Coinbase Receives ‘Buy’ Rating Ahead Q2 Earnings Release, What’s Next?

Highlights

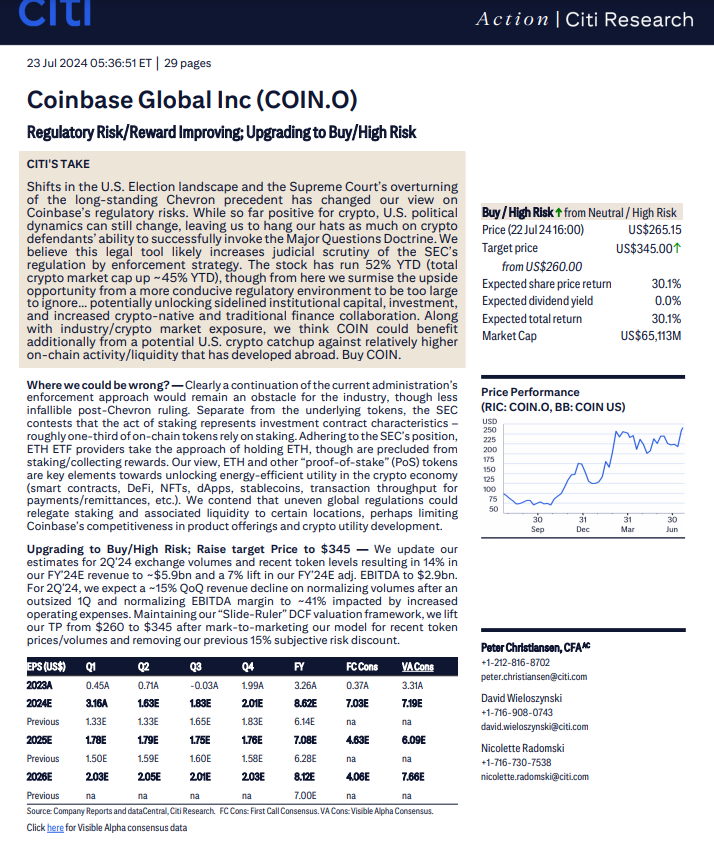

- CITI upgrades Coinbase stock rating to "Buy" ahead of Q2 earnings release.

- Favorable regulatory developments drive CITI's optimistic outlook for Coinbase.

- CITI raises Coinbase's price target from $260 to $345, reflecting increased confidence.

Coinbase, a leading crypto exchange, has garnered significant attention from investors as its COIN stock received a “buy” rating from CITI. Notably, this development comes just before the exchange’s anticipated Q2 earnings release in early August, sparking discussions about the potential reasons behind this optimistic outlook. So, here we take a closer look at the recent upgrade from Citi and see how the exchange’s stock is likely to perform ahead.

Coinbase Receives Buy Rating From CITI

CITI has elevated its rating for Coinbase from “Neutral” to “Buy/High Risk,” driven by recent changes in the U.S. political and legal landscape. The CITI analysts believe these shifts could positively affect the company’s regulatory risks. Specifically, the Supreme Court’s decision to overturn the Chevron precedent is seen as a favorable development for the cryptocurrency sector.

Meanwhile, the recent report highlights that the Chevron ruling could increase judicial scrutiny of the SEC’s regulation by enforcement strategy. This legal shift might enable crypto defendants to invoke the Major Questions Doctrine, leading to a closer examination of the SEC’s regulatory tactics.

In addition, the analysts suggest that a more favorable regulatory environment could attract institutional capital and foster investment. This scenario could enhance collaboration between crypto-native and traditional financial sectors, potentially benefiting Coinbase significantly.

However, despite the positive outlook, CITI notes potential risks. The current administration’s enforcement approach and the SEC’s stance on staking could pose challenges for Coinbase. About one-third of on-chain tokens rely on staking, but Ethereum ETF providers are barred from staking rewards.

This restriction could impact COIN’s performance, considering the importance of proof-of-stake tokens like ETH for energy-efficient crypto utility.

Also Read: Base By Coinbase Eases Crypto Donations For All US Politicians

What’s Next?

In its recent report, CITI raised Coinbase’s price target from $260 to $345, reflecting increased confidence in the company’s prospects. Besides, CITI’s report mentions that the launch of Spot Ethereum ETFs in the U.S. could act as a positive catalyst for one of the leading crypto exchanges.

This launch suggests the potential for more crypto ETFs to enter the market, leading to increased adoption of cryptocurrencies and a larger custody revenue opportunity for the exchange. Additionally, analysts also highlighted that the risk/reward setup for Coinbase has improved, particularly in its defense against the SEC’s lawsuit.

However, despite the positive update, COIN stock price was down about 1% from its previous close and exchanged hands at $263. On a YTD basis, the stock has witnessed a surge of 69%, while increasing 25% over the last 30 days. Meanwhile, all eyes are now on the upcoming Q2 FY24 earnings release by the exchange, which is scheduled for August 1, after the closing bell.

Also Read: Hamilton Lane Launches Private Credit Fund On Solana

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- U.S.–Iran War: Bitcoin Price Extends Decline as Oil Prices Surge To Two-Year High

- Bitcoin Treasury Firm MARA Considers Selling BTC Reserves After Policy Update

- Cardano Founder Warns Over CLARITY Act, Cites Lack of Protection for DeFi, Stablecoins, Prediction Markets

- Core Scientific Sells 1,900 BTC as Bitcoin Miner Pivots to AI, CORZ Stock Dips

- Bitcoin News: VanEck CEO Projects Gradual BTC Rally in 2026 as ETFs Sees $458M Inflows

- Circle Stock Price Climbs 15% to $96, Can Rally Continue in March 2026?

- Bitcoin Price Prediction as US-Iran War Enters 4th Consecutive Day

- Top 5 Historical Reasons Dogecoin Price Is Not Rising

- Pi Coin Price Prediction for March 2026 Amid Network Upgrade, KYC Boost, Rewards Distribution

- Gold Price Nears ATH; Silver Eyes $100 Breakout on Us- Iran War

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

Buy $GGs

Buy $GGs