Peter Schiff Reveals Biggest Regret About Bitcoin

Highlights

- Peter Schiff regrets not buying Bitcoin early as price surpasses $110K, signaling a shift in his stance.

- Max Keiser mocks Peter Schiff's Bitcoin oversight, calling him the "WORST MONEY MANAGER EVER!" for missing early gains.

- Long-term Bitcoin holders realize $930M in daily profits, yet continue accumulating, driven by ETF-led interest.

Peter Schiff, a long-time critic of Bitcoin has acknowledged a surprising regret regarding the cryptocurrency. The gold advocate, who has consistently voiced skepticism toward Bitcoin’s long-term value, admitted that he regrets not buying it when he first learned about it. Schiff’s comments came after Bitcoin saw a notable surge in its price, which caught the attention of both supporters and critics.

Peter Schiff Acknowledges Missed Bitcoin Opportunity

Peter Schiff has long championed gold as the superior store of value, often dismissing Bitcoin as a speculative asset.

However, in a recent X post, Schiff acknowledged his biggest regret regarding Bitcoin: not buying it when he initially came across it. “I regret not buying it when I first learned about it,” he said, signaling a shift in his stance, even as he continues to be cautious about the cryptocurrency’s future.

The remarks made by Schiff were in response to a surge in the price of BTC that reached above $110,000, although the overall sentiment is whether the cryptocurrency can rally back to its all time high. Although he has been skeptical in the past, recent comments made by Schiff indicate the even he is coming to realize the volatility of Bitcoin and its unexpected market fluctuations.

Max Keiser Comments on Peter Schiff and Bitcoin

One of the most vocal critics of Peter Schiff regarding his opinion on BTC has been Max Keiser, an American filmmaker and a Bitcoin evangelist. Keiser, a long-time Bitcoin proponent, responded to Schiffs latest statements by laughing at the opportunities that the gold

proponent had squandered. Keiser pointed out that he had recommended Schiff buy Bitcoin at much lower prices, including at $1, $10, $100, and even $10,000.

The American filmmaker didn’t hold back in expressing his opinion about Schiff’s decision to dismiss BTC. He took to X to call Schiff the “WORST MONEY MANAGER EVER!” and ridiculed Schiff’s decision to open a bank in Puerto Rico.

However, even as Schiff expressed regret over not investing in BTC earlier, he continues to stand by his belief that gold is the more stable and reliable asset. While acknowledging Bitcoin price surge, Schiff yesterday maintained that Bitcoin’s volatility makes it an unreliable store of value compared to gold.

Bitcoin Surprising Price Surge and Growing Profits

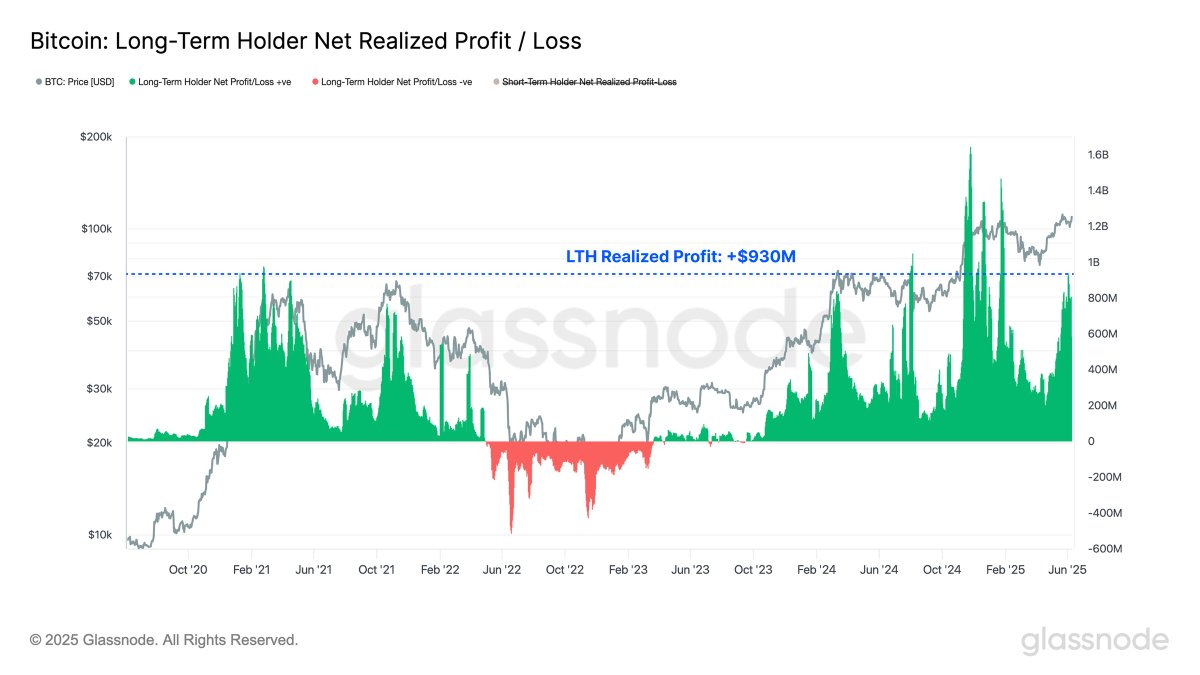

The latest BTC price surge has sparked significant reactions in the cryptocurrency community, with many taking note of the growing profit being realized by long-term holders. According to data from Glassnode, a “unique dynamic” has emerged in this Bitcoin cycle.

Long-term holders (LTHs) are realizing record profits while still increasing their BTC holdings. The data revealed that the net realized profit per day has reached $930 million, marking a significant uptick in Bitcoin’s profitability.

Another unusual phenomenon noted by Glassnode is the fact that long-term holder supply continues to increase, even as realization is occurring in huge profits. The ETF-led accumulation has significantly contributed to this trend, which has additionally encouraged BTC interest among institutional investors.

This group of long-term holders is accumulating Bitcoin even amid the increasing profitability, which has never been seen before in the history of the market cycle.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Senator Elizabeth Warren Targets Trump-Affiliated World Liberty Financial Over Bank Charter Bid

- JPMorgan Projects Bullish Crypto Market in H2 Following CLARITY Act Approval

- Hong Kong Moves Closer to Crypto Tax Cuts Amid Stablecoin Regulatory Framework

- Popular Analyst Willy Woo Predicts Major Bitcoin Price Crash, Bear Market Bottom Timeline

- Vitalik Buterin Maps Out Quantum Risks as Ethereum Foundation Unveils ‘Strawmap’

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

- Will Solana Price Rally to $100 If Bitcoin Reclaims $72K?

- XRP Price Eye $2 Rebound as On-Chain Data Signals Massive Whale Accumulation

Buy $GGs

Buy $GGs