Breaking: Polymarket Partners With Chainlink To Boost Market Resolution Process

Highlights

- Polymarket will integrate Chainlink data to enhance accuracy of market resolutions.

- The partnership will initially focus on asset pricing resolutions.

- This comes as Polymarket reenters the U.S. market.

Crypto prediction platform Polymarket has partnered with Chainlink as it looks to enhance the accuracy of its prediction market resolutions. As part of the partnership, the prediction platform will integrate Chainlink’s data feeds, which will help speed up the resolution process.

Polymarket To Integrate Chainlink’s Data Standard

In a press release, Chainlink announced that Polymarket will integrate its standard into its resolution process. The partnership will initially focus on enhancing the accuracy and speed of asset pricing resolutions, with Chainlink’s oracle providing real-time data on crypto prices. There are also plans to expand into additional markets.

This development comes as Polymarket reenters the U.S. market following a green light from the CFTC. Chainlink revealed that the prediction platform has already integrated its data standard on the Polygon mainnet.

This will enable the creation of “secure, real-time prediction markets around asset pricing, including hundreds of live crypto trading pairs.” Beyond these deterministic markets, both firms are also exploring how they can expand the use of Chainlink’s oracles to settle prediction markets involving more subjective questions.

Chainlink noted that the goal is to reduce reliance on social voting mechanisms and further minimize resolution risk. The Polymarket partnership represents another major win for Chainlink after the U.S. Commerce Department tapped the crypto project to roll out GDP data on the blockchain.

Meanwhile, the crypto prediction platform also confirmed the partnership with Chainlink in an X post. It simply stated that, “15-minute crypto up/down polymarkets are here,” confirming what prediction market it will initially use the data feeds for.

15 minute crypto up/down polymarkets are here. https://t.co/TlxUfdlHAz

— Polymarket (@Polymarket) September 12, 2025

How The Integration Will Work

Chainlink will provide deterministic data inputs to resolve the Polymarket outcomes. The oracle platform stated that the integration will combine its Data Streams with Automation to enable timely and automated on-chain settlement of markets. This will allow a swift resolution of asset pricing markets, such as Bitcoin price predictions, based on predetermined data.

Chainlink’s co-founder, Sergey Nazarov, said that Polymarket’s decision to integrate its oracle infrastructure is a pivotal milestone that greatly enhances how prediction markets are created and settled. He further remarked that the partnership is a “decisive step toward a world powered by cryptographic truth.”

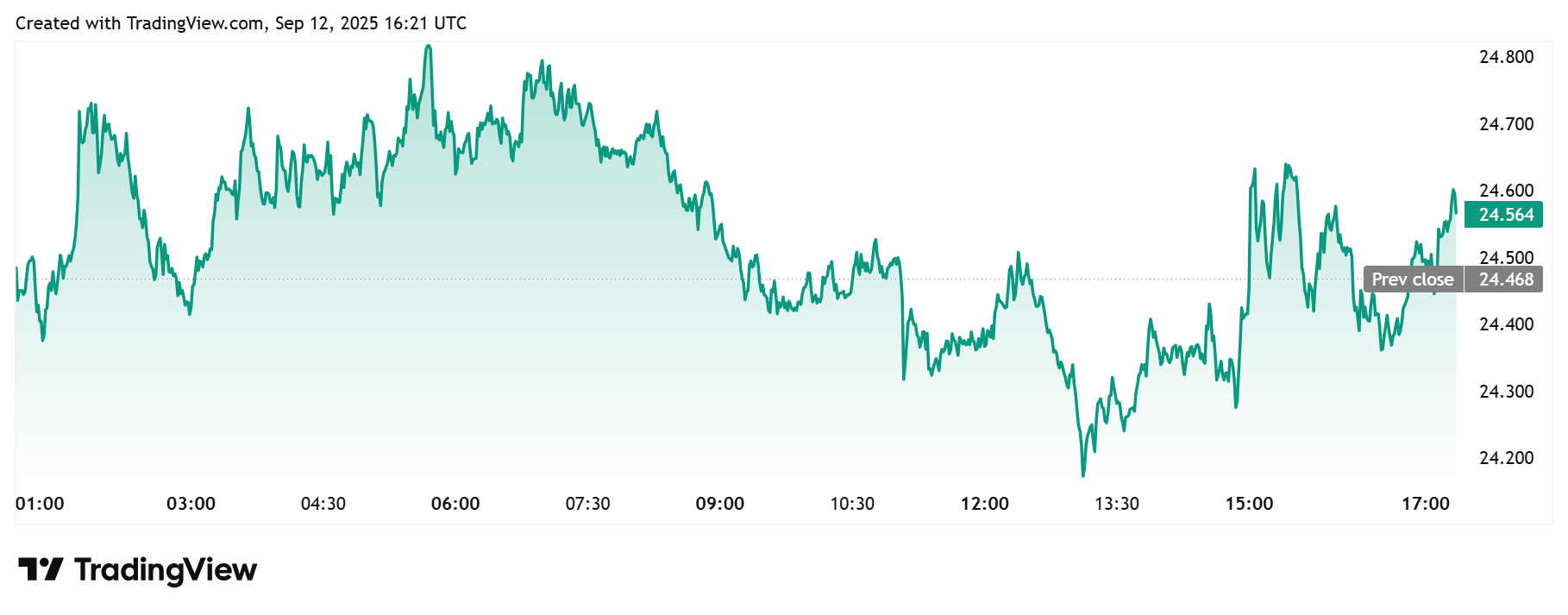

The LINK price is up amid this announcement. TradingView data shows that the altcoin is currently trading around $24.5, up over 3% in the last 24 hours.

The token is also up over 10% in the last week and 23% year-to-date (YTD).

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Meme Coin Market Dead? Top 5 Reasons Dogecoin, Shiba Inu, and Pepe Are Crashing

- Why Is Crypto Market Crashing Today (Feb 28)

- Breaking: Ethereum Price Drops Amid Israel-Iran Tensions; Machi Big Brother Liquidated Again

- CLARITY Act: Stablecoin Yield Debate Heats Up, but March 1 Deadline Not ‘Do or Die’

- Best Institutional Custody Solutions for Tokenized Assets in 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

Buy $GGs

Buy $GGs