US Fed’s Jerome Powell In FOMC Speech: Another Rate Hike Appropriate

US Federal Reserve Chair Jerome Powell delivered his speech in the post Federal Open Market Committee (FOMC) press conference. The FOMC had earlier decided to keep the interest rates steady at 525-550 bps, CoinGape reported.

Also Read: XRP Lawsuit Settlement: Attorney Says US SEC Not Ready Yet

Inflation Target In Focus

In his initial remarks, Powell said the current stance of policy is restrictive, while admitting that the Fed has a long way to go before achieving the 2% inflation target. Reiterating the hawkish stance, the Fed Chair said the Fed is determined to do everything it can to achieve goals. He added that the majority of policymakers believe it is more likely than not another rate hike will be appropriate.

Powell explained that the proposal to maintain the current policy stance received unanimous support from policymakers. The Bitcoin price remained largely unchanged in the initial minutes as the Federal Open Market Committee (FOMC) decided to maintain the interest rate steady at the current target rate of 5.25-5.50% in the September 20, 2023 meeting.

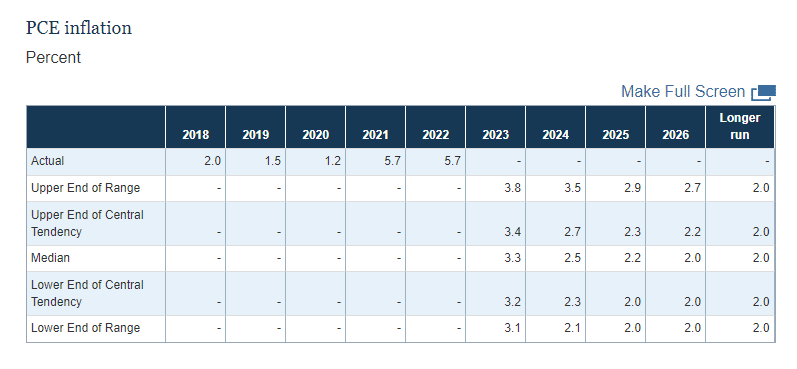

The Fed projects that the median PCE inflation would drop to 3.3% by the end of 2023, while projecting further drop to 2.5% and 2.2% in 2024 and 2025 respectively.

Interest Rate Hike In November FOMC Meeting?

The FOMC observed that inflation in the economy remained elevated while the unemployment rate has remained low. Overall, the Fed staff said it prioritizes bringing the inflation down to 2% target over time. The CME FedWatch Tool, which gauges market sentiment on probability of the Fed’s interest rate decisions, currently shows a 36.3% chance of raising interest rate to 5.50-5.75% range in the November FOMC meeting.

On the positive side, Chair Powell said there will be a point in the coming future when it would appropriate to cut interest rates. He stated that the Fed now has the ability to proceed carefully in terms of rate hikes, considering that the inflation target is closer. “We have the ability to move carefully, meeting by meeting.”

Meanwhile, the S&P 500 Index took a drop of 0.30% in response to the hawkish nature of the Powell speech.

Also Read: Elon Musk Calls DOJ’s Glass House Accusation ‘Next-Level Absurd”

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Meme Coin Market Dead? Top 5 Reasons Dogecoin, Shiba Inu, and Pepe Are Crashing

- Why Is Crypto Market Crashing Today (Feb 28)

- Breaking: Ethereum Price Drops Amid Israel-Iran Tensions; Machi Big Brother Liquidated Again

- CLARITY Act: Stablecoin Yield Debate Heats Up, but March 1 Deadline Not ‘Do or Die’

- Best Institutional Custody Solutions for Tokenized Assets in 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

Buy $GGs

Buy $GGs