What’s Next for ETHzilla Stock price, Another Crash Or Recovery?

Highlights

- ETHzilla Stock price drops to $3.50 as Ethereum slides and Peter Thiel exits the company.

- Forecasts warn ETHZ could fall 62% with a 90% chance of trading below $1.81.

- ETHZ remains down over 97% from 2025 highs amid broader crypto weakness.

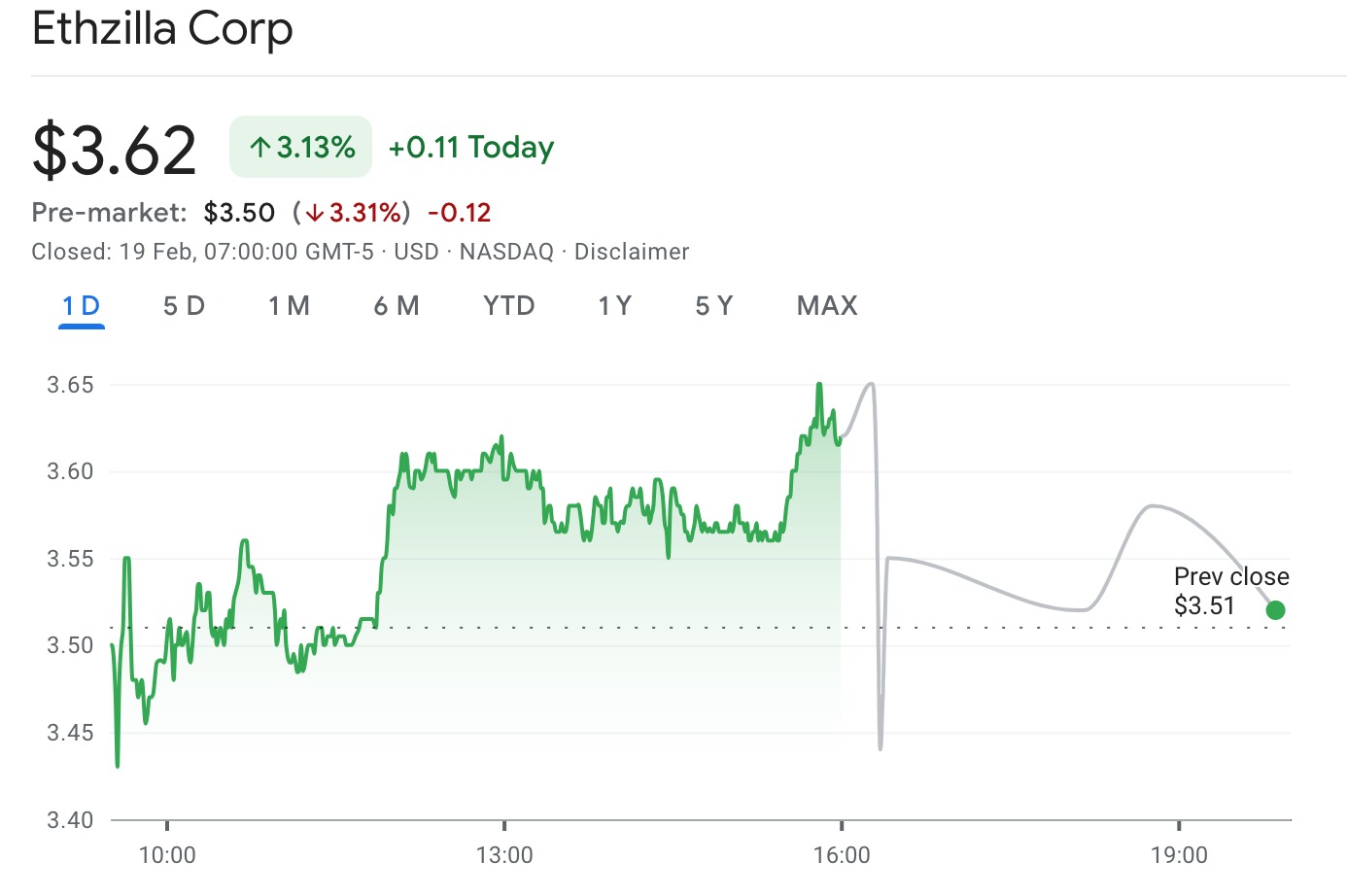

ETHzilla Stock Price (ETHZ) extended its decline in pre-market trading today, February 19. Ethereum, its focus cryptocurrency, and the broader crypto market have weakened. Notably, the drop also followed news that billionaire investor Peter Thiel and Founders Fund fully exited ETHzilla Corp.

ETHzilla Stock Price Slides in Pre-Market Trading

At the time of writing, the ETHzilla stock price was trading at $3.50 in pre-market activity, down 3.31% as per Yahoo Finance data. The day range is between $3.43 and $3.65, showing tight but pressured trading.

The crypto stock has been under pressure over the past year. ETHzilla’s stock price recorded a year range between $2.99 and $174.54. This shows how sharply the stock has fallen from its previous highs.

At the same time, ETHZ’s market cap stood at $68.82 million. Average daily trading volume remained around 646,840 shares, which suggested active participation despite the decline. The company’s decline also followed major shareholder changes.

According to a filing with the US Securities and Exchange Commission, Peter Thiel and his Founders Fund entities now report owning zero ETHzilla shares. In August, those same entities disclosed a 7.5% stake.

Will ETHZ Recover or Crash?

Questions about the next move for the crypto stock have started to emerge. According to StockInvest data, ETHzilla could drop 62% over the next three months. The forecast also suggested a 90% probability that the stock trades between $0.74 and $1.81.

CoinCodex data offered another bearish outlook, although its timeline stretched further. The platform projected the ETHzilla stock price could end 2026 near $2.60. That estimate implied a decline of roughly 25% to 28% from current levels near $3.50.

However, CoinCodex projected a smaller short-term decline. It is estimated that ETHZ could fall about 2.17% next week to roughly $3.43. Even so, the mixed forecasts still pointed toward continued downside pressure. The stock has dropped more than 97% from its 2025 highs. Since peaking in August, ETHzilla has tumbled about 97% through 2025.

Why Is the Crypto Stock Down?

ETHzilla Corporation trades as a public stock tied to Ethereum-based infrastructure. As a result, Ethereum’s decline mainly weighs on the ETHzilla stock price. Ethereum’s price is down by 37.4% in the past month, trading at $1,932.

Meanwhile, the broader crypto market has also weakened. Total crypto market value dropped about 1.9% to $2.28 trillion. As a result, ETHzilla has continued to move lower alongside the broader downturn.

Peter Thiel’s exit also came as Founders Fund reduced exposure elsewhere. The firm significantly cut its position in BitMine Immersion Technologies, which continues its Ethereum accumulation strategy. Entities tied to Founders Fund held more than 5 million BMNR shares in July 2025.

However, filings show those holdings dropped to about 2.5 million shares by September 2025. BMNR shares have also fallen nearly 64% in the past six months. In pre-market trading, BMNR slipped to $19.60, down 1.11%, over the past 24 hours.

- SEC Chair Reveals Regulatory Roadmap for Crypto Securities Amid Wait for CLARITY Act

- ProShares Launches First GENIUS Act Focused Money Market ETF, Targeting Ripple, Tether, Circle

- BTC Price Falls as Initial Jobless Claims Come In Below Expectations

- Breaking: CME Group To Launch 24/7 BTC, ETH, XRP, SOL Futures Trading On May 29

- White House to Hold CLARITY Act Meeting With Ripple, Coinbase, Banks Today

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise

- Cardano Price Prediction Feb 2026 as Coinbase Accepts ADA as Loan Collateral

- Ripple Prediction: Will Arizona XRP Reserve Boost Price?

- Dogecoin Price Eyes Recovery Above $0.15 as Coinbase Expands Crypto-Backed Loans

- BMNR Stock Outlook: BitMine Price Eyes Rebound Amid ARK Invest, BlackRock, Morgan Stanley Buying

- Why Shiba Inu Price Is Not Rising?