What’s Behind Coinbase Stock 22% Price Surge To All-Time High This Week?

Highlights

- Bernstein analysts are predicting an additional 35% upside for the Coinbase stock.

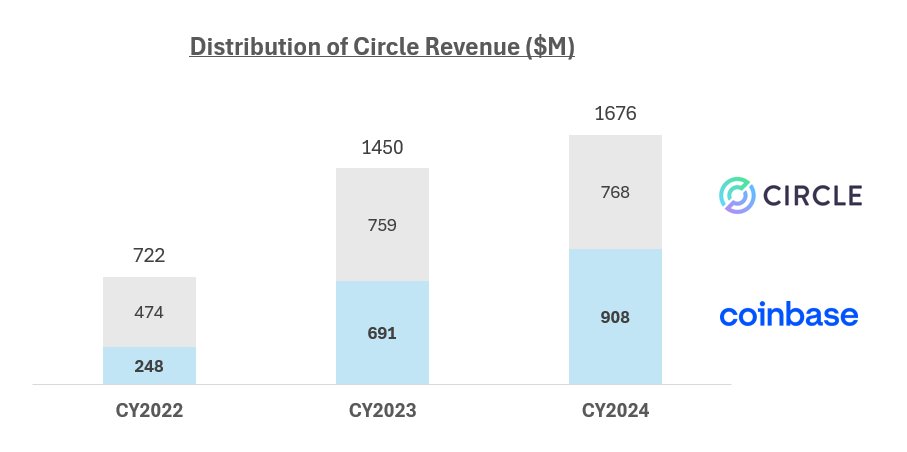

- Coinbase's collaboration with USDC issuer Circle continues to generate significant revenue.

- In 2024, Circle paid over $900 million to Coinbase from $1.7 billion in revenue.

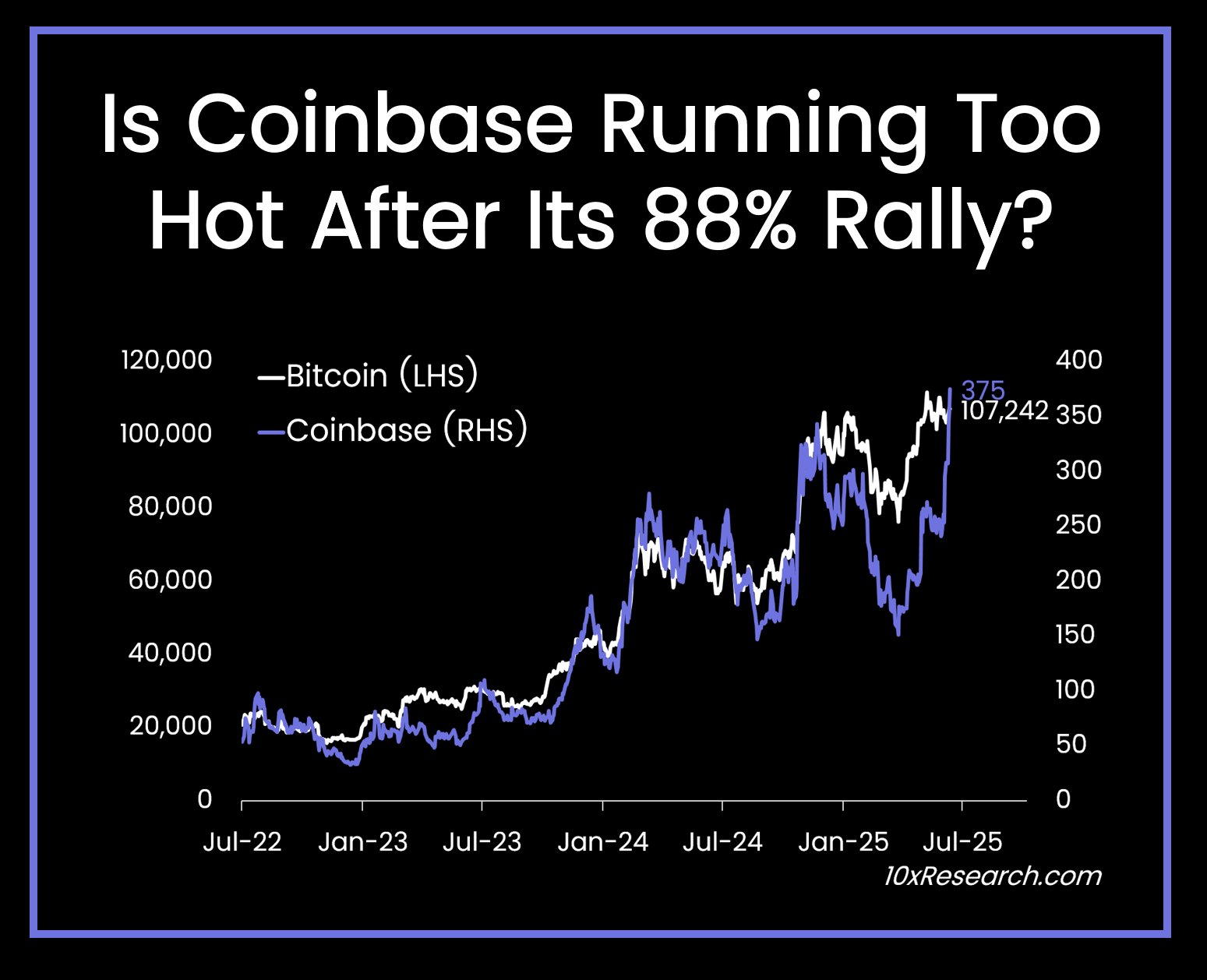

- The COIN share has outperformed peers with an 88% rally since mid-May, closing the gap with Bitcoin.

Coinbase stock surged over 22% this week, reaching a new all-time high of $380 on Thursday, driven by the Senate’s approval of the GENIUS Stablecoin Act. The COIN share has doubled in value since Trump Liberation Day on April 9, remaining a key focus for investors. Analysts at Bernstein project further gains, suggesting an additional 35% upside potential in the rally.

Why Coinbase Stock Price Hit All-Time Highs

With this week’s 22% upside, the Coinbase stock has surged to a new all-time high while overtaking its IPO price from April 2021. The passing of the GENIUS Stablecoin Act last week, along with the blockbuster Circle IPO, has fueled the surge in the crypto exchange stock price. Furthermore, the company’s weekly Bitcoin purchases have also fueled the rally. Here’s a deep dive into three key reasons behind this rally.

1. US Stablecoin Act Triggers Crypto Stock Rally

Crypto stocks, including Coinbase and Circle, have witnessed major upside as the U.S. lawmakers advanced the GENIUS Stablecoin Act with a 68-30 vote in the Senate. With the House vote pending for the stablecoin bill, President Donald Trump has urged lawmakers to expedite the process, requesting that the bill be sent to his desk without delay.

The GENIUS stablecoin bill grants non-bank entities like Coinbase the authority to continue issuing and profiting from digital dollars. Thus, it helped to bypass regulatory hurdles that posed a risk to the company’s revenue stream.

Moreover, with the stablecoin adoption accelerating, Coinbase’s USDC holdings in its products reached a massive $12.3 billion during the first quarter of 2025. On the other hand, as the USDC market soared to over $60 billion, and with the rise of USDC holdings in Coinbase products, it served as an additional catalyst for the Coinbase stock rally.

2. Coinbase Stock Rally Comes With Strong Circle Partnership

Back in 2018, Coinbase collaborated with Circle Internet Group to co-create the USDC stablecoin, thereby generating an additional revenue stream for the crypto exchange. According to recent reports:

- Coinbase receives 50% of USDC’s net interest income as part of its distribution agreement with Circle.

- In 2024, Circle generated approximately $1.7 billion in revenue, with over $900 million paid out to Coinbase for its role as a distribution partner.

This arrangement highlights a lucrative setup for Coinbase stock, as the revenue comes with minimal operational expenses. Now, with the Circle stock rally, the USDC firm valuations soared to $65 billion, offering an additional catalyst to Coinbase shares.

3. Brian Armstrong Confirms Coinbase Buying Bitcoin Every Week

Coinbase CEO Brian Armstrong recently confirmed that the crypto exchange purchases Bitcoins every week. His recent acknowledgment comes while crypto exchange Coinbase declared 24/7 perpetual style futures launch in the United States.

Coinbase CEO Brian Armstrong has repeatedly hinted at the possibility of Bitcoin’s price reaching millions of dollars in the future. He has also predicted that nations could soon begin adding Bitcoin to their balance sheets.

Is Coinbase Stock Running Too Hot?

The recent rally in Coinbase shares to its all-time highs has also provided profit booking opportunities to big players. On Thursday, Cathie Wood’s Ark Innovation ETF (ARKK) sold a total of 33,363 COIN shares from its holdings. Despite this sell-off, the fund still holds 1.81 million COIN shares.

Additionally, analysts at 10x Research stated that Coinbase stock has soared 88% since mid-May, significantly outperforming Bitcoin, trading volume trends, and nearly all other crypto stocks within its peer group.

Back in May, there was a significant divergence between the COIN share price and Bitcoin price, and the gap has been filled following the recent rally. As per the regression model, “Coinbase was undervalued by 32%”. However, the analysts at 10x research stated that the regression model is now flashing a warning sign after the recent run-up.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Peter Brandt Flips Bullish, Predicts Bitcoin Rally As Price Holds Above $70k

- XRP News: Institutional Use Case Expands as Doppler Finance Integrates WXRP for Multi-Chain Access

- Trump Tariffs: Bitcoin Faces Fresh Headwinds as 15% Global Tariffs Begin This Week Amid Iran War

- Bitget Unveils ‘Crypto Anti-Bias Pledge’ To Support Women’s Inclusion In Crypto

- U.S.-Iran War: Crypto Market Rebounds as Iran Reportedly Reaches Out To U.S. To End Conflict

- Dogecoin Price Outlook as BTC Recovers Above $73,000

- XRP Price Prediction as Iran-U.S. Peace Talks Trigger a Crypto Rally

- COIN Stock Analysis as Bitcoin Retests $72k Ahead of February NFP Data

- Robinhood Stock Price Prediction As Cathie Wood Buys $12M Dip in Bold ARK Move

- Bitcoin Price At Risk? Professor Who Predicted US-Iran War Says America Could Lose

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

Buy $GGs

Buy $GGs