Why Is Strategy (MSTR) Stock Price Surging Today?

Highlights

- MSCI has officially dropped plans to change index rules.

- The decision removes a major uncertainty on Michael Saylor’s Strategy (MSTR).

- MSTR stock jumped roughly 6.6% in after-hours trading after the announcement.

MSCI has officially withdrawn plans that could have rewritten index eligibility rules. The decision now removes a major overhang for Michael Saylor’s Strategy. MSTR stock surged in trading resulting from the news.

MSTR Reacts as MSCI Steps Back From DAT Exclusion Proposal

The firm announced that the proposal to exclude digital asset treasury companies(DATCOs), from its Indexes will not be implemented. They shared they will keep the current treatment unchanged for now, following the conclusion of its industry consultation.

“For the time being, the current index treatment of DATCOs identified in the preliminary list published by MSCI of companies whose digital asset holdings represent 50% or more of their total assets will remain unchanged,” they said.

According to the ruling, firms that were already considered DATCOs would continue to qualify for inclusion as long as they abide by the typical index requirements. The index organization, however, made it clear that it would stop raising share counts and inclusion factors.

For Strategy’s MSTR, this has removed the threat of uncertainty regarding index delisting. However, this firm has been one of those largely identified as vulnerable to index delisting due to the large number of Bitcoins it owns.

They also added that it plans to shortly launch a broader consultation on non-operating businesses because institutional investors voiced concerns that some DATCOs are investment funds in nature and hence are not operational businesses.

“This broader review is intended to ensure consistency and continued alignment with the overall objectives of the Indexes, which seek to measure the performance of operating companies and exclude entities whose primary activities are investment-oriented in nature.”

The controversy started last year over the research conducted by MSCI on the eligible status of companies that hold a large reserve of digital assets that could be similar to funds or trusts.

Strategy (MSTR) publicly challenged this proposal saying the firm was run like a normal business. It also said the exemption of digital asset treasuries because this would in turn affect their investors.

Bitwise was also a vocal public proponent of digital asset treasuries. The strategy attracted criticism for doing significant damage to the investor while clouding the line between operating businesses and funds.

Strategy’s Stock Rallies on Clarity

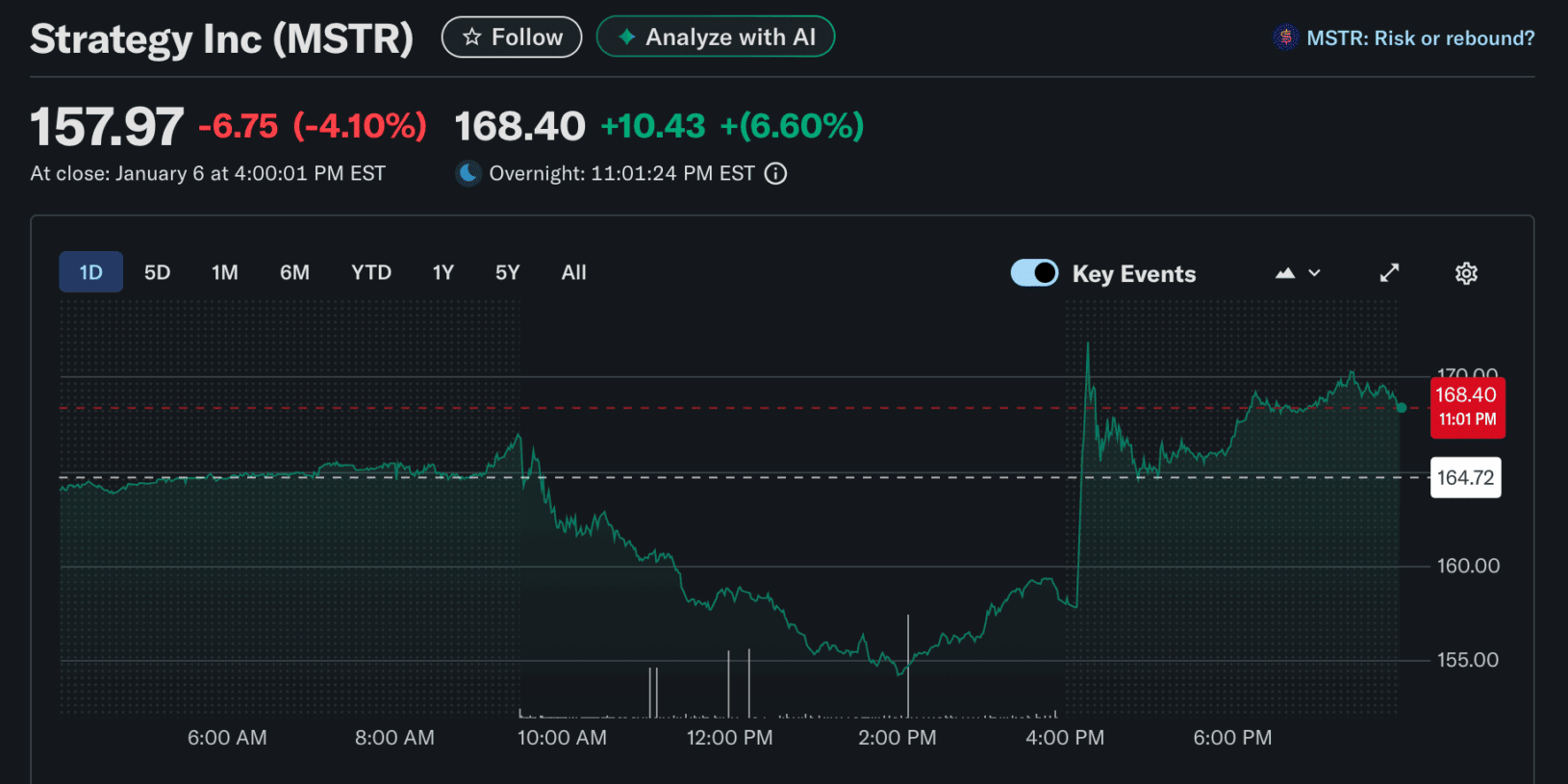

MSTR increased by about 6.6% in the after-market session following a previous drop of 4% during the day time.

The risk had been initially pointed out as a potential negative by analysts. JPMorgan has already warned that Michael Saylor’s company would have to sell billions of dollars worth of stocks if it were excluded from MSCI USA or Nasdaq100 indices.

Shortly after that, the company managed to retain its position within the Nasdaq 100 after the last rebalancing. This marked the continuation of its stay in the index for over a year.

- Bitcoin vs Gold Feb 2026: Which Asset Could Spike Next?

- Top 3 Reasons Why Crypto Market is Down Today (Feb. 22)

- Michael Saylor Hints at Another Strategy BTC Buy as Bitcoin Drops Below $68K

- Expert Says Bitcoin Now in ‘Stage 4’ Bear Market Phase, Warns BTC May Hit 35K to 45K Zone

- Bitcoin Price Today As Bulls Defend $65K–$66K Zone Amid Geopolitics and Tariffs Tensions

- COIN Stock Price Prediction: Will Coinbase Crash or Rally in Feb 2026?

- Shiba Inu Price Feb 2026: Will SHIB Rise Soon?

- Pi Network Price Prediction: How High Can Pi Coin Go?

- Dogecoin Price Prediction Feb 2026: Will DOGE Break $0.20 This month?

- XRP Price Prediction As SBI Introduces Tokenized Bonds With Crypto Rewards

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible