MSTR Stock at Risk? Peter Schiff Predicts Deeper Bitcoin Losses for Strategy Amid Crypto Crash

Highlights

- Peter Schiff warns Strategy’s Bitcoin losses could deepen over the next five years.

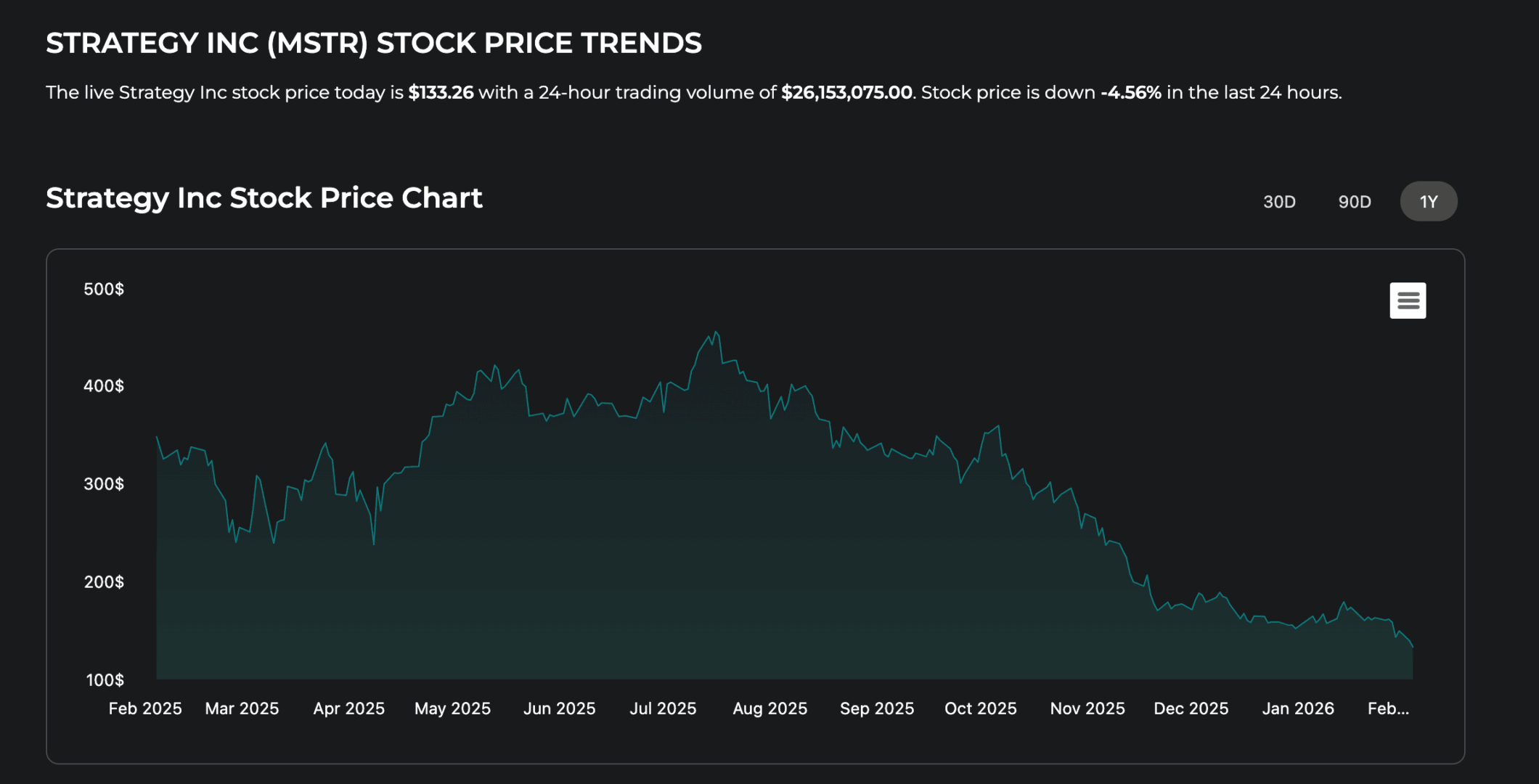

- MSTR stock slid nearly 5% in the latest trading session, tracking the decline in Bitcoin’s price.

- Bearish analysts project further downside, with some forecasting a drop toward $118 for MSTR shares.

The MSTR stock could be at risk of a continuous free fall as the market sentiment worsens. Peter Schiff has come out to project that Strategy Bitcoin losses could grow as BTC continues its downturn.

Peter Schiff Says Bitcoin Losses Could Get Worse as MSTR Stock Price Stumbles

In a post on X, Schiff criticized Michael Saylor’s Bitcoin treasury firm Strategy for its current valuation. He further said that with the current state of things, the firm could see additional losses over the next 5 years.

According to Saylor, Bitcoin is the best performing asset in the world. Yet MSTR invested over $54 billion in Bitcoin over the past five years,” he said. As of now the company is down about 3% on that investment. I’m sure the losses over the next five years will be much greater.”

The fall in Strategy BTC treasury value has affected the price movement of the MSTR stock, which has been losing value rapidly. Yesterday at the close of trading, the stock lost another value of nearly 5%.

Another question that Schiff posed is on the timing of the purchase. He observed that Bitcoin dipped below $75,000 and has continued to trade well below the latest purchase price of Strategy. He argues that waiting for a lower price would have helped reduce risk.

Schiff has always advocated for commodities as opposed to Bitcoin. He has always been of the opinion that BTC is a speculative asset with unknown fundamentals. He has also been warning investors about companies with big and concentrated exposures to Bitcoin, especially those with investments in stocks like MSTR.

Expert Projects Strategy Stock Decline to $118

Fund manager Aksel Kibar shared an analysis highlighting that the shares would fall as low as $118. The expert had made this projection since late 2025 and started to play out due to the crypto market crash.

Other experts have been projecting similar targets for the MSTR stock. As CoinGape reported, Ted Pillows shared that the shares are losing their monthly upward trend. This means its upcoming price movements would only tend downward unless the market recovers.

Despite the decline, the overall exposure of Strategy remains high. The company currently owns over 713,000 BTC tokens, which were acquired at a total cost of about $54.26 billion. The average price per coin for its overall holdings is about $76,000, which is still at the range of the current price.

- Expert Predicts Deeper Bitcoin Decline as JPMorgan CEO Warns of Similarities to the 2008 Financial Crisis

- Trump Won’t Pardon FTX’s Sam Bankman-Fried (SBF), White House Says

- Third Spot SUI ETF Goes Live as 21Shares Fund Launches on Nasdaq

- Mark Zuckerberg’s Meta Reportedly Eyes Stablecoin Integration This Year Amid Regulatory Clarity

- Coinbase Rivals Robinhood As It Rolls Out Stocks, ETFs Trading In ‘Everything Exchange’ Push

- Sui Price Eyes Recovery as Third Spot SUI ETF Debuts on Nasdaq

- Pi Network Price Eyes a 30% Jump as Migrations Jumps to 16M

- Will Ethereum Price Dip to $1,500 as Vitalik Buterin Continues Selling ETH?

- XRP Price Outlook as Clarity Act Passage Odds Plunge to 53%

- COIN Stock Risks Crashing to $100 as Odds of US Striking Iran Jump

- MSTR Stock Price Predictions As Michael Saylor’s Strategy Makes 100th BTC Purchase

Claim Card

Claim Card