How Donald Trump’s Win To Impact Spot Ether ETF Approval?

Highlights

- Bloomberg's senior ETF analyst Eric Balchunas said the SEC will likely reject spot Ether ETF on May 23.

- SEC's approval of spot Ethereum ETF may not come until the end of 2025, until new SEC chair's appointment.

- Republican Donald Trump's victory in election gives a boost to spot Ethereum ETF approval.

The U.S. Securities and Exchange Commission (SEC) can reject spot Ether ETF applications on May 23, said Bloomberg’s senior ETF analyst Eric Balchunas. Moreover, the SEC’s approval of spot Ethereum ETF may not come until the end of 2025.

The odds of spot Ethereum ETF approval largely depend on the 2024 US elections. If Donald Trump wins, the SEC will have a more favorable change in leadership compared to Gary Gensler.

SEC To Reject Spot Ethereum ETF on May 23

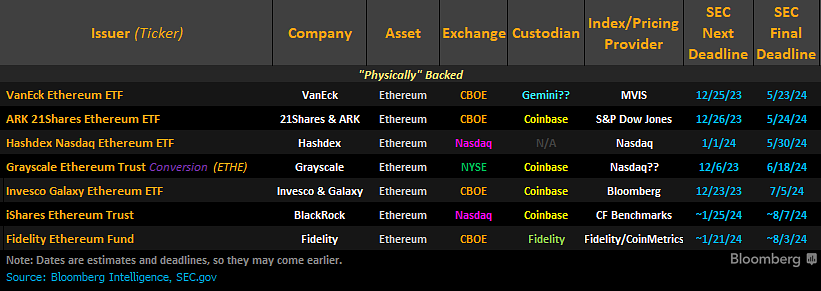

The U.S. SEC will likely to make a final decision on spot Ether ETF on May 23 and May 24, but experts believe it will be different from spot Bitcoin ETF. VanEck and Ark Invest are first in line for the SEC’s decision on May 23 and May 24, respectively.

Lack of interest from the SEC and its officials regarding spot Ethereum ETF, along with Ethereum’s current regulatory status, have made analysts pessimistic about approval this year.

The SEC will likely make decisions on each spot Ethereum ETF applications, with BlackRock iShares Ethereum ETF and Fidelity Ethereum ETF deadline in August.

Meanwhile, Polymarket data reveals the odds of Ethereum ETF approval by May 31 have increased to 13% from a drop to a low of 6% on May 6. The SEC has avoided any constructive discussions on spot Ether ETF with issuers, with disappointment in the crypto community impacting overall market sentiment.

There are upcoming meetings scheduled between ETF applicants and staff members of the U.S. Securities and Exchange Commission (SEC), said Fox Business journalist Eleanor Terrett.

Trump Victory To Help Ethereum ETF Approval

The 2024 US presidential election will impact the chances of Ethereum ETF approval. The SEC will have a new chairperson if Donald Trump wins the election. While Joe Biden throws shade on crypto with his anti-crypto stance, Trump has used crypto to attack Biden.

Meanwhile, billionaire entrepreneur Mark Cuban has criticized SEC Chair Gary Gensler and the New York SEC, warning of potential consequences in the upcoming election if current regulatory trends persist.

ETH price fell 7% this week, with the price currently trading at $2,927. The 24-hour low and high are $2,881 and $2,942, respectively. Furthermore, the trading volume has decreased by 14% in the last 24 hours.

Also Read:

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Deutsche Bank-Backed AllUnity Launches First MiCA-Compliant Swiss Franc Stablecoin

- Crypto Market on Edge as US-Iran Hold Talks Ahead of Trump’s War Deadline

- XRP Prepares for Phase 4 Lift-Off, $21.5 Level in Focus

- Vitalik Buterin Exceeds Planned Ethereum Sales as Total Liquidations Hit $35M

- Circle Stock Price Jumps 35% to $83 on Stablecoin Boom, USDC Supply Soars 72%

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

- Will Solana Price Rally to $100 If Bitcoin Reclaims $72K?

- XRP Price Eye $2 Rebound as On-Chain Data Signals Massive Whale Accumulation

- Ethereum Price Reclaims $2K- New Rally Ahead or a Temporary Bounce?

- COIN Stock Price Prediction as Wall Street Pros Forecast a 62% Surge

Buy $GGs

Buy $GGs