“Orange or Green?” Saylor’s Bitcoin Tracker Sparks New BTC Accumulation Speculation

Highlights

- Michael Saylor’s January 4 post renewed focus on Strategy’s Bitcoin exposure.

- “Orange or Green” post mirrored past signals but announced no new Bitcoin purchase.

- Coinbase premium recovery signals improving institutional BTC demand.

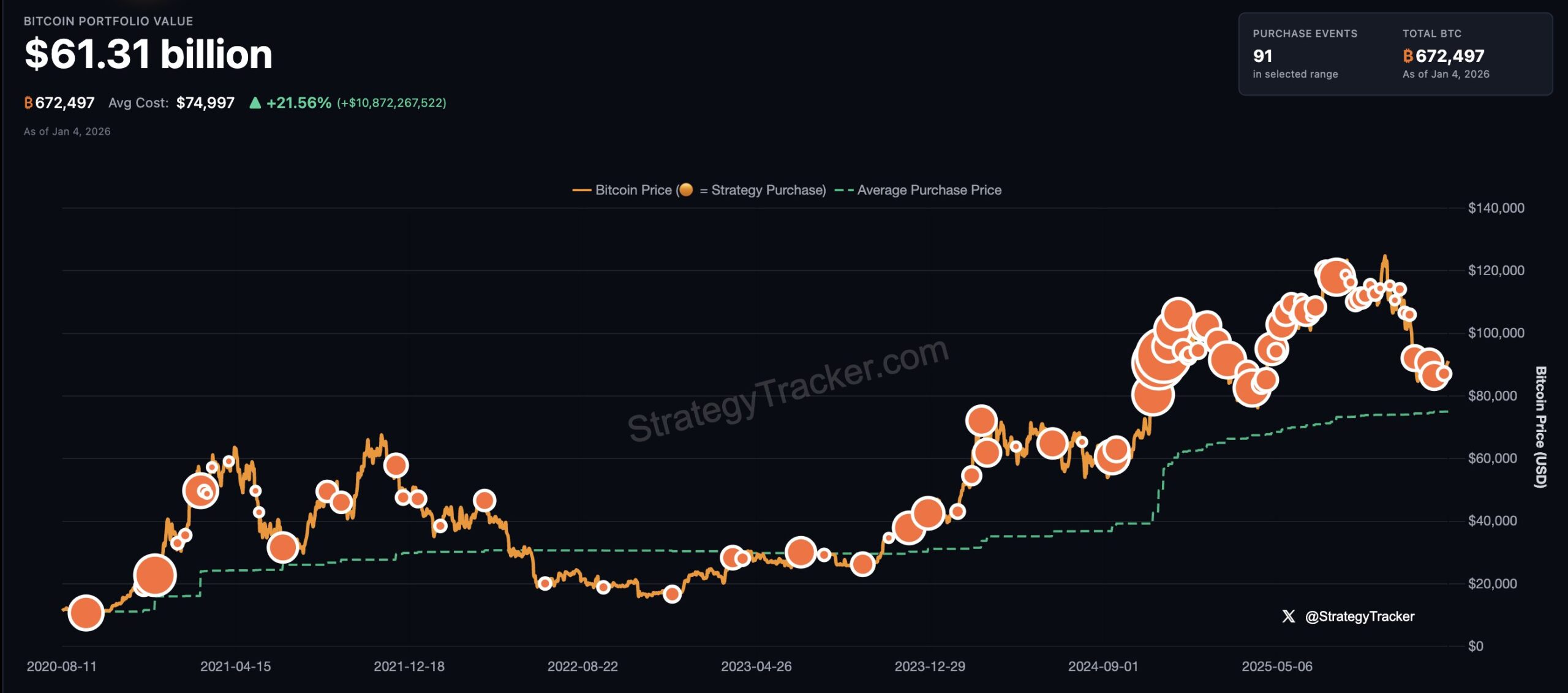

Strategy executive chairman Michael Saylor drew renewed attention on January 4 after an X post highlighted the company’s Bitcoin exposure. The post showed Strategy holding a Bitcoin portfolio worth $61.31 billion and spread across crypto markets.

“Orange or Green” and Strategy’s Bitcoin Position

Saylor posted the phrase Orange or Green? with a chart attached to the Strategy Bitcoin investment in an X post. In the past, he employed the same short signals prior to verified disclosure of purchase. No new transaction was announced in the post.

Strategy holds 672,497 BTC according to regulatory disclosures. These coins accrue to the company at an average cost of $74 997 per BTC. The total acquisition cost stands at $50.44 billion.

As of press time, BTC is trading at $91,359, and Strategy holdings were worth more than $61 billion. This position also indicated an unrealised gain of approximately 21.56% or approximately $10.87 billion.

Saylor shared a StrategyTracker.com chart outlining the firm’s Bitcoin buying record. It explained the history of Bitcoin purchases by the company in greater detail. The graphical visualization revealed there were 91 different purchase events in the chosen period.

Strategy has increased its BTC holdings as CoinGape reported earlier. The company purchased 1,229 Bitcoin that amounted to $108.8 million . In that transaction the average purchase price was 88,568 coins per coin. The acquisition took place on the 22-28 of December.

Coinbase Premium and Q4 Signal Shifting BTC Demand

Early indications of institutional demand for BTC have emerged after pointing to movement in a key market indicator, an analyst has said. In an X post, Ted noted that the Coinbase Bitcoin premium is starting to recover, showing a shift of demand conditions.

The Coinbase premium is the difference in price between Bitcoin on Coinbase and other major exchanges. U.S. based investors, including institutions, tend to buy more when the premium rises. He said the recent shift indicates that institutional interest is beginning to pick up.

Ted also alluded to current market activity. Bitcoin had a very weak Q4 he said, comparing its performance to how it’s done in 2022. BTC was also under that same pressure during this period. He added that Bitcoin recovered following the 2022 downturn.

- ProShares Launches First GENIUS Act Focused Money Market ETF, Targeting Ripple, Tether, Circle

- BTC Price Falls as Initial Jobless Claims Come In Below Expectations

- Breaking: CME Group To Launch 24/7 BTC, ETH, XRP, SOL Futures Trading On May 29

- White House to Hold CLARITY Act Meeting With Ripple, Coinbase, Banks Today

- Senator Warren Warns Fed Against Bitcoin Crash Rescue Amid Liquidity Pump Claims

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise

- Cardano Price Prediction Feb 2026 as Coinbase Accepts ADA as Loan Collateral

- Ripple Prediction: Will Arizona XRP Reserve Boost Price?

- Dogecoin Price Eyes Recovery Above $0.15 as Coinbase Expands Crypto-Backed Loans

- BMNR Stock Outlook: BitMine Price Eyes Rebound Amid ARK Invest, BlackRock, Morgan Stanley Buying

- Why Shiba Inu Price Is Not Rising?