On-chain Data Reveals Bitcoin Moving To Illiquid Wallets; Holders “Not Selling”

Glassnode data reveals intriguing trends in the Bitcoin market, with the illiquid supply of BTC continuing to expand and Bitcoin dominance on the rise. These developments suggest a strong inclination towards HODLing and a shifting of capital from altcoins to major cryptocurrencies.

BTC HODLers Multiply

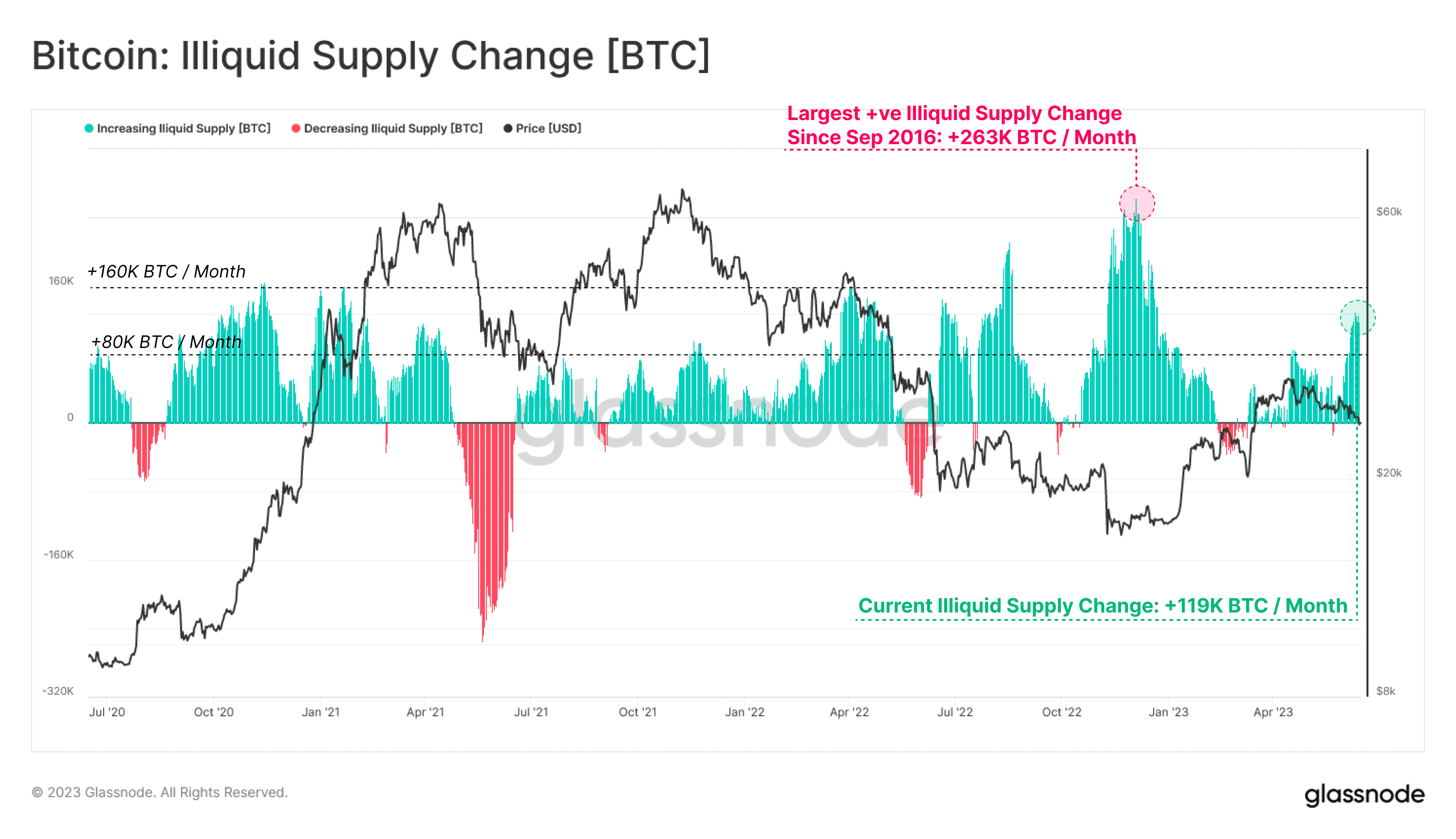

According to Glassnode, the illiquid supply of Bitcoin is steadily increasing at a rate of +119K BTC per month. This indicates that coins are increasingly accumulating in wallets with minimal transaction history, reinforcing the notion that HODLing remains the prevailing market dynamic.

This trend suggests that a significant portion of BTC holders are choosing to retain their coins rather than actively trading or selling them.

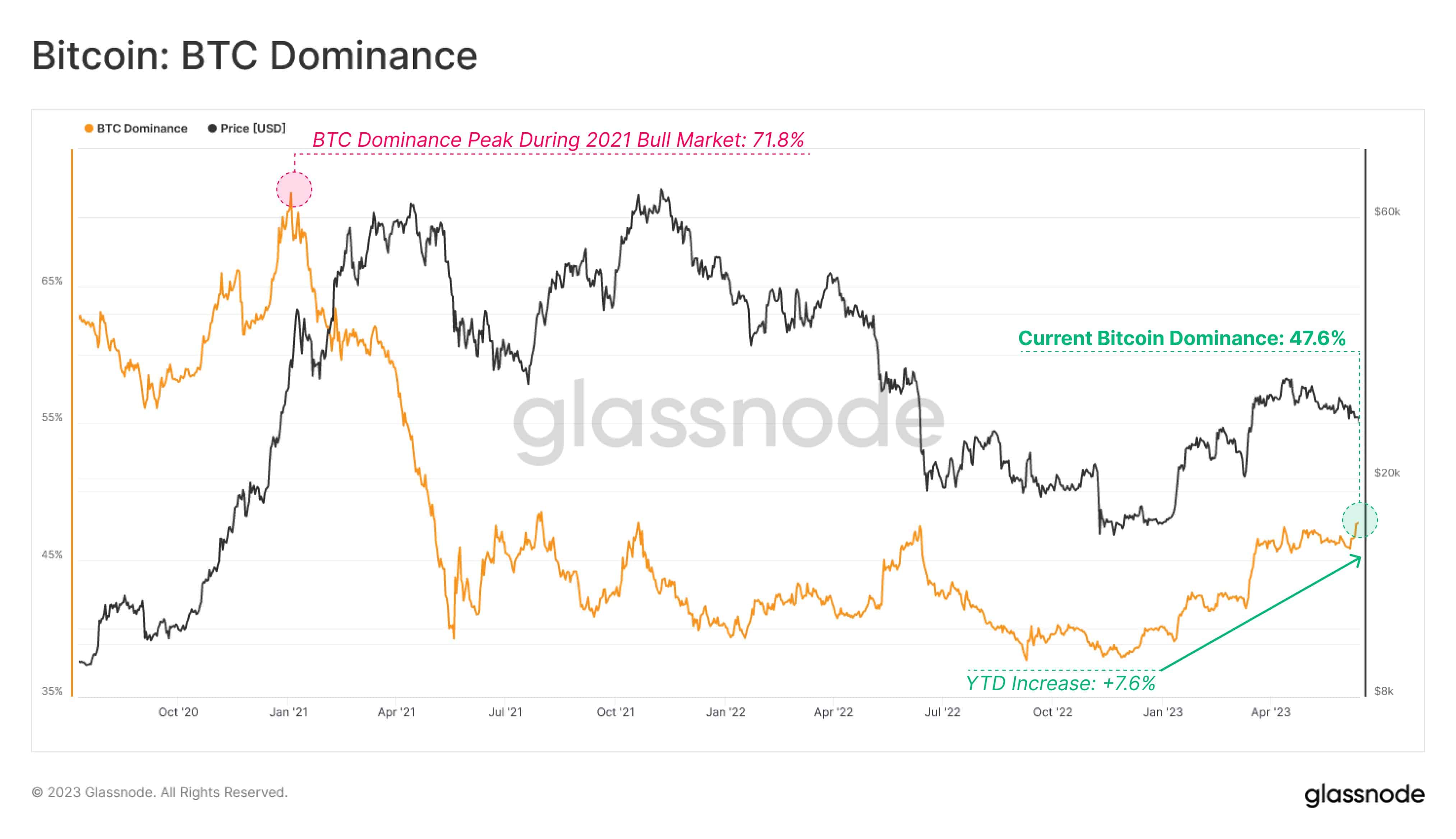

In parallel, Bitcoin dominance has been climbing, currently standing at 47.6%, representing a year-to-date increase of 7.6%. This upward trajectory indicates a consistent rotation of capital from altcoins to major cryptocurrencies.

As investors seek liquidity and stability, they are favoring the most established and liquid crypto asset, Bitcoin. This phenomenon highlights the growing preference for the market leader and the continued consolidation of capital in Bitcoin.

Bitcoin Price Action

Bitcoin’s price has seen some fluctuations, with a 0.33% increase in the past hour. However, it has experienced a 4.41% decline over the past 24 hours, dropping below $25K for the first time in 3 months is true.

BTC couldn’t stay in a positive zone after the Fed’s interest rate decision and fell below the $25,500, a new weekly low. This comes in when the Federal Reserve pauses rate hikes for the first time in the last 15 months.

Read CoinGape’s story on crypto market sell off today, where Ethereum and XRP turned out to be one of the biggest losers in the ongoing sell-off.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Crypto Market at Risk as U.S.–Iran War Threatens Inflation With Oil Price Surge

- Polymarket U.S.–Iran Strike Bets Fuel Insider Trading Speculation as Crypto Traders Net $1.2M

- Cardano’s DeFi TVL Climbs as USDCx Stablecoin Launches on Network

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

Buy $GGs

Buy $GGs