Why Coinbase (COIN) Stock Price Is Falling Today: Key Reasons

Highlights

- The COIN stock is down partly due to concerns that the crypto exchange may miss Q4 revenue estimates.

- The CLARITY Act has further stalled, which is also bearish for the crypto equity.

- Compass Point analysts predict that the stock could still drop to as low as $190.

Coinbase’s stock is down today, extending its decline from earlier in the week. The COIN stock decline comes amid concerns about a potential Q4 2025 revenue miss, setbacks in the CLARITY Act, and current crypto market conditions. Experts have also suggested that crypto equity could still drop further before finding a bottom.

Why The COIN Stock Is Down Today

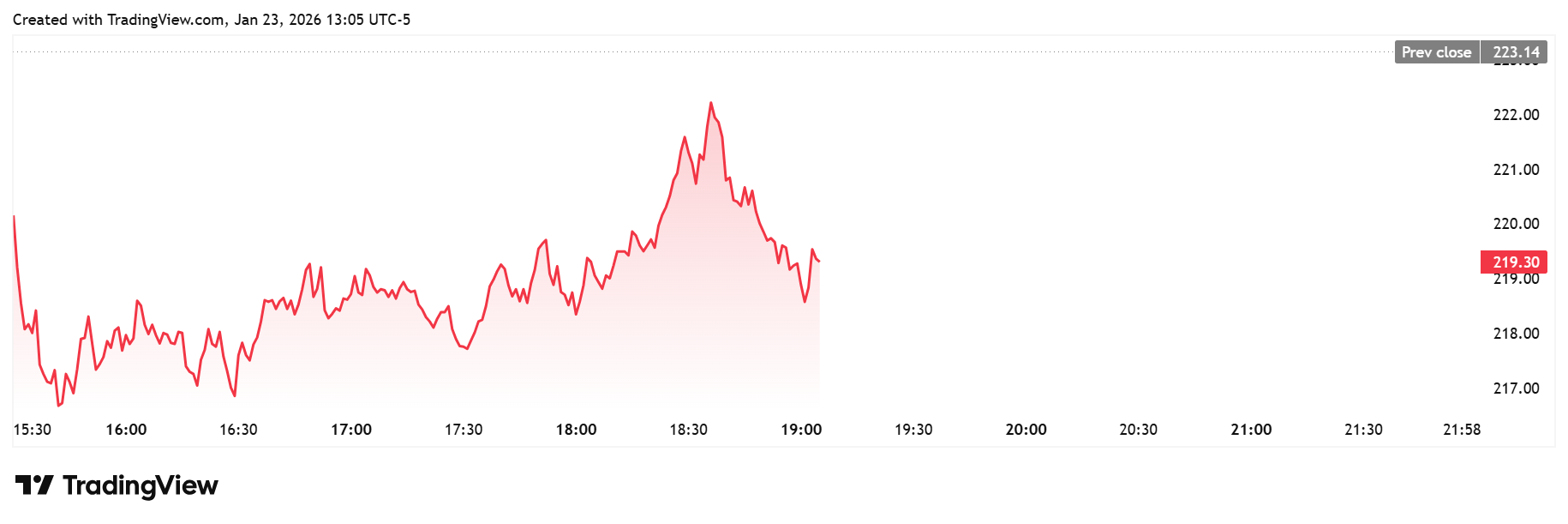

TradingView data shows that the COIN stock is down almost 2%, trading at around $218 after opening at $222. The stock is also down 8% in the last five days and 4% year-to-date (YTD).

The stock’s decline today follows Compass Point analysts’ reiteration of their sell rating, predicting a drop to $190. These analysts have warned of a potential Q4 revenue miss and limited upside until clarity on crypto legislation emerges.

They modeled a 4% revenue miss for the top crypto exchange in the fourth quarter of last year across both trading and subscription & services. Compass Point also noted how the drop in the COIN stock reflects weaker trading volumes.

Coinbase’s Q4 earnings call is scheduled for February 12, and analysts expect underwhelming Q4 results and Q1 2026 guidance. It is worth noting that the delay in the CLARITY Act is another factor contributing to the stock’s recent downtrend.

Compass Point analysts said they don’t expect any meaningful progress on the crypto bill between now and the crypto exchange’s earnings call in February. CoinGape reported earlier this week that the CLARITY Act is facing further delays, with a markup unlikely until late February or March.

Some experts have suggested that COIN stock could decline further before finding a bottom. Analyst Coin, who had earlier predicted a drop to $190 by month-end, opined that there is still some room to go lower.

Chart analyst Yimin said that the stock is still in risk-off mode even though it feels cheap. He added that if the range between $200 and $220 holds, a base can form while fear is high, and that reclaiming $250 would be the first real trend signal.

A Positive Outlook For The Crypto Stock

Amid the bearish sentiment towards the COIN stock, market analyst Danny Marques has provided a positive outlook for the crypto equity. In an X post, he noted that nobody cared about COIN when it was trading at $140, and then the stock went on to 3x.

$COIN – Coinbase

I know many don’t see it but Bitcoin $BTC and crypto have been written off by almost everybody at this point which means it’s probably a good time to be positioned in them

Nobody cared about

– Bitcoin in the $70s (so many calls for lower)

– Ethereum $ETH at… pic.twitter.com/bAPCNMZiT0— Danny Marques | Investing Informant (@Invst_Informant) January 22, 2026

The analyst believes that a similar setup is playing out for the crypto stock right now. He revealed that some strength indicators on the weekly chart have all reset, including the TMO, DSS Bresser, and RSI. Marques added that the price is slightly above the Ichimoku Cloud, which has preceded every massive reversal since 2024.

In line with this, he declared that the COIN stock is bearing the end of this correction, with selling volume declining and weakening. The analyst also noted that compression is as tight as it can be and that there is a lot of room to the upside for expansion now. “Don’t be surprised to see a 2x from current levels in 2026,” Marques concluded.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Peter Schiff Predicts BTC to Fall, Gold to Rise as Markets Price in Prolonged Iran War

- Institutional Re-Accumulation Signs Emerge as Bitcoin ETFs See $1.1B Net Inflows Since Iran War Began: Glassnode

- From Mining Pool to Infrastructure Platform: Nine Years of EMCD

- U.S.-Iran War: U.S. Oil Prices Spike To One-Year High, Bitcoin and Gold Dip

- Crypto Traders Bet Against U.S.-Iran Ceasefire This Month as Iran Denies Peace Talks

- HOOD Stock Targets $100 as Robinhood Unveils Platinum Card and Advance Dividend Feature

- Bitcoin Price Prediction if Donald Trump Signs the CLARITY Act on April 3, 2026

- Pi Network Price As BTC Rallies Above $74K: Can PI Coin Extend Gains to $0.30?

- XRP Price As Bitcoin Reclaims $74K- Is $5 Next?

- Dogecoin Price Outlook as BTC Recovers Above $73,000

- XRP Price Prediction as Iran-U.S. Peace Talks Trigger a Crypto Rally

Buy $GGs

Buy $GGs