“The Market Got It Wrong,” CryptoQuant Analyst Says Strategy’s MSTR is Massively Undervalued

Highlights

- A CryptoQuant analyst argues that the market is mispricing MSTR.

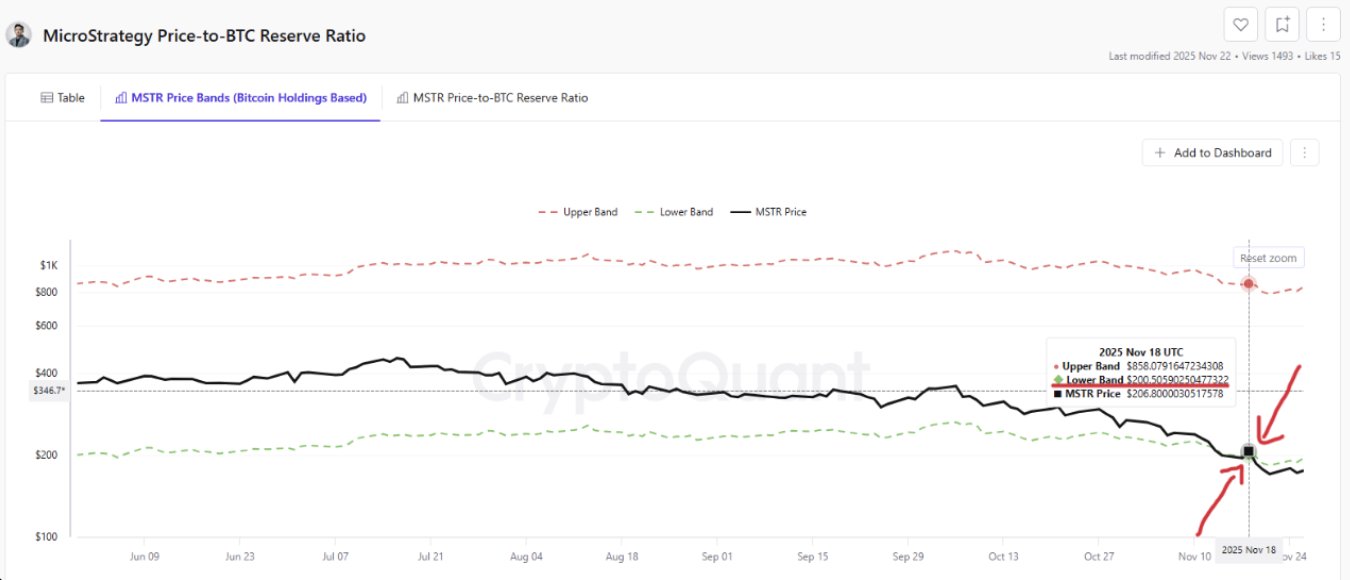

- MSTR has fallen into the lower CryptoQuant Price Band, a zone that shows deep undervaluation.

- Strategy maintains a strong cushion above its average BTC acquisition cost.

A CryptoQuant analyst has disagreed with the market’s current outlook for Strategy. In his argument, he claims that investors are mispricing the firm’s Bitcoin treasury. He said the true value of MSTR can be way higher than the traders might think.

“Market Misread the Signal”: Analyst Says MSTR Is Deep in Undervaluation

CryptoQuant analyst Carmelo Alemán shared in a report that the market is completely overlooking data behind Strategy’s Bitcoin balance sheet. According to the analyst, this investment firm now holds 649,870 BTC at an average purchase price of $74,432.

That puts its current unrealized gains margin at close to 22%. He thinks these metrics give a better representation of where the stock should be trading.

Alemán used CryptoQuant’s MSTR Price Bands to support his claim. He compared the stock’s current trading price to a theoretical value based on the company’s Bitcoin reserves. Recently, the stock fell into the lower band which indicates it is undervalued. This area often marks moments when the stock rebounds.

The drop in Bitcoin’s value helped cause the decline. MSTR fell more than the drop in its Bitcoin holdings. This widened the gap between the value of its Bitcoin-backed assets and its market price.

“If history repeats itself, this level of undervaluation could mark one of the most important market inflection points in recent years,” he said.

The recent decline in Bitcoin prices raised concerns about the firm’s portfolio. The average purchase price is still much lower than Bitcoin’s current price. This provides good cushion against price dips.

However, Strategy has struggled to keep its stock stable during the downturn. There has been claims that the company may need to sell part of its Bitcoin reserve.

Separately, MSCI has opened a consultation on whether companies like Strategy should be classified as funds or trusts. To that, Michael Saylor argued again that the index labels do not define the company’s identity.

Strategy Keeps Accumulation Plan Intact

As CoinGape reported earlier, Saylor said that Strategy is still committed to the accumulation plan. As Bitcoin continued in decline, he has always maintained that the firm wouldn’t stop buying the coin.

Interestingly, he hinted at the possibility of another BTC purchase yesterday. The comment came with an updated chart of the company’s BTC holdings.

Moreover, the company’s CEO cleared the doubt that they would sell holdings soon. He said the firm would sell Bitcoin under extreme conditions only.

- Robert Kiyosaki Reveals Why He Bought Bitcoin at $67K?

- XRP News: Ripple Partner SBI Reveals On-Chain Bonds That Pay Investors in XRP

- BitMine Ethereum Purchase: Tom Lee Doubles Down on ETH With $34.7M Fresh Buy

- BlackRock Buys $65M in Bitcoin as U.S. Crypto Bill Odds Passage Surge

- Bitcoin Sell-Off Ahead? Garett Jin Moves $760M BTC to Binance Amid Trump’s New Tariffs

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise

- Cardano Price Prediction Feb 2026 as Coinbase Accepts ADA as Loan Collateral

- Ripple Prediction: Will Arizona XRP Reserve Boost Price?