC amount is 162,105 BTCs worth $6.5 billion.

Will There Be Selloff Pressure

Experts have a different outlook on Bitcoin repayments by Mt. Gox Trustee. Some believe the repayments happen over months throughout the year.

However, some claim a lump sum repayment to creditors will happen at once. Mindao Yang said “Of course, the selling pressure should be relatively limited. After all, many debts have been sold over the years, and the prices have been reflected in the market.”

BTC price fell 3% in the past 24 hours, with the price currently trading at $39,981. The 24-hour low and high are $39,450 and $41,242, respectively. Furthermore, the trading volume has increased by 120% in the last 24 hours, indicating interest among traders.

Also Read:

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Vitalik Buterin Maps Out Quantum Risks as Ethereum Foundation Unveils ‘Strawmap’

- BlackRock Adds $289M in BTC as Bitcoin ETFs Log 2-Week High Inflows Of $500M

- Glassnode Signals Bitcoin Still Faces Downside Risk Amid Massive Sell Pressure at $70K

- U.S House Introduces Bipartisan Crypto Bill To Protect Crypto Developers Amid DeFi Push Under CLARITY Act

- XRP News: Ripple Unveils Funding Hub To Support Innovation On XRPL

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

- Will Solana Price Rally to $100 If Bitcoin Reclaims $72K?

- XRP Price Eye $2 Rebound as On-Chain Data Signals Massive Whale Accumulation

Buy $GGs

Buy $GGs