Expert Predicts MSTR Stock Drop to $120 as Peter Schiff Criticizes Michael Saylor’s Bitcoin Strategy

Highlights

- According to market analysts, MSTR stock will still drop, with one projecting a decrease to $120.

- Another analyst predicts a long drop, adding that there will not be a bottom until the end of 2026.

- Economist Peter Schiff faults Strategy's Bitcoin model based on the large losses incurred recorded by the stock.

MSTR stock is facing bearish sentiment, with several market analysts projecting a further decline amid Bitcoin’s crash to new yearly lows. At the same time, renowned economist Peter Schiff has again criticized Michael Saylor’s decision to adopt a Bitcoin strategy for his firm instead of buying gold.

Analyst Identifies Bearish Chart Set Up for MSTR Stock

Chartered Market Technician Aksel Kibar highlighted a long-forming topping structure for the stock’s price on the weekly chart. Then, he forecasted a downside continuation for the MSTR stock. According to him, the chart projects the MSTR price to drop to about $120.

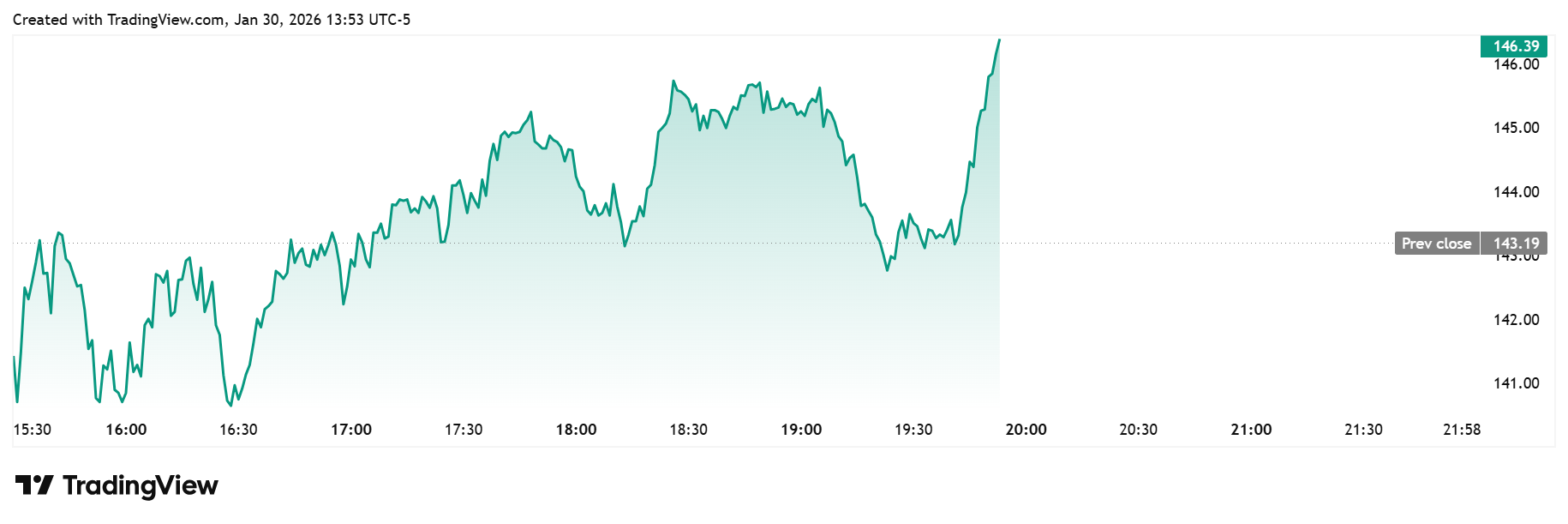

He added that the chart showed a drop below a multi-month support band and that lower highs have formed during recent swings. According to TradingView data, MSTR price is trading at about $146, up over 2% in today’s trading session, rebounding from a 52-week low of around $143 yesterday. However, the stock is still down over 7% year-to-date (YTD).

Analyst Ted Pillows also noted that MSTR has lost its prior monthly upward trend. Also, it is currently trading below important trend and momentum indicators. Crypto market analyst Benjamin Cowen wrote that the previous major cycle of MSTR took 98 weeks to bottom out. Hence, he presented a comparative chart model indicating that if the same duration is repeated, there might be a cycle low by October 2026.

Trader The Great Mattsby indicated a more immediate technical interest zone at around $130. According to the shared chart, the level was calculated from the Fibonacci retracement and horizontal support lines.

Schiff Questions Strategy’s Bitcoin Treasury Model

In an X post, Peter Schiff said that MSTR stock is currently almost 70% below its peak. This came as he tied the stock’s decline to Strategy and Saylor’s decision to build a Bitcoin treasury. According to him, Strategy spent over $52 billion to acquire more than 700,000 BTC at an average price of over $76,000, including the 2,932 BTC it bought between January 20 and 25.

The company reported an unrealized loss of $17.44 billion in the fourth quarter of 2025, as the BTC price declined by 25% during the quarter. MSTR stock dropped 53% in Q4 alone and is 66% off its record high.

Another argument by Schiff is that the firm’s unrealized gain of 11% over the past five years of buying BTC is small. He said the firm would have achieved larger gains if it had purchased gold instead. In a recent interview, Schiff ruled out Bitcoin as a reserve currency, calling it a speculative currency with no underlying value.

He noted that central banks continue to accumulate gold rather than Bitcoin as reserves. He said this is due to the lack of influence of technology and investor sentiment on its price. Another point Schiff made is that gold has proven to be a consistent store of value during crises.

- Breaking: U.S. Supreme Court Strikes Down Trump Tariffs, BTC Price Rises

- Breaking: U.S. PCE Inflation Rises To 2.9% YoY, Bitcoin Falls

- BlackRock Signals $270M Bitcoin, Ethereum Sell-Off as $2.4B in Crypto Options Expire

- XRP News: Dubai Tokenized Properties Trading Goes Live on XRPL as Ctrl Alt Advances Project

- Aave Crosses $1B in RWAs as Capital Rotates From DeFi to Tokenized Assets

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise

- Cardano Price Prediction Feb 2026 as Coinbase Accepts ADA as Loan Collateral

- Ripple Prediction: Will Arizona XRP Reserve Boost Price?

- Dogecoin Price Eyes Recovery Above $0.15 as Coinbase Expands Crypto-Backed Loans