Over 10K Bitcoin (BTC) Moved To Crypto Exchange, Are Miners Selling?

Bitcoin price rallied after Fed Chair Jerome Powell hinted at slower rate hikes in December and upcoming sessions. The BTC price hit a high of $17,194 with an over 200% jump in trading volume. On-chain data indicates that miners facing financial issues are indeed selling their Bitcoin holdings, with Bitcoin hashrate decreasing continuously due to declined mining activity.

Miner Capitulation Restricts Bitcoin Rally

Whale Alert in a tweet on December 1 reported that an unknown wallet moved 10,050 Bitcoin worth over $171 million to the crypto exchange Coinbene at 08:48 UTC. In addition, there are other BTC selloff transactions in the last 24 hours.

On-chain analyst IT Tech confirmed a 10K outflow from miner Poolin. The mean amount of coins per transaction sent from the affiliated miners’ wallets. If miners transfer part of their reserve at the same time, it could trigger a BTC price drop.

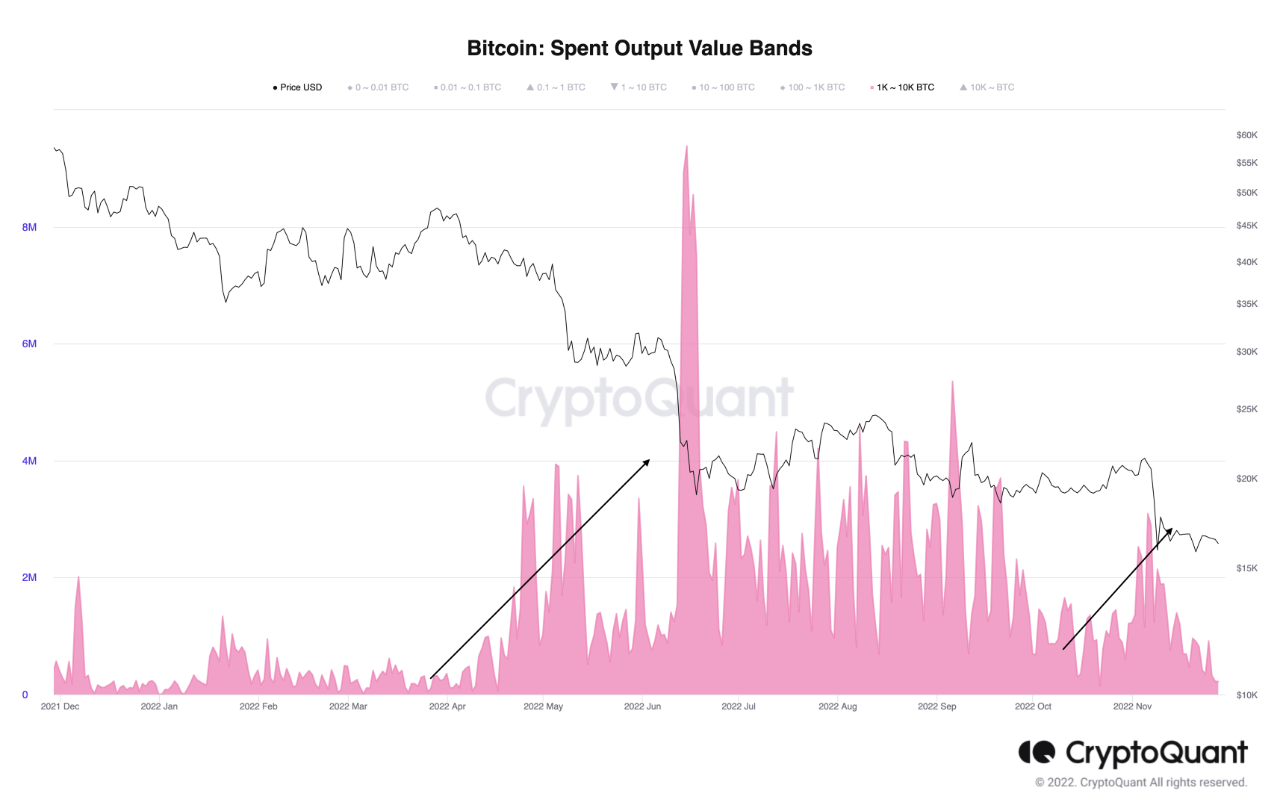

Bitcoin price fails to show any massive rise despite some whale accumulation due to rising selling pressure from miners. In fact, miners selling 4K BTC this week pull the price of Bitcoin downward, marking the fourth spike in 2022. As per on-chain data, miners’ BTC transfers to exchanges increased again after BTC fell from $20,000 to $16,000.

Miners’ BTC reserves have decreased by 13K BTC in the last few months. It has now at the same level as at the beginning of 2022 amid fewer earnings due to the BTC price drop. Moreover, Bitcoin hashrate continues to fall due to decreased mining activity.

Will BTC Price Witness Rally Amid Dovish Fed?

Bitcoin price soared nearly 2% in the last 24 hours, hitting a high of $17,194. The rally came after Fed Chair Jerome Powell in his latest speech pointed to slower rate hikes from December.

At the time of writing, the BTC price is trading at $17,103, with an over 200% increase in trading volume. Crypto analyst Michael van de Poppe predicts a rally to $18.3K. However, he agreed with on-chain data that BTC price could face stronger resistance at $18k.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- BTC Price Bounces as Spot Investors Buy The Dip Amid Iran War Jitters

- CFTC Chief Mike Selig Signals US Crypto Perpetual Futures Rollout in Coming Weeks

- Fed Rate Cut Odds Drop as Inflation Fears Rise Due To U.S. Iran Conflict

- Here’s Why Tether Gold (XAUt) Price Is Falling Even With Growing Gold Demand

- XRP News: Ripple Expands Payments Platform To Unify Fiat and Stablecoins Globally

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

- RIOT Stock Prediction as Needham, Piper Sandler Slash Target After Earnings

- Cardano Price Outlook As Charles Hoskinson Warns Over CLARITY Act

- Circle Stock Price Climbs 15% to $96, Can Rally Continue in March 2026?

- Bitcoin Price Prediction as US-Iran War Enters 4th Consecutive Day

- Top 5 Historical Reasons Dogecoin Price Is Not Rising

Buy $GGs

Buy $GGs