MSTR Stock Jumps 20% as TD Cowen Sets $440 Price Target for Michael Saylor’s Strategy

Highlights

- TD Cowen analyst Lance Vitanza has given Strategy a buy rating with a target of $440.

- The investment bank's analysts stated that Saylor's company is well positioned to benefit from a recovery for Bitcoin.

- The MSTR stock is up over 20% today following its slump to as low as $107 yesterday.

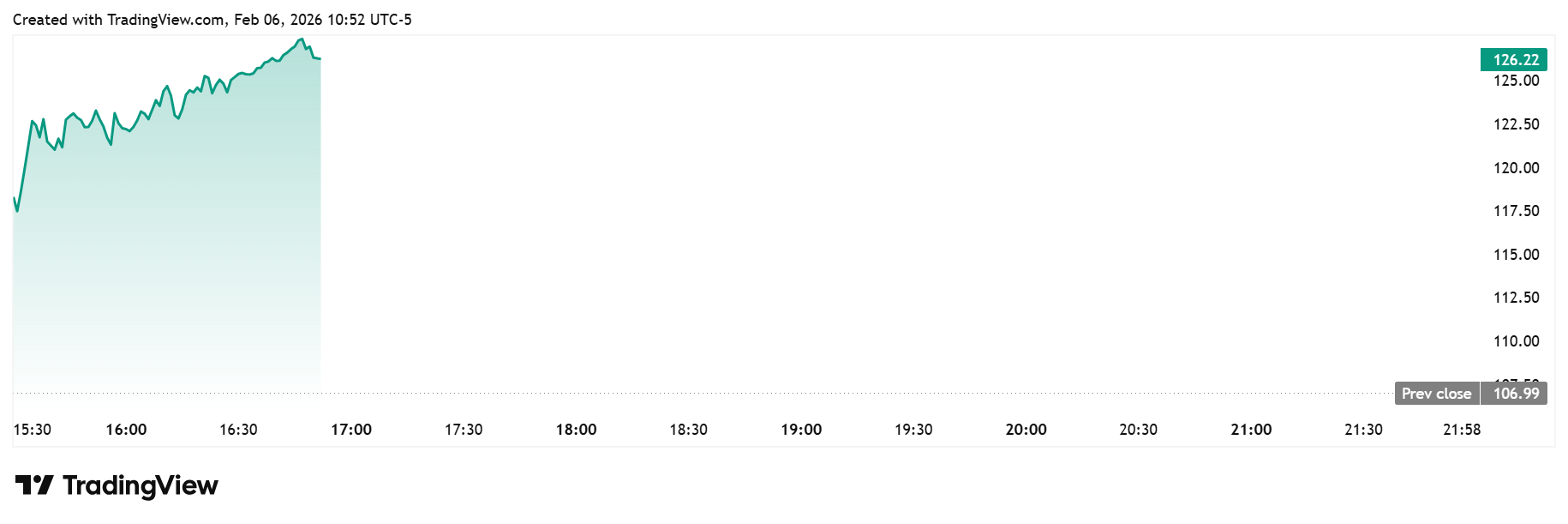

The MSTR stock is rebounding from its decline earlier this week, up as much as 20% in today’s trading session. This comes as TD Cowen analysts predict that the stock price could still rally to as high as $440, despite its recent underperformance.

MSTR Stock Climbs as TD Cowen Gives Strategy Buy Rating

TradingView data show the MSTR stock is trading at around $128, up over 20% from its previous close of $107. This comes amid a bullish prediction from analysts at investment bank TD Cowen, who gave Strategy a Buy rating.

In a research note today, TD Cowen analyst Lance Vitanza explained that Strategy has the capital to handle a much deeper Bitcoin decline, which is why the analyst is giving the company a Buy rating with a price target of $440.

Vitanza further alluded to the company’s $2.25 billion cash reserve, which he noted can fund its $900 million in fixed charges for almost 17 months and finance the potential redemption of $1 billion of convertible bonds in September 2027.

This comes just as Strategy’s CEO, Phong Le, assured investors that Bitcoin would have to drop to $8,000 for them to face liquidation of their holdings to satisfy the convertible notes. He and executive chairman Michael Saylor also revealed that the plan is to keep buying more BTC amid the downtrend.

Strategy Well-Positioned For a BTC Recovery

Commenting on Strategy’s Bitcoin exposure, the TD Cowen analyst noted that MSTR stock is well-positioned for a potential BTC recovery. He added that the investment bank expects BTC to eventually reach a new all-time high (ATH) following this crash, likely as early as the third quarter.

MSTR’s rebound marks a positive as the stock had dropped to as low as $106 yesterday following the BTC crash to a yearly low of $60,000. Strategy had also reported a $12.4 billion loss in Q4 earnings, which also caused the stock to decline.

Notably, Bitcoin has reclaimed the psychological $69,000 level today, up over 10%. This has also contributed to the MSTR stock’s surge today, given Strategy’s BTC exposure. Market expert Adam Livingston suggested that the drop to $106 may have marked the bottom for the stock, with more price gains on the horizon.

Other crypto stocks have also recorded significant gains today as the crypto market recovers from yesterday’s crash, which triggered bear-market jitters. The HOOD and COIN stocks are also among the largest gainers today, up 15% and 10% respectively.

Tom Lee’s BitMine is also up 15% today, after crashing to as low as $17 yesterday as Ethereum dropped below $2,000. ETH is back above this psychological level today, up over 10% on the day.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Why Is Crypto Market Crashing Today (Feb 28)

- Breaking: Ethereum Price Drops Amid Israel-Iran Tensions; Machi Big Brother Liquidated Again

- CLARITY Act: Stablecoin Yield Debate Heats Up, but March 1 Deadline Not ‘Do or Die’

- Best Institutional Custody Solutions for Tokenized Assets in 2026

- Minnesota Considers Ban on Bitcoin and Crypto ATMs as Scam Reports Rise

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

Buy $GGs

Buy $GGs