Just-In: Mt. Gox Starts Repaying Creditors, Bitcoin To Dip Further?

Highlights

- Mt. Gox has announced to start repaying creditors today.

- Bitcoin worth billions of dollars have been moved in recent transactions, sparking market concerns.

- Bitcoin price was down about 8% today, reflecting the heightened selling pressure in the crypto market.

The long-awaited Mt. Gox repayments have finally commenced, creating a stir in the cryptocurrency market. Notably, Bitcoin price has dropped below $54,000 as Mt. Gox transfers another 3,000 BTC, heightening fears of further declines.

Notably, this move is part of the exchange’s effort to repay its creditors, who have been waiting since the 2014 collapse. As the repayments start, the market remains on edge, anticipating how recipients will handle their newfound assets.

Mt. Gox Starts Repaying Creditors Sparking Market Concerns

Mt. Gox’s recent Bitcoin transfers are substantial, with the latest transfer of approximately 2,702 BTC to new addresses. Precisely, 1,157.1 BTC, valued at $63.57 million, was moved to a new address “bc1qkj…ug68h” and 1,544.67 BTC, worth $84.87 million, was moved to Bitbank.

Earlier today, an even larger sum of 47,229 BTC, valued at $2.7 billion, was transferred to a new wallet. These actions are consistent with Mt. Gox’s plan to start creditor repayments in July.

Meanwhile, this latest round of transfers echoes similar movements in May, where large sums were sent to new wallets, raising questions about Mt. Gox’s intentions. However, Mt. Gox confirmed its repayment strategy today, calming some market fears but also leading to heightened volatility.

With Bitcoin already struggling below the $54,000 mark, such substantial transfers are causing anxiety among investors. Besides, the timing of these movements coincides with the start of repayments to creditors, as confirmed by a notice from Mt. Gox.

The exchange’s rehabilitation trustee, Nobuaki Kobayashi, stated that repayments are being made in Bitcoin and Bitcoin Cash. The process involves multiple conditions, including validation of accounts and agreements with cryptocurrency exchanges. Kobayashi assured that repayments would continue as long as they could be made safely and securely.

Also Read: Labour Party Wins UK Election, What It Means For Crypto?

What’s Next For BTC Amid Market FUD?

The initiation of Mt. Gox repayments has led to a mixed reaction in the market. Some investors fear a potential sell-off, which could exacerbate the current price dip. In other words, the broader crypto market crash, compounded by the anticipation of further Bitcoin sales, has dampened sentiment.

However, some industry experts remain optimistic about Bitcoin’s long-term prospects. Nischal Shetty, CEO of WazirX, cleared market FUD, suggesting that the impact might not be as severe as feared. He pointed out that the repayments are being made in BTC and BCH, which means there won’t be a mass sell-off by a single entity.

Shetty noted, “People receiving these assets are Bitcoin OGs who may sell a portion for liquidity but likely won’t flood the market. Think of it as a massive Bitcoin airdrop campaign.”

The repayment of approximately 142,000 BTC and 143,000 BCH, worth about $9 billion, to around 127,000 creditors is significant. Given the value of these assets, many recipients might choose to hold rather than sell immediately. Besides, the Bitcoin held by creditors has increased in value since the Mt. Gox hack in 2014, making them potentially more inclined to keep their assets long-term, Shetty added.

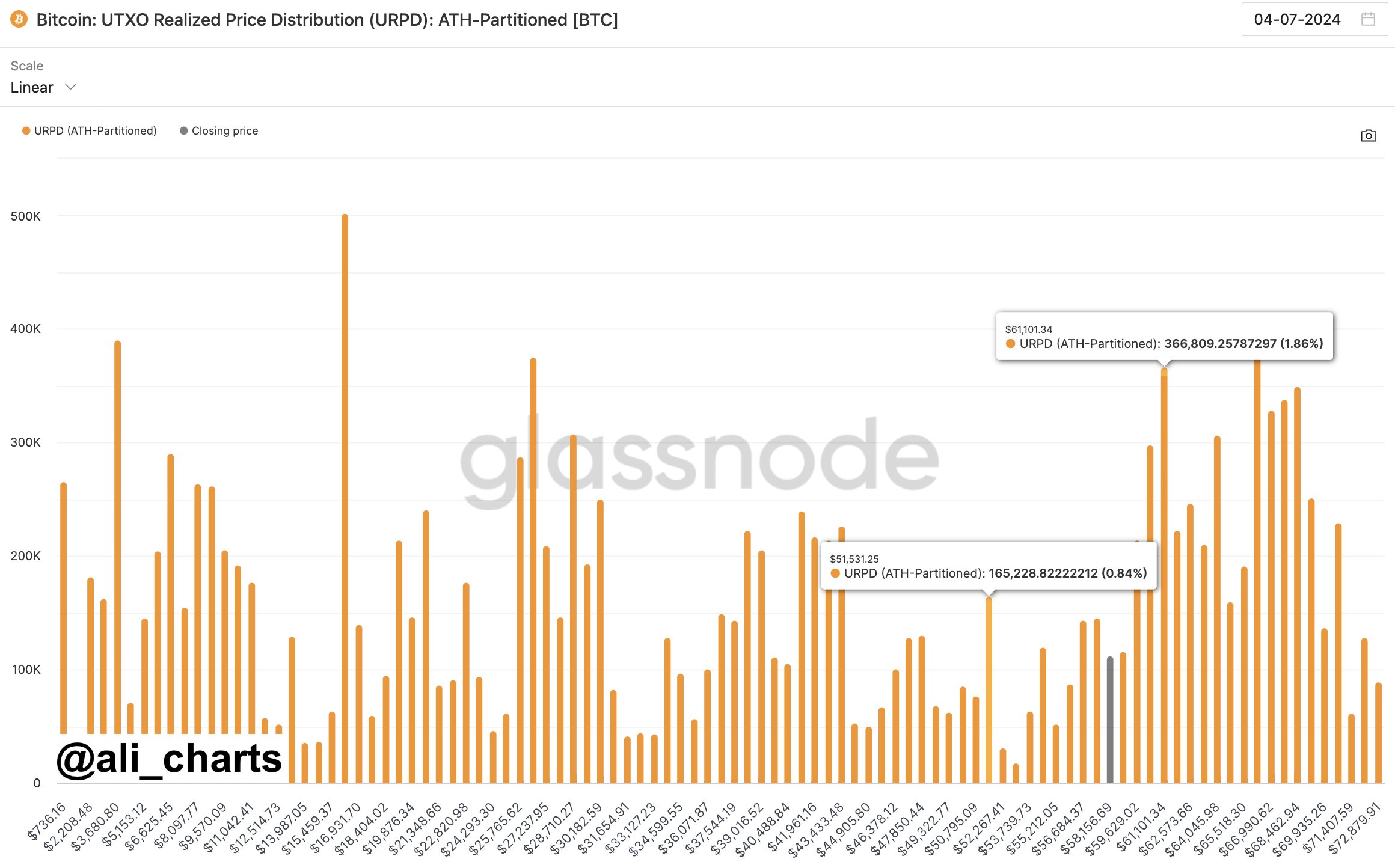

However, the recent market analysis signals a further dip in the BTC price. According to Ali Martinez, Bitcoin’s drop below $57,000 confirms its next support at $51,000. Previously, 10X Research also said that Bitcoin risks falling to $50K, or even lower, sparking market concerns.

As of writing, Bitcoin price was down about 8% but stayed above the $54,300 level. Over the last 24 hours, the crypto has touched a low of $53,717.38. Furthermore, its trading volume rose 52% over the last 24 hours to $52.18 billion.

Also Read: Ethereum Suffers Most Liquidations In Panic Selling

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Peter Brandt Flips Bullish, Predicts Bitcoin Rally As Price Holds Above $70k

- XRP News: Institutional Use Case Expands as Doppler Finance Integrates WXRP for Multi-Chain Access

- Trump Tariffs: Bitcoin Faces Fresh Headwinds as 15% Global Tariffs Begin This Week Amid Iran War

- Bitget Unveils ‘Crypto Anti-Bias Pledge’ To Support Women’s Inclusion In Crypto

- U.S.-Iran War: Crypto Market Rebounds as Iran Reportedly Reaches Out To U.S. To End Conflict

- Dogecoin Price Outlook as BTC Recovers Above $73,000

- XRP Price Prediction as Iran-U.S. Peace Talks Trigger a Crypto Rally

- COIN Stock Analysis as Bitcoin Retests $72k Ahead of February NFP Data

- Robinhood Stock Price Prediction As Cathie Wood Buys $12M Dip in Bold ARK Move

- Bitcoin Price At Risk? Professor Who Predicted US-Iran War Says America Could Lose

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

Buy $GGs

Buy $GGs