MSTR vs BTC: Will MicroStrategy Outperform Bitcoin by Feb end?

Highlights

- MSTR vs BTC debate intensifies as MicroStrategy trading near its Bitcoin treasury value.

- MicroStrategy holds 717,131 Bitcoin, about $5.7B below average cost.

- ETF outflows and resistance near $135 shape near term MSTR moves.

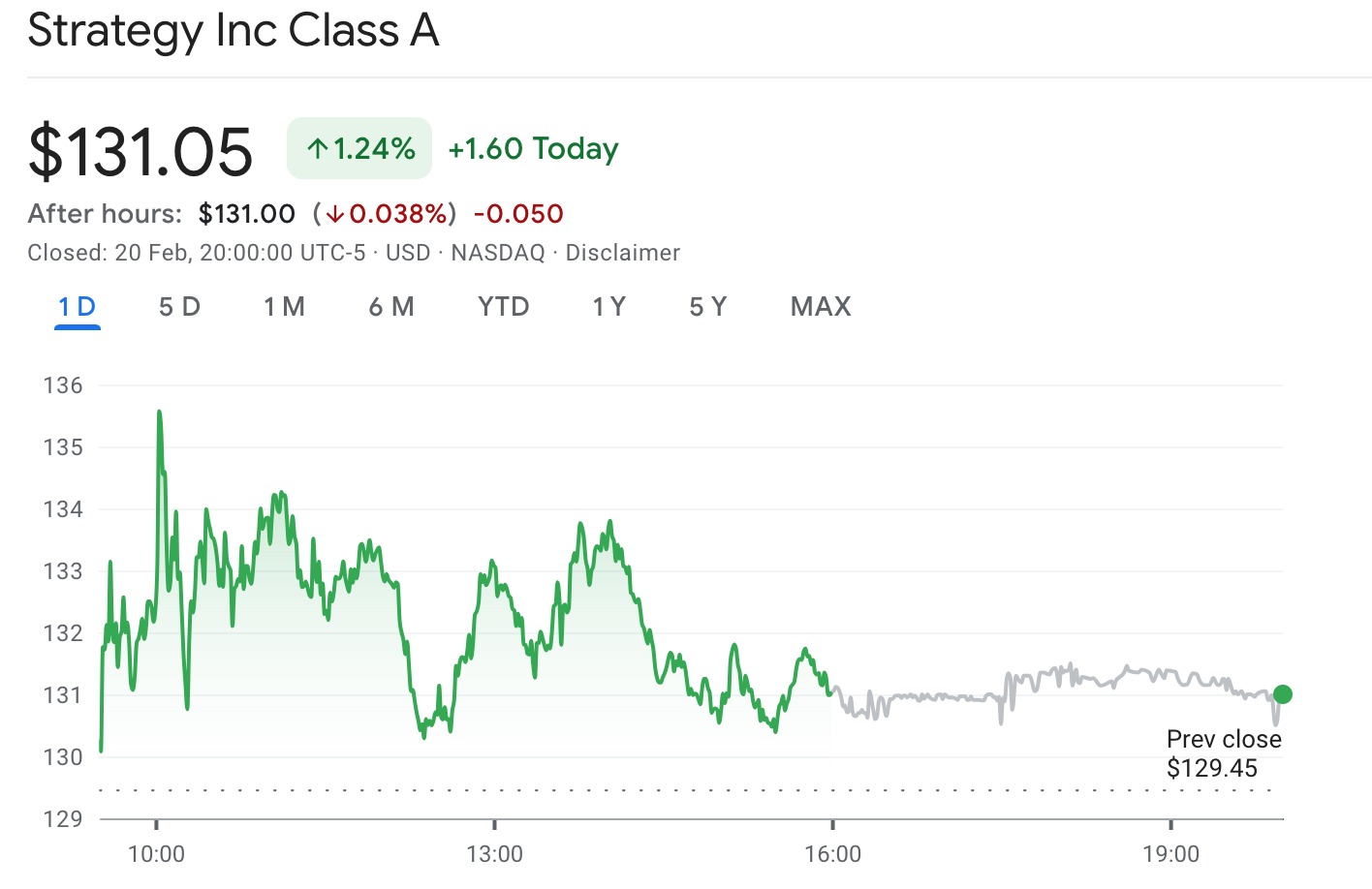

The MSTR vs BTC talks continue as February nears its end, with investors tracking whether the MicroStrategy stock can outpace Bitcoin. At press time, BTC was trading at $68,063, down by 23% over the past month, while MSTR closed Friday at $131.05.

MSTR vs BTC Price Action and Treasury Gap

Bitcoin price has struggled through February, despite a modest 0.15% daily gain. In contrast, MSTR rose 1.24% in Friday’s session, trading between $129.41 and $136.14 on roughly 17.6 million shares. After-hours price activity was at $131.

MicroStrategy holds 717,131 BTC as of Feb. 17. The company bought those coins at an average price near $76,027, totaling about $54.5 billion. At current prices, those holdings are near $48.8 billion.

After roughly $6 billion in net debt and some cash adjustments, MSTR trades near a slight discount to its Bitcoin treasury value. That contrasts with prior bull phases, when the stock commanded significant premiums.

MSTR has historically acted as a leveraged proxy for Bitcoin. Over five years, its beta is near 3.5, and daily moves often reach two to three times BTC’s percentage change. Therefore, a 2% Bitcoin move can translate into a 4% to 6% swing in MSTR.

Conference Catalyst and Corporate Buying

Strategy is holding its “Bitcoin for Corporations” conference in Las Vegas on Feb. 24–25. Michael Saylor could highlight the firm’s treasury approach, which could increase trading interest in the last week of February.

Moreover, the company has announced Bitcoin purchases almost every Monday. These routine disclosures reinforce its accumulation model, which relies on debt, preferred shares, or equity issuance to fund additional BTC buys.

According to an X post by Open4profit, MicroStrategy holds Bitcoin without selling, even while sitting about $5.7 billion below its average cost. The post noted that Saylor raises capital through stock or debt instead of liquidating BTC.

Additionally, Mizuho Securities cut its 12-month price target from $403 to $320. The company also reported a $12.4 billion net loss and a $17.4 billion unrealized digital asset loss.

Market Structure and Broader Bitcoin Debate

Technically, the crypto stock trades between $125 support and $135 resistance after rebounding from the $105–110 zone. The RSI is at 54.97, indicating mild bullish momentum. Meanwhile, the MACD shows a positive crossover, though expansion remains limited.

Year to date, some trackers show MSTR down 13.75%, compared with Bitcoin’s 22% decline. That relative resilience has fueled the current MSTR vs BTC debate. Meanwhile, according to Walter Bloomberg, Bitcoin faces pressure from ETF outflows totaling $3.8 billion over five weeks.

However, cumulative ETF inflows still stand near $54 billion. Network data also shows a hash rate near 1,000 exahashes per second and Lightning capacity above 5,600 BTC. With Bitcoin consolidating near $68,000 and gold trading above $5,100, investors continue to monitor whether MSTR can extend its recent relative strength before February closes.

- Bitcoin Price Today As Bulls Defend $65K–$66K Zone Amid Geopolitics and Tariffs Tensions

- XRP Realized Losses Spike to Highest Level Since 2022, Will Price Rally Again?

- Crypto Market Rises as U.S. and Iran Reach Key Agreement On Nuclear Talks

- Trump Tariffs: U.S. Raises Global Tariff Rate To 15% Following Supreme Court Ruling

- Bitwise CIO Names BTC, ETH, SOL, and LINK as ‘Mount Rushmore’ of Crypto Amid Market Weakness

- Pi Network Price Prediction: How High Can Pi Coin Go?

- Dogecoin Price Prediction Feb 2026: Will DOGE Break $0.20 This month?

- XRP Price Prediction As SBI Introduces Tokenized Bonds With Crypto Rewards

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act