MSTR Stock Rebounds As Strategy Upsizes STRD IPO To $1B For More Bitcoin Purchases

Highlights

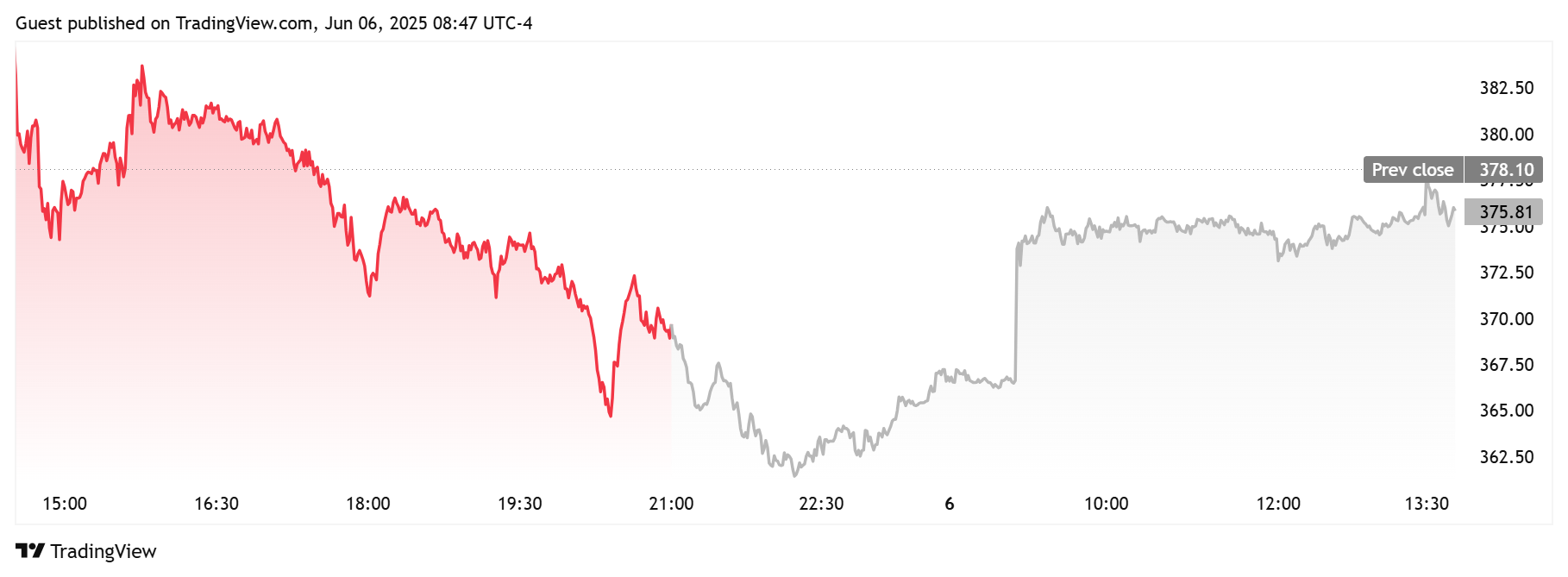

- MSTR stock has gained over 2% today following the drop below $370 on June 5.

- This comes following Strategy's upsized STRD IPO offering.

- Saylor's company plans to raise $1 billion from the offering to buy more Bitcoin.

The MSTR stock is back in the green after it closed the June 5 trading session down over 2%, as the Bitcoin price also dropped to as low as $100,000. This rebound comes following Strategy’s announcement of an upsized STRD IPO for more BTC acquisition.

MSTR Stock Gains Almost 2% As Strategy Upsizes STRD Offering

TradingView data shows that the MSTR stock is up almost 2% in pre-market trading, trading at around $375. As CoinGape reported, Strategy stock was one of the crypto stocks that tanked on June 5 as investors looked to scoop up some Circle shares after the stablecoin firm debuted on the NYSE.

In a press release, Strategy, previously MicroStrategy, announced the pricing of its initial public offering on June 5, 2025, of 11,764,700 shares of 10.00% Series A Perpetual Stride Preferred Stock at a public offering price of $85 per share.

The company intends to issue and sell the STRD stock on June 10, 2025, subject to customary closing conditions. Strategy estimates that the net proceeds from the STRD sale will be around $979.7 million, after deducting the underwriting discounts and commissions and the firm’s estimated offering expenses.

Saylor and Strategy again reiterated that it intends to use the net proceeds from the offering for general corporate purposes, including the acquisition of Bitcoin. This provides a bullish outlook for the MSTR stock price.

MarketWatch data shows that the stock is currently up over 27% year-to-date (YTD). MSTR is also up over 131% in the last year. In the last 3 months, the stock has also recorded the highest returns among the major assets, including Bitcoin and the magnificent seven stocks.

- XRP Realized Losses Spike to Highest Level Since 2022, Will Price Rally Again?

- Crypto Market Rises as U.S. and Iran Reach Key Agreement On Nuclear Talks

- Trump Tariffs: U.S. Raises Global Tariff Rate To 15% Following Supreme Court Ruling

- Bitwise CIO Names BTC, ETH, SOL, and LINK as ‘Mount Rushmore’ of Crypto Amid Market Weakness

- Prediction Market News: Kalshi Faces New Lawsuit Amid State Regulatory Crackdown

- Dogecoin Price Prediction Feb 2026: Will DOGE Break $0.20 This month?

- XRP Price Prediction As SBI Introduces Tokenized Bonds With Crypto Rewards

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise