Pepecoin Dumped By Another Whale, Is PEPE Craze Over?

On-Chain Analysis platform, Lookonchain has reported another whale transaction around once trending PEPE memecoin. Causing speculations about potential insider trading, a whale has sold its entire holdings of 972.84 billion PEPE tokens. Additionally, the token’s value has experienced a significant decline over the past week.

Whale’s PEPE Token Dump

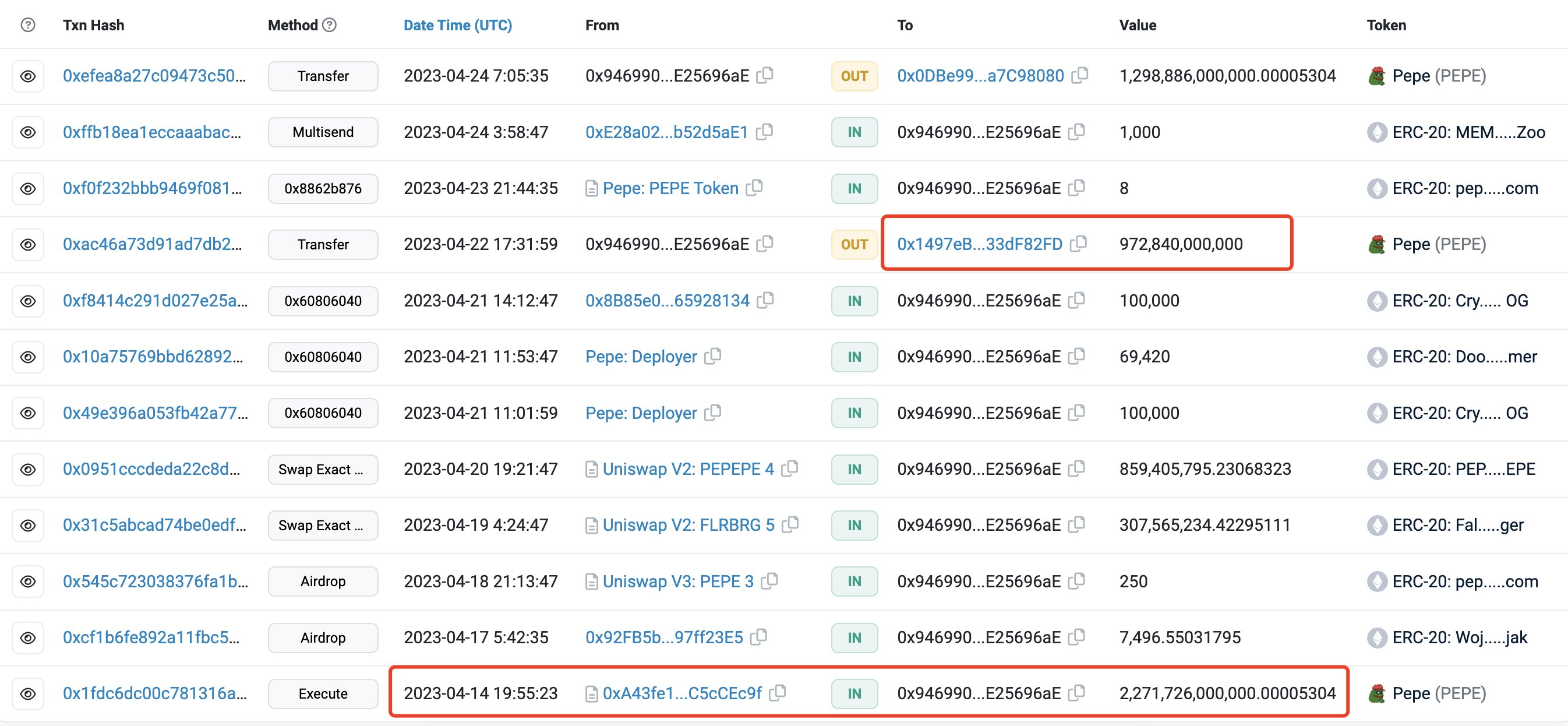

According to Lookonchain, address 0x1497 recently sold its entire holdings of 972.84 billion PEPE tokens. The sale was executed for 514 ETH, equivalent to approximately $848,000. The selling price was recorded at $0.0000008718 per token. This transaction has led some individuals to question whether the seller might be engaged in insider trading.

Further investigation reveals that the aforementioned address received 0.58 ETH from FixedFloat and promptly used a portion of it, approximately 0.027 ETH (equivalent to $58), to purchase a staggering 2.27 trillion PEPE tokens. Notably, this transaction occurred within just 10 minutes of PEPE’s trading commencement.

CoinGape reported a separate incident from five days ago, a whale incurred a significant loss while trading PEPE. The whale sold 468.5 billion PEPE tokens for 109 ETH (approximately $190,000) and 237.5 thousand USDT. This transaction resulted in a 52% loss for the whale.

Bearish Outlook For PEPE?

Pepecoin price rose steadily in late April and went on to explode on May 5, when Binance announced listing of the meme coin.

But these recent whale-induced token dump has compounded the bearish sentiment surrounding PEPE. The high-volume sale by whales has intensified the downward pressure on the token’s value. The impact of the whale’s token dump on PEPE’s price has been evident in recent market movements. In the aftermath of the sale, PEPE’s value has continued to decline, reflecting the negative sentiment surrounding the token.

Over the past week, PEPE has experienced a notable decline in value. The token’s price has decreased by 1.12% within the last hour, 5.48% over the past 24 hours, and a substantial 17.06% in the span of seven days. These price movements indicate a bearish trend for PEPE and may be indicative of wider market sentiment.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Indiana Signs Bitcoin Bill Into Law Allowing Crypto in Retirement Plans

- ‘Time to Act Is Now’: CFTC Chief Pushes Swift Passage of CLARITY Act

- Trump Tells Congress to Pass Crypto Market Bill ‘ASAP,’ Blasts Banks for Stalling

- BTC Price Bounces as Spot Investors Buy The Dip Amid Iran War Jitters

- CFTC Chief Mike Selig Signals US Crypto Perpetual Futures Rollout in Coming Weeks

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

- RIOT Stock Prediction as Needham, Piper Sandler Slash Target After Earnings

- Cardano Price Outlook As Charles Hoskinson Warns Over CLARITY Act

- Circle Stock Price Climbs 15% to $96, Can Rally Continue in March 2026?

- Bitcoin Price Prediction as US-Iran War Enters 4th Consecutive Day

- Top 5 Historical Reasons Dogecoin Price Is Not Rising

Buy $GGs

Buy $GGs