Why is MSTR Stock Price Falling? (Feb 2)

Highlights

- MSTR stock is down today, having dropped about 8% in pre-market trading as Bitcoin extended its weekend sell-off.

- Strategy was facing over $900 million in unrealized Bitcoin losses after BTC dipped below its average purchase price.

- The firm continued raising capital through stock sales to fund additional Bitcoin purchases despite the downturn.

The stock of the Bitcoin treasury firm, MSTR, has now started to show losses as the market is declining. There are a couple of factors that have caused a change in the sentiment of the shares, especially the recent Bitcoin price crash.

MSTR Stock Falls as Bitcoin Price Plunges

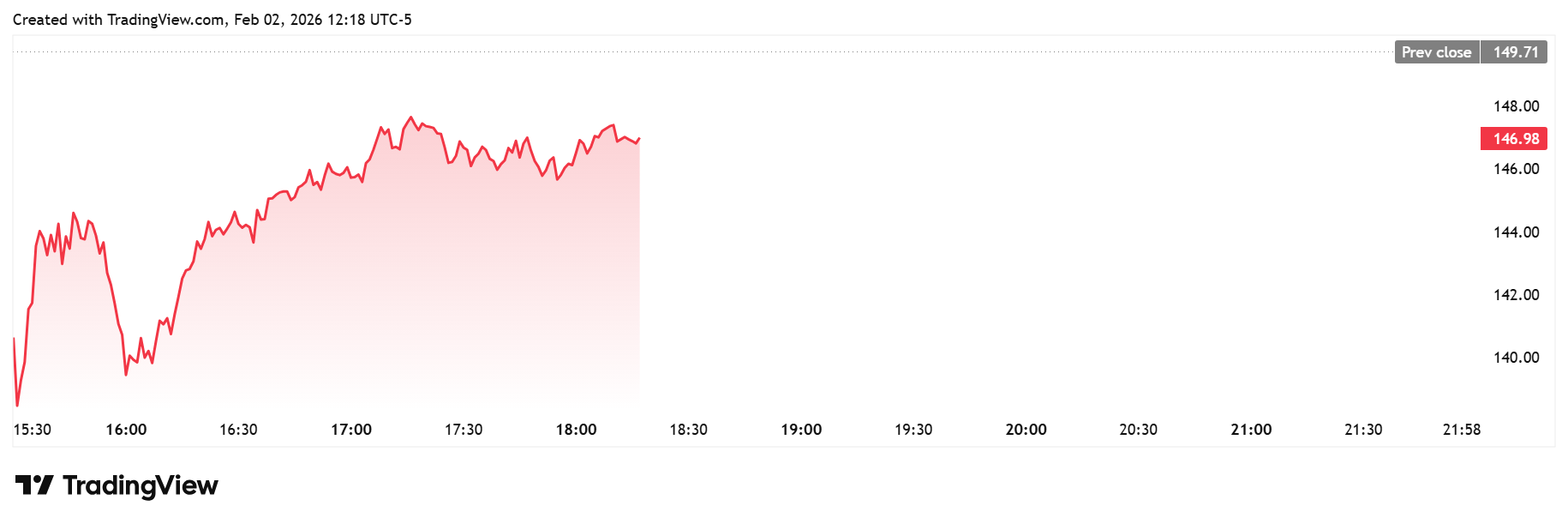

TradingView data shows that the MSTR stock is down today, dropping to as low as $139 on the day. The stock had also notably declined 8% in premarket trading earlier in the day, just as Strategy announced another weekly Bitcoin purchase.

As CoinGape reported, Saylor’s company bought 855 BTC For $75.3 million last week and now holds 713,502 BTC. Meanwhile, the decline in the MSTR stock came as the Bitcoin price crash got worse over the weekend. The coin fell as low as $74,000 in the late hours of Sunday. The fall has caused millions in liquidations, and major devaluations have been seen in the stocks of major investors, especially Bitcoin treasury firms.

The main driver for the MSTR stock price decline was news of losses already seen by Strategy. As CoinGape reported, the Michael Saylor firm is now sitting at over $900 million in unrealized losses of its BTC holdings. The firm had maintained its purchases despite the crash that started two weeks ago.

However, the coin fell below its average purchase price of $76,000 in the dip. Meanwhile, the company has been selling some of its shares for its Bitcoin buys. Strategy sold 1,569 million of its common stock from January 20 to 25.

In the process, the company raised a sum of $257 million in net proceeds. It also sold 70,201 shares of STRC stock, raising $7 million in net proceeds. This was used in last week’s Monday BTC purchase of $264 million.

It is also worth noting that the MSTR stock has fallen by 10% over the past week. As experts have previously highlighted, the stock varies with how the crypto moves, and with the coin still trading sideways, it could fall even more.

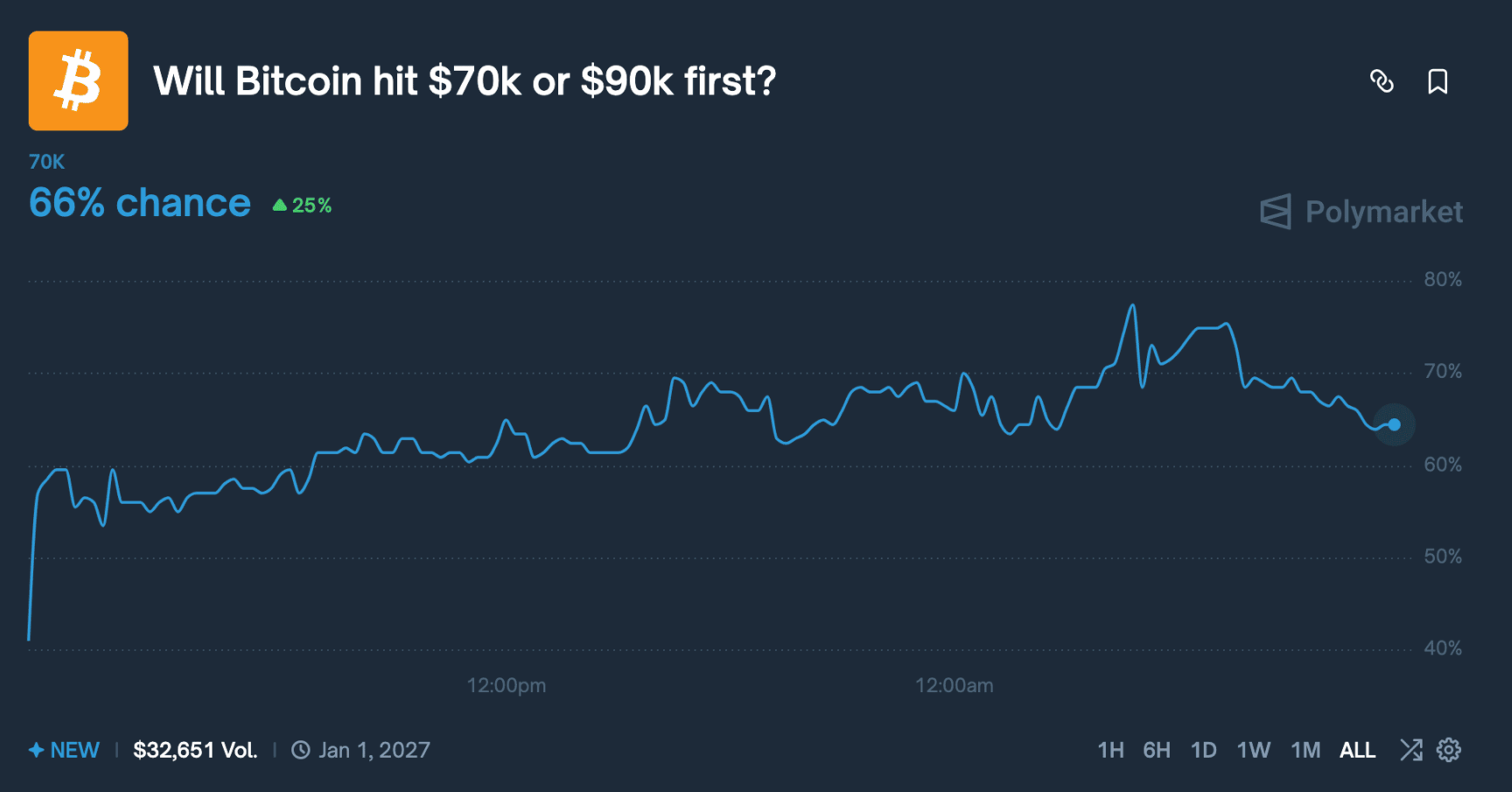

Crypto Traders Bet on BTC Falling to Below $70,000

More investors are increasingly of the opinion that the coin will continue its downtrend for most of Q1. As per Polymarket, traders are giving a 66% probability that the token will drop to or below $70,000 before it gets back to $90,000.

The top crypto analysts appear to be in consensus with the forecast. For example, Peter Brandt recently reduced his target price due to the volatility. Due to this sentiment, an expert predicted the MSTR stock could still fall to $120.

Peter Schiff recently criticized the company’s Bitcoin treasury plan, saying they should have stacked up more gold instead. Meanwhile, Michael Saylor hinted at another purchase to come this week.

- Fed’s Chris Waller Says Support For March Rate Cut Will Depend On Jobs Report

- Breaking: Tom Lee’s BitMine Adds 51,162 ETH Amid Vitalik Buterin’s Ethereum Sales

- Breaking: Michael Saylor’s Strategy Makes 100th Bitcoin Purchase, Buys 592 BTC as Market Struggles

- Satoshi-Era Whale Dumps $750M BTC as Hedge Funds Pull Out Billions in Bitcoin

- XRP Sees Largest Realized Loss Since 2022, History Points to Bullish Price Run: Report

- Top 3 Meme Coins Price Prediction As BTC Crashes Below $67k

- Top 4 Reasons Why Bitcoin Price Will Crash to $60k This Week

- COIN Stock Price Prediction: Will Coinbase Crash or Rally in Feb 2026?

- Shiba Inu Price Feb 2026: Will SHIB Rise Soon?

- Pi Network Price Prediction: How High Can Pi Coin Go?

- Dogecoin Price Prediction Feb 2026: Will DOGE Break $0.20 This month?