Nasdaq-Listed Bonk Holdings Makes First Major Purchase of $32M, Nears 3% of Total Supply

Highlights

- Bonk Holdings Inc. (BNKK) made its first major acquisition of $32 million worth of BONK tokens.

- The Nasdaq-listed firm now controls nearly 3% of BONK’s total supply.

- The acquisition establishes the firm as the first BONK Digital Asset Treasury (DAT).

Bonk Holdings Inc. (BNKK) has made its first significant acquisition of $32 million worth of BONK. This is the company’s largest purchase of the Solana-based token to date. The Nasdaq-listed firm now holds nearly 3% of the token’s total supply.

Bonk Holdings Makes $32M Treasury Move

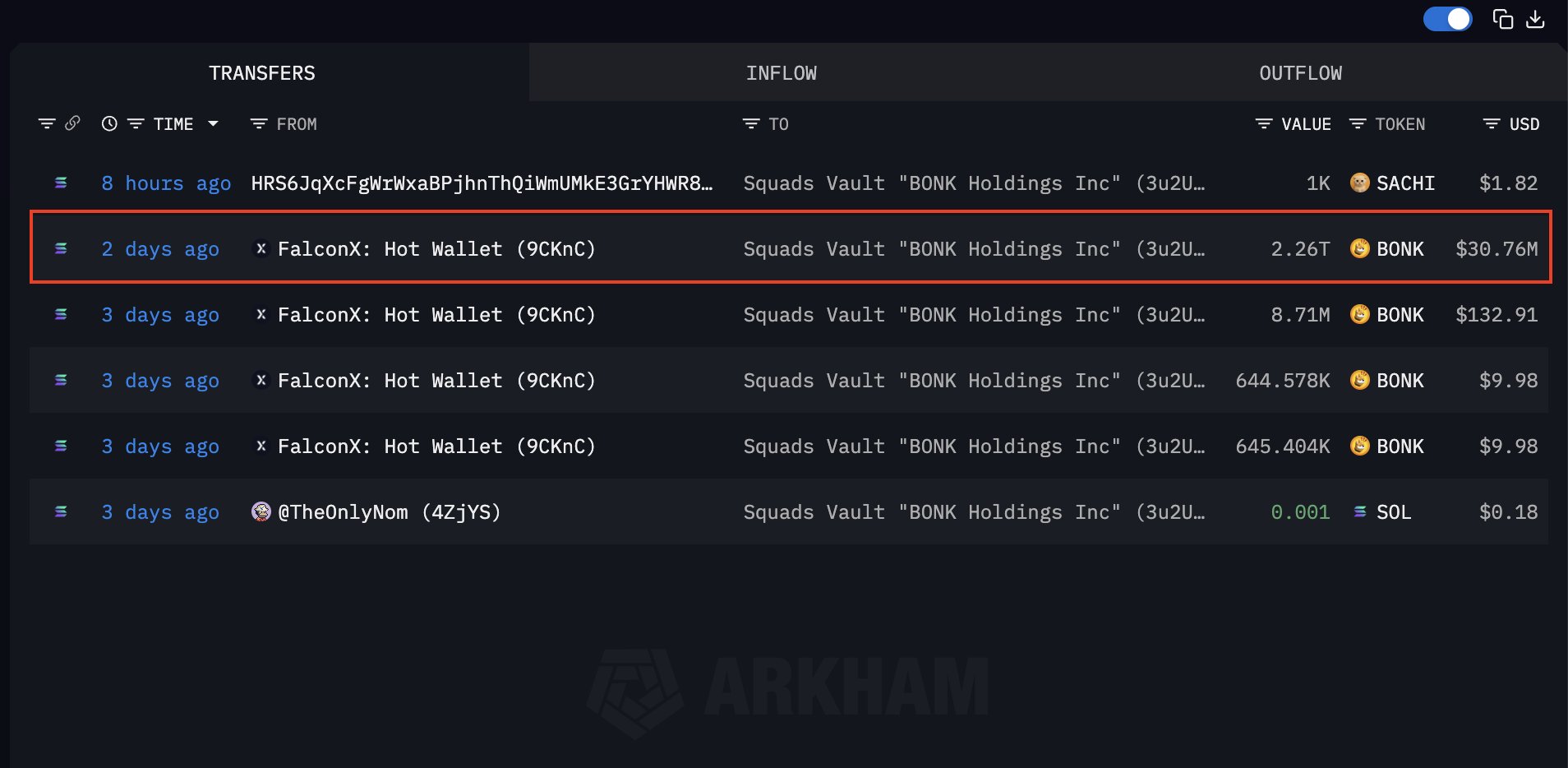

According to Arkham Intelligence data, Bonk Holdings Inc. recently received 2.26 trillion BONK tokens, valued at around $32 million. The purchase was made via crypto brokerage FalconX, which now custodies the assets through Fireblocks.

The holdings are secured in a Solana Squad Multisig wallet. This ensures multi-signature control and institutional-grade transparency.

The company also revealed plans to double its holdings in the near future. This acquisition officially establishes the firm as the first BONK Digital Asset Treasury (DAT). Bonk Holdings, formerly known as Safety Shot, was initially known for its functional beverage line. The firm has now begun to expand into digital finance. In August, the firm acquired a 10% revenue-sharing interest in BONK.fun.

The platform ranks among the world’s top 10 most profitable decentralized applications. It has also seen peak days with 20,000 token launches and daily trading volumes exceeding $100 million. These impressive figures highlight BONK.fun’s capacity to generate consistent revenue streams.

Company CEO Jarrett Boon expressed enthusiasm for the company’s strategy.

“We are deeply integrating our public company with a proven, revenue-generating leader in the digital asset space. We are confident this model will unlock significant long-term value for our shareholders,” he said.

Safety Shot rebranded as Bonk Holdings Inc., adopting the Nasdaq ticker BNKK on October 10, 2025. This transition follows a series of institutional alignments surrounding the meme coin.

In September, Sharps Technology shared it would stake a portion of its 2 million SOL holdings into BonkSOL, the platform’s liquid staking token (LST), backed by Cantor Fitzgerald & Co.

Analyst Sees Bullish Upside for the Meme Token

A crypto analyst shared on X that the meme coin had completed its downside “order block taps.” This is a technical setup often signaling the end of a correction phase. “We went down — now it’s UP only,” he added, implying a bullish reversal ahead.

Meanwhile, Tuttle Capital filed to launch a Bonk Income Blast ETF with the U.S. SEC. This could be one of the first meme coins to secure an ETF product in the market if approved.

The treasury moves and major financial products now tied to BONK suggest the token’s fundamentals are strengthening. One analyst summarized, “It’s rare to see a meme coin get this level of corporate backing, but BONK might be redefining what institutional adoption looks like on Solana.”

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- XRP News: Ripple-Backed Ctrl Alt Completes $280M in Diamond Tokenization on XRPL

- Bitwise CIO Calls Bitcoin Selloff ‘Classic Cycle,’ Dismisses Manipulation Rumors

- Cardone Capital Takes Real Estate On-Chain With $5B Tokenization Plan

- Senator Elizabeth Warren Targets Trump-Affiliated World Liberty Financial Over Bank Charter Bid

- JPMorgan Projects Bullish Crypto Market in H2 Following CLARITY Act Approval

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

- Will Solana Price Rally to $100 If Bitcoin Reclaims $72K?

- XRP Price Eye $2 Rebound as On-Chain Data Signals Massive Whale Accumulation

Buy $GGs

Buy $GGs