Peter Brandt Predicts Bitcoin To Hit $90,000, But There’s A Condition

Highlights

- Peter Brandt predicts Bitcoin could surge to $90,000 amid current market performance.

- Brandt identifies a pattern in Bitcoin's price movements indicating a potential massive rally.

- Bitcoin's price recently rose nearly 6% today, reflecting increased investor interest and market momentum.

Veteran trader Peter Brandt recently stirred excitement in the crypto community with his bold prediction for Bitcoin. In a social media post, he forecasted a potential surge in the crypto’s price, suggesting it could soar past the $90,000 mark. Meanwhile, his analysis comes amid a notable uptick in the asset’s market performance, sparking widespread interest.

Peter Brandt Predicts Bitcoin Price To Cross $90K

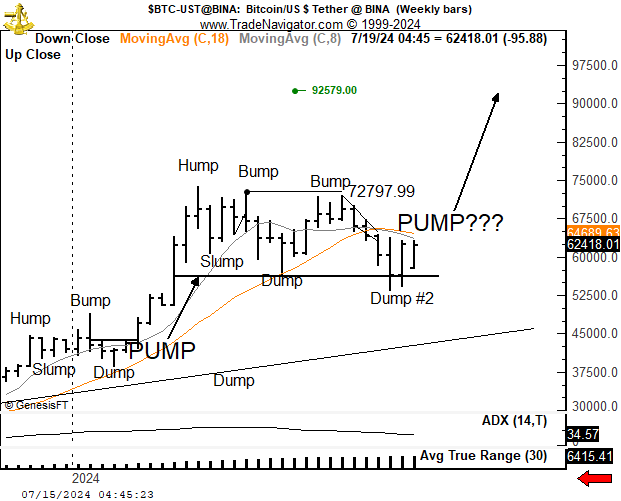

Peter Brandt shared his insights on Bitcoin’s price trajectory, highlighting a possible massive rally. According to Brandt, BTC might be unfolding a pattern he describes as “Hump->Slump->Bump->Dump->Pump.”

Meanwhile, he noted that the July 5 attempt at a double top was a bear trap, confirmed by the July 13 close. Besides, Brandt believes that bears are now trapped, and the most likely scenario is a continued upward trend.

However, it’s worth noting that he also cautioned that a close below $56,000 would negate this bullish interpretation. As of the latest data, Bitcoin has noted a surge of more than 5%.

This uptick is part of a broader rally that has caught the attention of investors and market analysts alike.

Also Read: Wirex & Visa Unveil ‘Wirex Pay’ Revolutionizing Web3 Payments

Market Analysts Echo Optimism

Peter Brandt’s prediction has sparked discussions among other market analysts, many of whom share his optimistic outlook. The recent performance of Bitcoin, coupled with significant inflows into the Spot BTC ETF, suggests a bullish trend. These inflows highlight increasing investor interest, contributing to the upward momentum in the crypto’s price.

Meanwhile, the Spot BTC ETF has played a crucial role in this scenario. The substantial inflows reflect heightened interest from both retail and institutional investors. This surge in investment underscores the broader acceptance of BTC as a valuable asset.

Analysts believe this trend will continue to drive the crypto’s price higher, potentially reaching Brandt’s predicted target of $90,000. However, the market remains cautious despite the current sentiment is positive. Factors such as regulatory changes and market volatility could impact the asset’s trajectory.

During writing, Bitcoin price rose 5.6% and exchanged hands at $63,020.13, with its trading volume soaring 37% to $29.16 billion. On a weekly basis, the crypto has jumped about 10%, reflecting the growing market interest. Besides, CoinGlass data also hinted towards a similar picture, with BTC Futures Open Interest rising about 5% from yesterday.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- XRP News: Ripple-Backed Ctrl Alt Completes $280M in Diamond Tokenization on XRPL

- Bitwise CIO Calls Bitcoin Selloff ‘Classic Cycle,’ Dismisses Manipulation Rumors

- Cardone Capital Takes Real Estate On-Chain With $5B Tokenization Plan

- Senator Elizabeth Warren Targets Trump-Affiliated World Liberty Financial Over Bank Charter Bid

- JPMorgan Projects Bullish Crypto Market in H2 Following CLARITY Act Approval

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

- Will Solana Price Rally to $100 If Bitcoin Reclaims $72K?

- XRP Price Eye $2 Rebound as On-Chain Data Signals Massive Whale Accumulation

Buy $GGs

Buy $GGs