Corona Virus Update: Oil Tumbles To Negative Prices, Time For Plan Bitcoin (BTC)?

The oil market is in disarray at the moment, recording lower lows by the minute as the world watches on in shock. Over the past few months, reports of price wars among top oil-producing countries Saudi Arabia and Russia have culminated in the worst oil market crash in history. The price of a gallon of WTI crude oil stood at -$30 at one point in the early trading hours in the U.S market.

The dip in oil prices has been attributed to the raging Corona Virus effects that impact the demand alongside political and economic pressures across the oil market. The cryptocurrency community has come out gun blazing to praise Bitcoin (BTC) as the investment asset of choice following the capitulation of the oil commodity market.

Oil dips to lowest prices ever, 120% drop in a day

Go back a few years back when oil traded at $100 a barrel and the markets screamed bullish – some analysts predicting a possible boost to $500. Now, buyers are getting paid to take off the barrels of oil from the suppliers as demand hits rock bottom.

Over the past 24 hours, the price of oil fell over 120%, yes that’s right from over $30 at markets opening to -$3, as at the time of writing.

Where were you when this happened?? pic.twitter.com/sj0gwo1BON

— Larry Cermak (@lawmaster) April 20, 2020

The huge collapse in oil prices is also partly caused by the front-month expiring contracts. Looking at the West Texas Index Crude Oil Term structure charts, the futures contracts expected to expire tomorrow are piling up with no one willing to take up the delivery. According to the volumes, June expiry contracts now hold 6.5X more volume than May contracts. Skew Markets tweet explains,

“June contracts today had 6.5x more volumes than May contracts and open interest is 5x larger – “only” down 10% on the day.”

Bitcoin is the way to go!

The Bitcoin community is making their stance clear on the latest fall of oil as analysts claim the power of Bitcoin to wither the market despite the tough conditions brought about by COVID-19. Gemini exchange co-founder, Cameron Winklevoss, tweeted praising BTC as a store of value alongside cash and gold.

After today, oil can no longer be considered a reliable store of value. Your next best options are the U.S. dollar (gulp), gold (scarce), or Bitcoin (fixed).

— Cameron Winklevoss (@winklevoss) April 20, 2020

Bitcoin has held its own during the Great Lockdown market crash despite hitting a low of $3,800 on Mar. 12. Currently, the top coin trades at $6,832, representing a 5% drop over the past 24 hours. The price bulls failed to breach past the key resistance level at $7,490 bouncing off $7,310, and signaling a possible double top pattern formation.

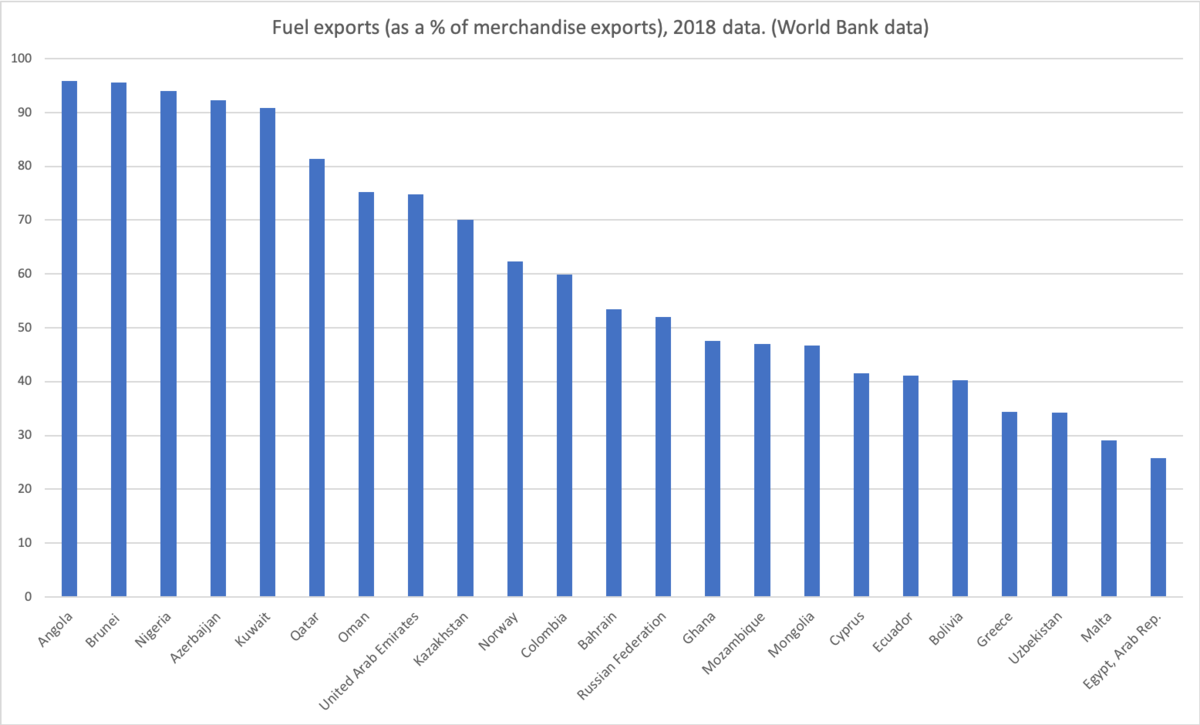

However heading to the halving, the price fundamentals remain solid for the digital gold. A scary situation arises on the sovereign debt default rate in the coming years as oil-exporting countries expect to feel the crunch.

Countries with a high percentage of exports on oil-based products and weak currencies may be forced to switch to foreign currencies or better still cryptocurrencies as witnessed in Venezuela.

The situation may have gotten worse from the COVID-19 virus effects to gross economic debt defaults across the world.

- BTC Price Falls as Initial Jobless Claims Come In Below Expectations

- Breaking: CME Group To Launch 24/7 BTC, ETH, XRP, SOL Futures Trading On May 29

- White House to Hold CLARITY Act Meeting With Ripple, Coinbase, Banks Today

- Senator Warren Warns Fed Against Bitcoin Crash Rescue Amid Liquidity Pump Claims

- Top 5 Reasons Ethereum Price Is Down Today

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise

- Cardano Price Prediction Feb 2026 as Coinbase Accepts ADA as Loan Collateral

- Ripple Prediction: Will Arizona XRP Reserve Boost Price?

- Dogecoin Price Eyes Recovery Above $0.15 as Coinbase Expands Crypto-Backed Loans

- BMNR Stock Outlook: BitMine Price Eyes Rebound Amid ARK Invest, BlackRock, Morgan Stanley Buying

- Why Shiba Inu Price Is Not Rising?